GNC 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Pre-Opening Expenditures. The Company recognizes the cost associated with the opening of new stores as incurred. These costs are charged to

expense and are not material for the periods presented. Franchise store pre-opening costs are incurred by the franchisees.

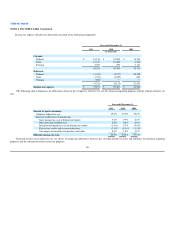

Income Taxes. The Company utilizes the asset and liability method of accounting for income taxes. Under the asset and liability method, deferred tax

assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statements carrying amounts of

existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in

which those temporary differences are expected to be recovered or settled. See Note 4, "Income Taxes."

It is the Company's policy to recognize interest and penalties related to uncertain tax positions as a component of income tax expense. See Note 4,

"Income Taxes," for additional information regarding the change in unrecognized tax benefits.

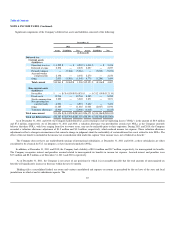

Self-Insurance. The Company has procured insurance for: (1) general liability; (2) product liability; (3) directors and officers liability; and

(4) property insurance. The Company is self-insured for: (1) medical benefits; (2) worker's compensation coverage in the State of New York with a stop loss

of $250,000; (3) physical damage to the Company's tractors, trailers and fleet vehicles for field personnel use; and (4) physical damages that may occur at the

corporate store locations. The Company is not insured for certain property and casualty risks due to the Company's assessment of frequency and severity of a

loss, the cost of insurance and the overall risk analysis.

The Company carries product liability insurance with a retention of $3.0 million per claim with an aggregate cap on retained losses of $10.0 million. The

Company carries general liability insurance with retention of $110,000 per claim with an aggregate cap on retained losses of $600,000. The majority of the

Company's workers' compensation and auto insurance policies are in deductible/retrospective plans. The Company reimburses the applicable insurance

company for the workers compensation and auto liability claims, subject to a $250,000 and $100,000 loss limit per claim, respectively.

As part of the medical benefits program, the Company contracts with national service providers to provide benefits to its employees for all medical,

dental, vision and prescription drug services. The Company then reimburses these service providers as claims are processed from Company employees. The

Company maintains a specific stop loss provision of $250,000 per individual per plan year with a maximum lifetime benefit limit of $2.0 million per

individual. The Company has no additional liability once a participant exceeds the $2.0 million ceiling. The Company's liability for medical claims is included

as a component of accrued benefits in Note 7, "Deferred Revenue and Other Current Liabilities," and was $1.9 million as of each of December 31, 2011 and

2010.

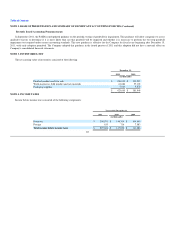

Stock-based Compensation. The Company utilizes the Black-Scholes model to calculate the fair value of stock options. The grant-date fair value of the

Company's restricted stock awards is based on the stock price on the grant date. The resulting compensation cost is recognized in the Company's financial

statements over the option and restricted stock vesting periods.

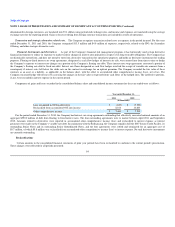

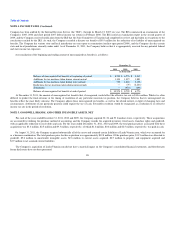

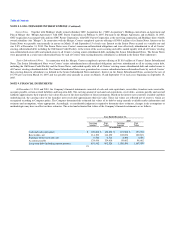

Earnings Per Share. Basic earnings per share is computed by dividing net earnings by the weighted average number of shares of common stock

outstanding for the period. Diluted earnings per share is computed by dividing net earnings by the weighted average number of shares of common stock

outstanding adjusted for the additional dilutive effect of unexercised stock options and unvested restricted stock.

Foreign Currency. For all foreign operations, the functional currency is the local currency. In accordance with the standard on foreign currency

matters, assets and liabilities of those operations,

83