GNC 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

related to former indebtedness, $1.6 million in original issue discount related to the Senior Subordinated Notes and $2.4 million related to the defeasance of

the Senior Notes and Senior Subordinated Notes. Additionally, we recognized $4.9 million of original issue discount and deferred financing fees expense

related to the $300.0 million pay down of debt in connection with the IPO. The increase was partially offset by a decrease in overall interest rates and

outstanding indebtedness.

Income Tax Expense

We recognized $75.3 million (or 36.3% of pre-tax income) of income tax expense for the year ended December 31, 2011 compared to $50.4 million (or

34.3% of pre-tax income) in 2010. The 2011 income tax expense includes $2.3 million, or 1.5% of pretax income, related to non-deductible costs. Income tax

expense for the years ended December 31, 2011 and 2010 was reduced by valuation allowance adjustments of $1.5 million and $3.1 million, respectively.

These valuation allowance adjustments reflected a change in circumstances that caused a change in judgment about the realizability of certain deferred tax

assets related to state net operating losses. Also, for 2011, income tax expense was favorably impacted by $2.6 million related to non-recurring tax credits.

Net Income

As a result of the foregoing, consolidated net income increased $35.7 million, or 37.0%, to $132.3 million for the year ended December 31, 2011

compared to $96.6 million in 2010. Net income for the year ended December 31, 2011 includes $31.2 million of transaction related expense, net of tax effect,

related to the Refinancing, the IPO, the Secondary Offering and executive severance. For the year ended December 31, 2011, excluding transaction related

expenses related to the Refinancing, the IPO, the Secondary Offering, and executive severance, net income, net of tax effect, was $163.5 million.

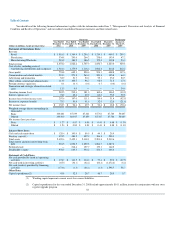

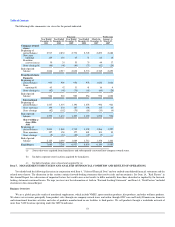

Comparison of the Years Ended December 31, 2010 and 2009

Revenues

Our consolidated net revenues increased $115.2 million, or 6.7%, to $1,822.2 million for the year ended December 31, 2010 compared to

$1,707.0 million in 2009. The increase was the result of increased sales in our Retail and Franchise segments, partially offset by a decline in our

Manufacturing/Wholesale segment.

Retail. Revenues in our Retail segment increased $88.1 million, or 7.0%, to $1,344.4 million for the year ended December 31, 2010 compared to

$1,256.3 million in 2009. Domestic retail revenue increased $64.8 million as a result of an increase in our same store sales and $17.1 million in our non-same

store sales. The same store sales increase includes GNC.com revenue, which increased $12.2 million, or 26.2%, to $59.0 million, compared to $46.8 million

in 2009. Sales increases occurred primarily in the vitamin and sports nutrition categories. Our company-owned domestic same store sales, including our

internet sales, improved by 5.6% in 2010 compared to 2009. Canadian retail revenue increased by $6.1 million in U.S. dollars. In local currency, Canadian

retail revenue declined by CAD $3.3 million. This decline was primarily a result of a CAD $5.6 million, or 5.7%, decline in company-owned same store sales,

partially offset by an increase of CAD $2.3 million in non-same store sales. Our company-owned store base increased by 83 domestic stores to 2,748

compared to 2,665 at December 31, 2009, primarily due to new store openings and franchise store acquisitions, and by two Canadian stores to 169 at

December 31, 2010 compared to 167 at December 31, 2009.

Franchise. Revenues in our Franchise segment increased $29.4 million, or 11.1%, to $293.6 million for the year ended December 31, 2010 compared

to $264.2 million in 2009. Domestic franchise revenue increased by $7.2 million, or 4.0%, to $185.9 million in 2010, compared to $178.7 million in 2009,

primarily due to higher wholesale revenues and fees. There were 903 stores at December 31, 2010 compared to 909 stores at December 31, 2009.

International franchise revenue increased by $22.2 million, or 25.8%, to

60