GNC 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 19. RELATED PARTY TRANSACTIONS (Continued)

Lease Agreements. At December 31, 2011, General Nutrition Centres Company, the Company's wholly owned subsidiary, was party, as lessee, to 18

lease agreements with Cadillac Fairview Corporation ("Cadillac Fairview"), as lessor, and 1 lease agreement with Ontrea, Inc. ("Ontrea"), as lessor, with

respect to properties located in Canada. Each of Cadillac Fairview and Ontrea is a direct wholly owned subsidiary of OTPP. For the years ended

December 31, 2011, 2010 and 2009, the Company paid $2.4 million, $2.6 million and $2.2 million, respectively, under the lease agreements with Cadillac

Fairview, and $0.2 million in each such year under the lease agreement with Ontrea. As of December 31, 2011, the aggregate future minimum lease payments

under the lease agreements with Cadillac Fairview and Ontrea were $10.1 and $0.7 million, respectively. Each lease was negotiated in the ordinary course of

business on an arm's length basis.

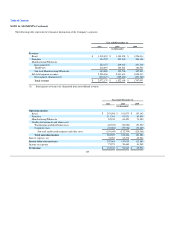

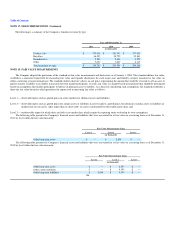

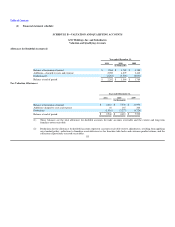

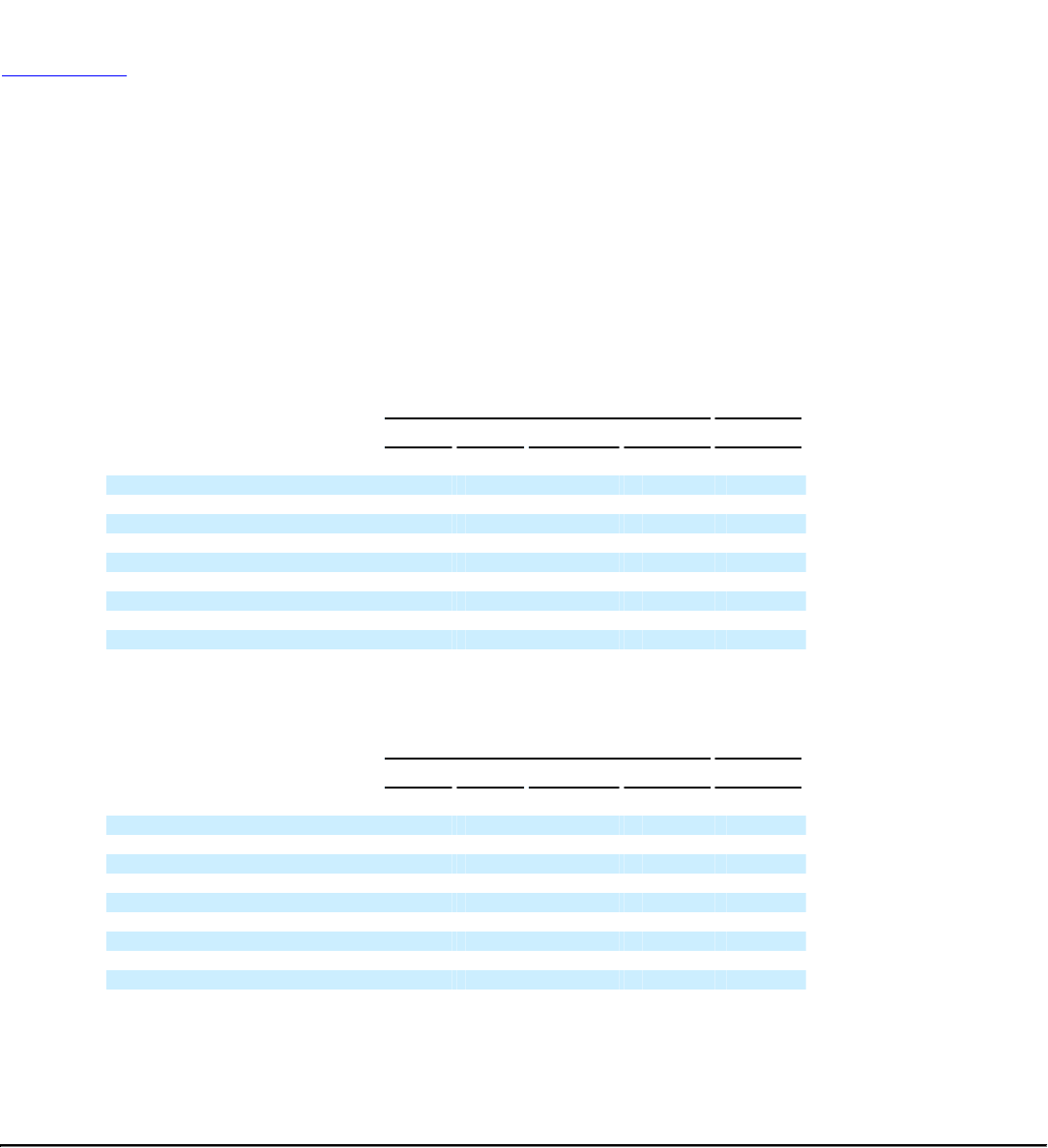

NOTE 20. QUARTERLY FINANCIAL INFORMATION

The following table summarizes the Company's 2011 and 2010 quarterly results:

Three months ended Year ended

March 31,

2011 June 30,

2011 September 30,

2011 December 31,

2011 December 31,

2011

($ in thousands, except per share $)

Total revenue $ 506,008 $ 518,535 $ 538,028 $ 509,608 $ 2,072,179

Gross profit 183,847 190,917 194,899 184,170 753,833

Operating income 57,689 72,697 82,600 69,521 282,507

Net income 9,923 36,004 48,663 37,743 132,333

Weighted average shares outstanding:

Basic 87,367 102,723 104,390 106,309 100,261

Diluted 90,088 105,908 107,351 109,116 103,010

Earnings per share:

Basic $ 0.07 $ 0.35 $ 0.47 $ 0.36 $ 1.27

Diluted $ 0.06 $ 0.34 $ 0.45 $ 0.35 $ 1.24

Three months ended Year ended

March 31,

2010 June 30,

2010 September 30,

2010 December 31,

2010 December 31,

2010

($ in thousands, except per share $)

Total revenue $ 465,019 $ 455,730 $ 465,660 $ 435,759 $ 1,822,168

Gross profit 165,899 163,612 163,059 149,712 642,282

Operating income 57,183 56,372 58,790 40,061 212,406

Net income 25,661 25,411 26,669 18,826 96,567

Weighted average shares outstanding:

Basic 87,339 87,353 87,357 87,367 87,339

Diluted 87,574 87,778 88,179 88,719 88,917

Earnings per share:

Basic $ 0.24 $ 0.23 $ 0.25 $ 0.15 $ 0.87

Diluted $ 0.24 $ 0.23 $ 0.24 $ 0.15 $ 0.85

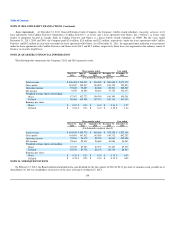

NOTE 21. SUBSEQUENT EVENTS

On February 15, 2012, the Board authorized and declared a cash dividend for the first quarter of 2012 of $0.11 per share of common stock, payable on or

about March 30, 2012 to stockholders of record as of the close of business on March 15, 2012.

108