GNC 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

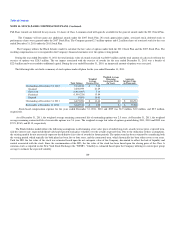

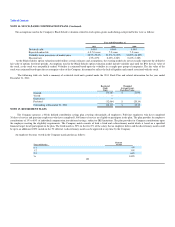

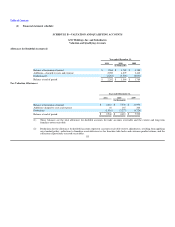

NOTE 17. FRANCHISE REVENUE (Continued)

The following is a summary of the Company's franchise revenue by type:

Year ended December 31,

2011 2010 2009

(in thousands)

Product sales $ 275,026 $ 241,932 $ 217,920

Royalties 46,507 38,722 35,561

Franchise fees 5,585 5,646 4,570

Other 7,674 7,249 6,117

Total franchise revenue $ 334,792 $ 293,549 $ 264,168

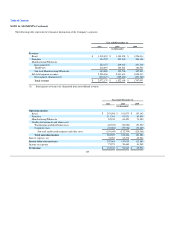

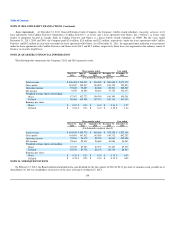

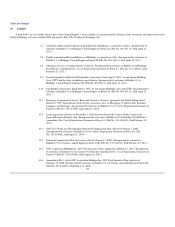

NOTE 18. FAIR VALUE MEASUREMENTS

The Company adopted the provisions of the standard on fair value measurements and disclosures as of January 1, 2008. This standard defines fair value,

establishes a consistent framework for measuring fair value and expands disclosures for each major asset and liability category measured at fair value on

either a recurring or nonrecurring basis. The standard clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined

based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, the standard establishes a

three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1 — observable inputs such as quoted prices in active markets for identical assets and liabilities;

Level 2

—

observable inputs such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in

markets that are not active, other inputs that are observable, or can be corroborated by observable market data; and

Level 3

—

unobservable inputs for which there are little or no market data, which require the reporting entity to develop its own assumptions.

The following table presents the Company's financial assets and liabilities that were accounted for at fair value on a recurring basis as of December 31,

2011 by level within the fair value hierarchy:

Fair Value Measurements Using

Level 1 Level 2 Level 3

(in thousands)

Other long-term assets $ — $ 2,699 $ —

The following table presents the Company's financial assets and liabilities that were accounted for at fair value on a recurring basis as of December 31,

2010 by level within the fair value hierarchy:

Fair Value Measurements Using

Level 1 Level 2 Level 3

(in thousands)

Other long-term assets $ — $ 2,577 $ —

Other current liabilities $ — $ 4,395 $ —

Other long-term liabilities $ 3,034 $ 3,074 $ —

106