GNC 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

SECURITIES.

Market Information

Since March 31, 2011, the Class A common stock has been traded on the NYSE under the symbol "GNC." As of February 15, 2012, there were

103,832,767 shares of Class A common stock outstanding, 2,060,178 shares of Class B common stock outstanding, the closing price of the Class A common

stock was $30.00 per share, and we had approximately 62 stockholders of record (including 46 holders of restricted stock).

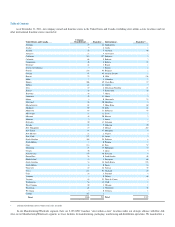

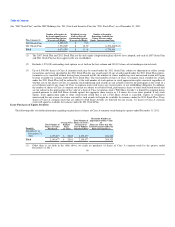

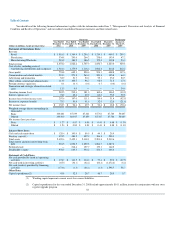

The following table presents the high and low sales prices by quarter for the Class A common stock, as reported by the NYSE:

2011 Quarter ended: High Low

June 30 $ 22.43 $ 16.08

September 30 $ 26.48 $ 19.72

December 31 $ 29.50 $ 19.52

Dividends

Prior to the consummation of the IPO, OTPP, as the holder of Class B common stock, was entitled to receive ratably an annual special dividend payment

equal to an aggregate amount of $750,000 per year when, as and if declared by the Board, for a period of ten years commencing on March 16, 2007 (the

"Special Dividend Period"). The special dividend payment was payable in equal quarterly installments on the first day of each quarter commencing on

April 1, 2007. For our fiscal years ended December 31, 2011 and 2010, $187,500 and $750,000, respectively, was paid to OTPP as a special dividend

pursuant to the obligations under the Class B common stock.

Upon the consummation of the IPO, OTPP's right to receive the special dividend payments was terminated and OTPP received, in lieu of quarterly

special dividend payments during the remainder of the Special Dividend Period, an automatic payment equal to the net present value of the aggregate amount

of quarterly special dividend payments that would have been payable to OTPP during the remainder of the Special Dividend Period, calculated in good faith

by the Board. The amount of such payment was $5.6 million. No further special dividend payments will be made.

There were no dividends declared on the Class A common stock for our fiscal years ended December 31, 2011 or 2010.

On February 15, 2012, the Board authorized and declared a cash dividend for the first quarter of 2012 of $0.11 per share of common stock, payable on or

about March 30, 2012 to stockholders of record as of the close of business on March 15, 2012. We currently intend to pay regular quarterly dividends;

however, the declaration of such future dividends and the establishment of the per share amount, record dates and payment dates for such future dividends are

subject to the final determination and approval of the Board and will depend on many factors, including, without limitation, our financial condition, future

earnings and cash flows, legal requirements, taxes and any other factors that the Board deems relevant.

Securities Authorized for Issuance under Equity Compensation Plans

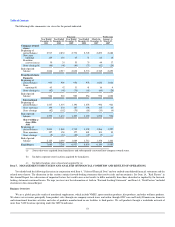

The following table sets forth information regarding outstanding option awards and shares remaining available for future issuance under each of the GNC

Acquisition Holdings Inc. 2007 Stock Incentive Plan

48