GNC 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

GNC HOLDINGS, INC. (GNC)

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 02/27/2012

Filed Period 12/31/2011

Table of contents

-

Page 1

GNC HOLDINGS, INC.

(GNC)

10-K

Annual report pursuant to section 13 and 15(d) Filed on 02/27/2012 Filed Period 12/31/2011

-

Page 2

Use these links to rapidly review the document TABLE OF CONTENTS TABLE OF CONTENTS

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ...

-

Page 3

...accelerated filer ý

(Do not check if a smaller reporting company)

Smaller reporting company o No ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o

As of February 15, 2012, the number of outstanding shares of Class A common stock, par...

-

Page 4

...on Accounting and Financial Disclosure Item 9A Controls and Procedures Item 9B Other Information Part III Item 10 Item 11 Item 12 Item 13 Item 14

4 21 40 40 42 47

48 51 53 70 72 109 109 110

Directors and Executive Officers of the Registrant and Corporate Governance Executive Compensation Security...

-

Page 5

...and product recall costs; loss or retirement of key members of management; costs of compliance and our failure to comply with new and existing governmental regulations including, but not limited to, tax regulations; costs of litigation and the failure to successfully defend lawsuits and other claims...

-

Page 6

..."), sports nutrition products and diet products. Our diversified, multi-channel business model derives revenue from product sales through company-owned domestic retail stores, domestic and international franchise activities, third-party contract manufacturing, e-commerce and corporate partnerships...

-

Page 7

...this Annual Report, unless the context requires otherwise, references to "we," "us," "our," "Company" or "GNC" refer collectively to Holdings and its subsidiaries. Corporate History Our business was founded in 1935 by David Shakarian who opened our first health food store in Pittsburgh, Pennsylvania...

-

Page 8

... the brand and reinforcing GNC's credibility with consumers. Attractive, loyal customer base. Our large customer base includes approximately 4.9 million active Gold Card members in the United States and Canada who account for over 50% of company-owned retail sales and spend on average two times more...

-

Page 9

... sales from GNC.com, royalties, wholesale sales and fees from both domestic and international franchisees, revenue from third-party contract manufacturing, wholesale revenue and fees from our Rite Aid store-within-a-store locations, and wholesale revenues from Sam's Club and PetSmart. Our business...

-

Page 10

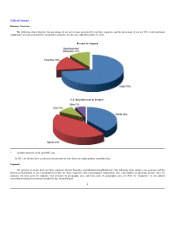

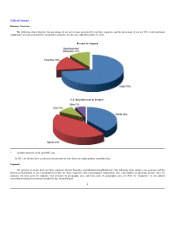

... nutritional supplements revenue generated by our product categories for the year ended December 31, 2011:

Revenue by Segment

U.S. Retail Revenue by Product*

*

includes domestic retail and GNC.com In 2011, we did not have a material concentration of sales from any single product or product line...

-

Page 11

.... This additional sales channel has enabled us to market and sell our products in regions where we have limited or no retail operations. Internet purchases are fulfilled and shipped directly from our distribution centers to our consumers using a third-party courier service. To date, we believe...

-

Page 12

...in the United States accounted for approximately 62% of our total franchise revenues for the year ended December 31, 2011. New franchisees in the United States are generally required to pay an initial fee of $40,000 for a franchise license. Existing GNC franchise operators may purchase an additional...

-

Page 13

...service our wholesale operations, including the manufacture and supply of our proprietary and third-party brand products to Rite Aid, Sam's Club, PetSmart and www.drugstore.com. We use our available capacity at these facilities to produce products for sale to third-party customers. The principal raw...

-

Page 14

...party brand names. We report our sales in four major nutritional supplement categories: VMHS, sports nutrition, diet and other wellness. In addition, our retail sales offer an extensive mix of brands, including over 1,800 SKUs across multiple categories and products. Through our online channels, GNC...

-

Page 15

... of sales system, and certain revenue adjustments that are recorded to ensure conformity with generally accepted accounting principles in the United States, including deferral of our Gold Card revenue to match the twelve month discount period of the card, and a reserve for customer returns. These...

-

Page 16

... Beyond Raw®. In 2011, we estimate that GNC-branded products generated more than $975 million of retail sales across company-owned retail, domestic franchise locations, GNC.com and Rite Aid store-within-a-store locations. Research and Development We have an internal research and development group...

