GNC 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

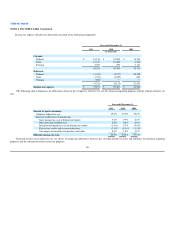

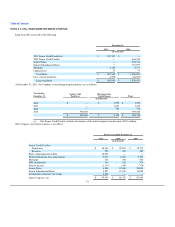

NOTE 8. LONG-TERM DEBT/INTEREST EXPENSE (Continued)

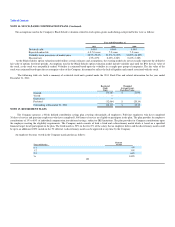

The following is a summary of the Company's debt:

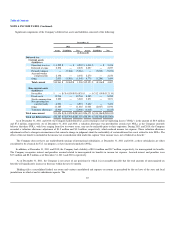

Senior Credit Facility. On March 4, 2011, Centers entered into the Senior Credit Facility, consisting of the Term Loan Facility and the Revolving

Credit Facility. As of December 31, 2011, the Company believes that it is in compliance with all covenants under the Senior Credit Facility. As of

December 31, 2011, $8.0 million of the Revolving Credit Facility was pledged to secure letters of credit. The Senior Credit Facility permits the Company to

prepay a portion or all of the outstanding balance without incurring penalties (except London Interbank Offering Rate ("LIBOR") breakage costs). GNC

Corporation, the Company's indirect wholly owned subsidiary ("GNC Corporation"), and Centers' existing and future domestic subsidiaries have guaranteed

Centers' obligations under the Senior Credit Facility. In addition, the Senior Credit Facility is collateralized by first priority pledges (subject to permitted

liens) of Centers' equity interests and the equity interests of Centers' domestic subsidiaries.

All borrowings under the Term Loan Facility and, initially, borrowings under the Revolving Credit Facility, bear interest, at the Company's option, at a

rate per annum equal to (A) the sum of (i) the greatest of (a) the prime rate (as publicly announced by JPMorgan Chase Bank, N.A. as its prime rate in effect),

(b) the federal funds effective rate plus 0.50%, (c) one month adjusted LIBOR plus 1.0% and (d) 2.25% plus (ii) the applicable margin of 2.0% or (B) the sum

of (i) the greater of (a) adjusted LIBOR or (b) 1.25% plus (ii) the applicable margin of 3.0%. Effective on and after the first date on which quarterly financial

statements are delivered to the lenders pursuant to the Senior Credit Facility following the first full quarter ending six months after the closing date of the

Senior Credit Facility, borrowings under the Revolving Credit Facility shall have an applicable margin of 1.75% for ABR Loans and 2.75% for Eurodollar

Loans provided our consolidated net senior secured leverage ratio is not greater than 3.25 to 1.00 and no event of default exists. In addition to paying interest

on outstanding principal under the Senior Credit Facility, the Company is required to pay a commitment fee to the lenders under the Revolving Credit Facility

in respect of unutilized revolving loan commitments at a rate of 0.50% per annum, as well as letter of credit fees of 3.0% to lenders and 0.25% to the issuing

bank. As of December 31, 2011, the Company's current interest rate on its Senior Credit Facility is 4.25%, as a result of the interest rate minimum

requirement as described above.

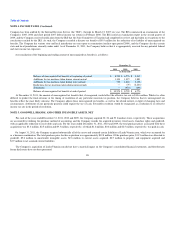

In connection with the Refinancing, Centers used a portion of the net proceeds from the Term Loan Facility to refinance its former indebtedness,

including all outstanding indebtedness under the Old Senior Credit Facility, the Senior Notes and the Senior Subordinated Notes.

Old Senior Credit Facility. The Old Senior Credit Facility consisted of the Old Term Loan Facility and the Old Revolving Credit Facility. As of

December 31, 2010, $8.8 million was pledged to secure letters of credit. The Old Senior Credit Facility permitted the Company to prepay a portion or all of

the outstanding balance without incurring penalties (except LIBOR breakage costs). GNC Corporation and Centers' then existing indirect domestic

subsidiaries guaranteed Centers' obligations under the Old Senior Credit Facility. In addition, the Old Senior Credit Facility was collateralized by first priority

pledges (subject to permitted liens) of Centers' equity interests and the equity interests of Centers' domestic subsidiaries.

All borrowings under the Old Senior Credit Facility bore interest, at the Company's option, at a rate per annum equal to (i) the higher of (x) the prime

rate (as publicly announced by JPMorgan Chase Bank, N.A. as its prime rate in effect) and (y) the federal funds effective rate, plus 0.50% per annum plus, at

December 31, 2010, in each case, applicable margins of 1.25% per annum for the Old Term Loan Facility and 1.0% per annum for the Old Revolving Credit

Facility or (ii) adjusted LIBOR plus 2.25% per annum for the Old Term Loan Facility and 2.0% per annum for the Old Revolving Credit Facility. In addition

to paying interest on outstanding principal under the Old Senior Credit Facility, the Company was required to pay a commitment fee to the lenders under the

Old Revolving Credit Facility in respect of unutilized revolving loan commitments at a rate of 0.50% per annum.

92