GNC 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

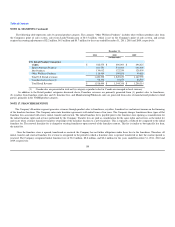

NOTE 14. STOCK-BASED COMPENSATION PLANS (Continued)

Full Share Awards are forfeited for any reason, 1.8 shares of Class A common stock will again be available for the grant of awards under the 2011 Stock Plan.

The Company will not grant any additional awards under the 2007 Stock Plan. No stock appreciation rights, restricted stock, deferred stock or

performance shares were granted under the 2007 Stock Plan. The Company granted 2.3 million options and 0.2 million shares of restricted stock for the year

ended December 31, 2011 under the 2011 Stock Plan.

The Company utilizes the Black Scholes model to calculate the fair value of options under both the 2011 Stock Plan and the 2007 Stock Plan. The

resulting compensation cost is recognized in the Company's financial statements over the option vesting period.

During the year ended December 31, 2011 the total intrinsic value of awards exercised was $60.9 million and the total amount of cash received from the

exercise of options was $28.5 million. The tax impact associated with the exercise of awards for the year ended December 31, 2011 was a benefit of

$22.4 million and was recorded to additional capital. During the year ended December 31, 2010, an immaterial amount of options was exercised.

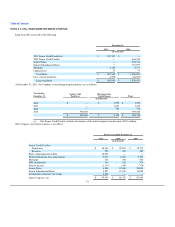

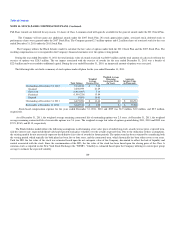

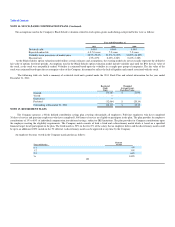

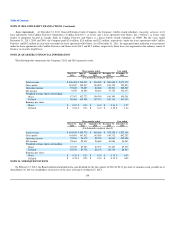

The following table sets forth a summary of stock options under all plans for the year ended December 31, 2011:

Total Options

Weighted

Average

Exercise Price

Weighted Average

Remaining

Contractual Term

(In Years)

Aggregate

Intrinsic Value

(in Thousands)

Outstanding at December 31, 2010 9,344,188 $ 7.60

Granted 2,256,959 21.29

Exercised (3,912,067) 7.24

Forfeited (1,010,226) 13.84

Expired (5,800) 10.81

Outstanding at December 31, 2011 6,673,054 $ 11.46 6.0 $ 116,712

Exercisable at December 31, 2011 3,640,334 $ 6.98 5.4 $ 79,966

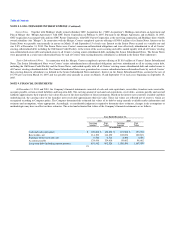

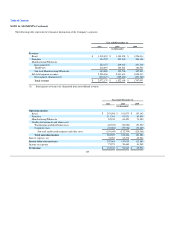

Stock-based compensation expense for the years ended December 31, 2011, 2010 and 2009 was $3.9 million, $3.2 million, and $2.9 million,

respectively.

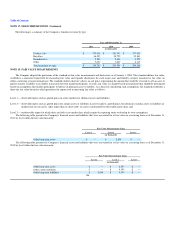

As of December 31, 2011, the weighted average remaining contractual life of outstanding options was 2.5 years. At December 31, 2011, the weighted

average remaining contractual life of exercisable options was 5.4 years. The weighted average fair value of options granted during 2011, 2010 and 2009 was

$7.23, $2.65, and $3.19, respectively

The Black-Scholes model utilizes the following assumptions in determining a fair value: price of underlying stock, award exercise price, expected term,

risk-free interest rate, expected dividend yield and expected stock price volatility over the award's expected term. Due to the utilization of these assumptions,

the existing models do not necessarily represent the definitive fair value of awards for future periods. The option term has been estimated by considering both

the vesting period, which typically for both plans has been five or four years, and the contractual term, which historically has been either seven or ten years.

Until the IPO, the fair value of the stock was estimated based upon the net enterprise value of the Company, discounted to reflect the lack of liquidity and

control associated with the stock. Since the consummation of the IPO, the fair value of the stock has been based upon the closing price of the Class A

common stock as reported on the New York Stock Exchange (the "NYSE"). Volatility is estimated based upon the Company utilizing its current peer group

average to estimate the expected volatility.

100