-

Page 17

...supplements retail industry is a large, highly fragmented and growing industry, with no single industry participant accounting for a majority of total industry retail sales. Competition is based on price, quality and assortment of products, customer service, marketing support and availability of new...

-

Page 18

... of the states and localities in which our products are sold. The Dietary Supplement Health and Education Act of 1994 ("DSHEA") amended the Federal Food, Drug, and Cosmetic Act (the "FDC Act") to establish a new framework governing the composition, safety, labeling, manufacturing and marketing of...

-

Page 19

... prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operations. For example, we sell products manufactured by third parties that contain...

-

Page 20

... of federal law applicable to dietary supplements, including powers to issue a public warning or notice of violation letter to a company, publicize information about illegal products, detain products intended for import, require the reporting of serious adverse events, require a recall of illegal or...

-

Page 21

... policy is to use advertising that complies with the consent decrees and applicable regulations. Nevertheless, there can be no assurance that inadvertent failures to comply with the consent decrees and applicable regulations will not occur. Some of the products sold by franchise stores are purchased...

-

Page 22

... to franchise terms and charges, royalties and other fees; and place new stores near existing franchises.

To date, these laws have not precluded us from seeking franchisees in any given area and have not had a material adverse effect on our operations. Bills concerning the regulation of certain...

-

Page 23

... risk factors could cause our financial performance to differ significantly from the goals, plans, objectives, intentions and expectations expressed in this Annual Report. If any of the following risks and uncertainties actually occur, our business, financial condition, results of operations or cash...

-

Page 24

... our costs associated with this growth, our operating margins and profitability will be adversely affected. We operate in a highly competitive industry. Our failure to compete effectively could adversely affect our market share, revenues and growth prospects. The U.S. nutritional supplements retail...

-

Page 25

...to our market share. The success of our new product offerings depends upon a number of factors, including our ability to: accurately anticipate customer needs; innovate and develop new products; successfully commercialize new products in a timely manner; price our products competitively; manufacture...

-

Page 26

... case on acceptable terms, we may be unable to continue our current rate of growth and store expansion, which may have an adverse effect on our revenues and results of operations. We require a significant amount of cash to service our debt. Our ability to generate cash depends on many factors beyond...

-

Page 27

... may be exposed, our business, reputation, financial condition and operating results could be materially and adversely affected. In addition, our insurance policies may not provide adequate coverage. Compliance with new and existing governmental regulations could increase our costs significantly and...

-

Page 28

... costs, and reduced growth prospects. Additional or more stringent laws and regulations of dietary supplements and other products have been considered from time to time. These developments could require reformulation of some products to meet new standards, recalls or discontinuance of some products...

-

Page 29

... retail sales in the first four months of 2009. We provided refunds or gift cards to consumers who returned these products to our stores. In the second quarter of 2009, we experienced a reduction in sales and margin due to this recall as a result of accepting returns of products from customers and...

-

Page 30

... prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operation. For example, we sell products manufactured by third parties that contain...

-

Page 31

... increase in the price of raw materials that cannot be passed on to customers could have a material adverse effect on our results of operations and financial condition. In addition, if we no longer are able to obtain products from one or more of our suppliers on terms reasonable to us or at...

-

Page 32

... in our existing franchise agreements as well as our ability to identify additional markets in the United States and other countries. If we are unable to open additional franchise locations, we will have to sustain additional growth internally by attracting new and repeat customers to our existing...

-

Page 33

...quality of franchise store operations may be diminished by any number of factors beyond our control. Consequently, franchisees may not successfully operate stores in a manner consistent with our standards and requirements or standards set by federal, state and local governmental laws and regulations...

-

Page 34

.... Our ability to timely open new stores and to expand into additional market areas depends in part on the following factors: the availability of attractive store locations; the absence of occupancy delays; the ability to negotiate acceptable lease terms; the ability to identify customer demand in...

-

Page 35

... our Internet service providers, and could prevent us from processing customer purchases. Any significant interruption in the availability or functionality of our website or our customer processing, distribution or communications systems, for any reason, could seriously harm our business, financial...

-

Page 36

...other business data is critical to us. Federal, state, provincial and international laws and regulations govern the collection, retention, sharing and security of data that we receive from and about our employees, customers, vendors and franchisees. The regulatory environment surrounding information...

-

Page 37

... interest rates; fuel and energy costs; energy shortages; taxes; general political conditions, both domestic and abroad; and the level of customer traffic within department stores, malls and other shopping and selling environments. Consumer product purchases, including purchases of our products, may...

-

Page 38

... that increase the amount of our indebtedness or sell revenue-generating assets. Moreover, the Sponsors are in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. The Sponsors may also...

-

Page 39

... General Corporation Law (the "DGCL"), could delay or make it more difficult to remove incumbent directors or for a third-party to acquire us, even if a takeover would benefit our stockholders. These provisions include a classified Board; the sole power of a majority of the Board to fix the number...

-

Page 40

...; conditions and trends in the markets we serve; announcements of significant new products by us or our competitors; unfavorable publicity or consumer perception of our products or the ingredients they contain or any similar products distributed by other companies; changes in our pricing policies or...

-

Page 41

... are available for sale in the open market upon exercise by the holders, subject to vesting restrictions and Rule 144 limitations applicable to our affiliates. Our dual-class capitalization structure and the conversion features of our Class B common stock may dilute the voting power of the holders...

-

Page 42

... 2,000 square feet. In our Franchise segment, primarily all of our franchise stores in the United States and Canada are located on premises we lease and then sublease to our respective franchisees. All of our franchise stores in the remaining international markets are owned or leased directly by our...

-

Page 43

... Total

*

includes distribution centers where retail sales are made

In our Manufacturing/Wholesale segment, there are 2,125 GNC franchise "store-within-a-store" locations under our strategic alliance with Rite Aid. Also, in our Manufacturing/Wholesale segment, we lease facilities for manufacturing...

-

Page 44

41

-

Page 45

..., Pennsylvania where the distribution of LuckyVitamin.com products is now being fulfilled. We own our 253,000 square-foot corporate headquarters located in Pittsburgh, Pennsylvania. We lease three small regional sales offices in Fort Lauderdale, Florida, Tustin, California and Mississauga, Ontario...

-

Page 46

... v. Muscletech Research and Development, Inc., U.S. District Court, Northern District of Alabama, 10CV370 (filed February 19, 2010); Amber Lutz, et al. v. General Nutrition Centers, Inc., et al., Superior Court of California, County of Orange, 30-2010 00357532 (filed March 26, 2010); Shannon Justers...

-

Page 47

...et al. v. General Nutrition Centers, Inc., et al., Superior Court of California, County of San Francisco, CGC 10-497919 (filed March 19, 2010); Phillip Sims v. GNC Corporation, et al., U.S. District Court, District of New Jersey, 10CV1728 (filed April 5, 2010); Donna Natali v. GNC Corporation, et al...

-

Page 48

... Research and Development, Inc., et al., U.S. District Court, Northern District of Alabama, 10CV3611 (filed December 29, 2010); Maurice Harris v. Iovate Health Sciences, et al., U.S. District Court, Southern District of New York, 10CV9698 (filed December 30, 2010); Marek Kosciesza v. GNC Corporation...

-

Page 49

...et al. v. GNC Corporation, et al., Superior Court of California, County of Los Angeles, BC-460551 (filed April 29, 2011); and Sean Sebastian Waters v. GNC, Inc., et al., Superior Court of New Jersey, Atlantic County, ATL-L- 00270510 (filed June 24, 2010 (GNC added to amended complaint on May 2, 2011...

-

Page 50

...

By court order dated October 6, 2009, the United States Judicial Panel on Multidistrict Litigation consolidated pretrial proceedings of many of the pending actions (including the above-listed GNC class actions) in the Southern District of California (In re: Hydroxycut Marketing and Sales Practices...

-

Page 51

..., without limitation, our financial condition, future earnings and cash flows, legal requirements, taxes and any other factors that the Board deems relevant. Securities Authorized for Issuance under Equity Compensation Plans The following table sets forth information regarding outstanding option...

-

Page 52

... of Approximate Dollar Value) Average Price Shares (or Units) of Total Number of Paid per Purchased as Shares (or Units) that May Shares (or Units) Share Part of Publicly Yet Be Purchased under the Purchased (or Unit) Announced Plans Plans or Programs(2)

Period(1)

December 1 to December 31, 2011...

-

Page 53

... in January 2012. In February 2012, the Board authorized a new share repurchase program pursuant to which Holdings may purchase up to 1.0 million shares of Class A common stock over the forthcoming year. Stock Performance Graph The line graph below compares the cumulative total stockholder return on...

-

Page 54

... in this Annual Report. The selected consolidated financial data for the period January 1, 2007 to March 15, 2007 represent the period during which GNC Parent Corporation was owned by an investment fund managed by Apollo. GNC Acquisition Inc., a wholly owned subsidiary of Holdings, completed the...

-

Page 55

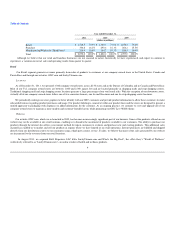

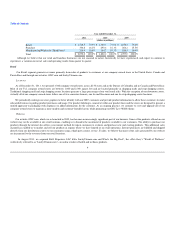

... 2007

Statement of Operations Data: Revenue: Retail Franchising Manufacturing/Wholesale Total revenue Cost of sales, including costs of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion Other selling, general and administrative Foreign...

-

Page 56

... our company-owned stores and online through GNC.com and LuckyVitamin.com, domestic and international franchise activities and sales of products manufactured in our facilities to third parties. We sell products through a worldwide network of more than 7,600 locations operating under the GNC brand...

-

Page 57

... Domestic franchising revenue grew 11.5%, and we added 21 net new franchise stores. International franchise revenue grew by 16.6%, as we added 153 net new franchise stores. We began making wholesale sales in China through multiple retailers and other distribution channels. We acquired LuckyVitamin...

-

Page 58

... the management of unallocated costs from our warehousing, distribution and corporate segments, as follows: • Retail: We generate retail revenues by sales at our company-owned stores and online through GNC.com and LuckyVitamin.com. Although we believe that our retail and franchise businesses are...

-

Page 59

... to a different mall or shopping center, or converted to a franchise store or a company-owned store, sales from that store up to and including the closing day or the day immediately preceding the relocation or conversion are included as same store sales as long as the store was open during the same...

-

Page 60

..., 2011 Revenues: Retail Franchise Manufacturing / Wholesale: Intersegment revenues(1) Third Party Subtotal Manufacturing / Wholesale Intersegment elimination(1) Total revenues Operating expenses: Cost of sales, including warehousing, distribution and occupancy costs Compensation and related benefits...

-

Page 61

... of increases in product sales, royalties and fees. Our international franchise store base increased by 153 stores to 1,590 at December 31, 2011 compared to 1,437 at December 31, 2010. Manufacturing/Wholesale. Revenues in our Manufacturing/Wholesale segment, which includes third-party sales from our...

-

Page 62

... 31, 2011 compared to $69.4 million in 2010. This was primarily due to higher revenue from third party manufacturing contracts and contributions from new wholesale customers. Warehousing and distribution costs. Unallocated warehousing and distribution costs increased $5.6 million, or 10.1%, to $60...

-

Page 63

... to $46.8 million in 2009. Sales increases occurred primarily in the vitamin and sports nutrition categories. Our company-owned domestic same store sales, including our internet sales, improved by 5.6% in 2010 compared to 2009. Canadian retail revenue increased by $6.1 million in U.S. dollars...

-

Page 64

...result of increases in product sales and royalties. Our international franchise store base increased by 130 stores to 1,437 at December 31, 2010 compared to 1,307 at December 31, 2009. Manufacturing/Wholesale. Revenues in our Manufacturing/Wholesale segment, which includes third-party sales from our...

-

Page 65

...in 2009. This increase was due to increases in royalty income, franchise fees, higher dollar margins on increased product sales to franchisees and reductions in bad debt expenses and amortization expense. Manufacturing/Wholesale. Operating income decreased $4.1 million, or 5.6%, to $69.4 million for...

-

Page 66

... $72.0 million available under the Revolving Credit Facility, after giving effect to $8.0 million utilized to secure letters of credit. We expect that our primary uses of cash in the near future will be for capital expenditures, working capital requirements, repurchase of additional shares of Class...

-

Page 67

... facilities and information technology systems. In each of 2012 and 2013, we expect our capital expenditures to be approximately $50 million, which includes costs associated with growing our domestic square footage. We anticipate funding our 2012 capital requirements with cash flows from operations...

-

Page 68

...(x) the prime rate (as publicly announced by JPMorgan Chase Bank, N.A. as its prime rate in effect) and (y) the federal funds effective rate, plus 0.50% per annum plus, at December 31, 2010, in each case, applicable margins of 1.25% per annum for the Old Term Loan Facility and 1.0% per annum for the...

-

Page 69

... collectively represented approximately 36% of the aggregate costs associated with our company-owned retail store operating leases. These balances consist of $3.5 million of advertising agreements.

(2)

(3)

(4) (5)

Excludes cash settlements with taxing authorities for unrecognized tax benefits...

-

Page 70

..., 2011, 2010 and 2009. We recognize revenues on product sales to franchisees and other third parties when the risk of loss, title and insurable risks have transferred to the franchisee or third party. We recognize revenues from franchise fees at the time a franchise store opens or at the time of 67

-

Page 71

... with the initial purchase of a franchise location. The notes are demand notes, payable monthly over periods of five to seven years. We generate a significant portion of our revenue from ongoing product sales to franchisees and thirdparty customers. An allowance for doubtful accounts is established...

-

Page 72

... of our brand name which requires assumptions as to the revenue growth rates, royalty rates and appropriate discount rates. We conduct impairment testing annually at the beginning of the fourth quarter of each fiscal year. In the event of declining financial results and market conditions, we could...

-

Page 73

...Revenue and Other Current Liabilities" to our audited consolidated financial statements included in this Annual Report, and was $1.9 million as of December 31, 2011 and 2010. Leases We have various operating leases for company-owned and franchise store locations and equipment. Store leases generally...

-

Page 74

... from local currencies to the U.S. dollar of the reported financial position and operating results of our non-U.S. based subsidiaries. We are also subject to foreign currency exchange rate changes for purchases of goods and services that are denominated in currencies other than the U.S. dollar...

-

Page 75

... of Contents Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

TABLE OF CONTENTS

Page

Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets As of December 31, 2011 and 2010 Consolidated Statements of Income For the years ended December 31, 2011, 2010 and 2009...

-

Page 76

... the financial position of GNC Holdings, Inc. and subsidiaries at December 31, 2011 and 2010, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2011 in conformity with accounting principles generally accepted in the United States of...

-

Page 77

Table of Contents

PART I-FINANCIAL INFORMATION Item 1. Financial Statements

GNC HOLDINGS, INC. AND SUBSIDIARIES Consolidated Balance Sheets (in thousands, except per share data)

December 31, 2011 Current assets: Cash and cash equivalents Receivables, net Inventories (Note 3) Prepaids and other ...

-

Page 78

-

Page 79

... thousands, except per share data)

Year ended December 31, 2011 2010 2009

Revenue Cost of sales, including cost of warehousing, distribution and occupancy Gross profit Compensation and related benefits Advertising and promotion Other selling, general and administrative Foreign currency loss (gain...

-

Page 80

Table of Contents

GNC HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of Stockholders' Equity ...cash stockbased - compensation Balance at December 31, 59,199 $ 2010 Comprehensive income (loss): Net income Unrealized gain on derivatives designated and qualified as cash flow hedges, net of tax...

-

Page 81

...) Conversion of stock 26,109 Purchase of treasury (2,235) - - stock Preferred stock - - - dividends Exercise of stock 3,912 3 - options Non-cash stockbased - - - compensation Balance at December 31, 102...$298,831

The accompanying notes are an integral part of the consolidated financial statements. 76

-

Page 82

... from sale of Class A Common Stock Proceeds from issuance of long-term debt Debt financing fees Net cash used in financing activities Effect of exchange rate on cash Net (decrease) increase in cash Beginning balance, cash Ending balance, cash Supplemental Cash Flow Information Income taxes paid...

-

Page 83

...Manufacturing/Wholesale. Corporate retail store operations are located in the United States, Canada and Puerto Rico and in addition the Company offers products domestically through GNC.com, LuckyVitamin.com and www.drugstore.com. Franchise stores are located in the United States and 53 international...

-

Page 84

...principles generally accepted in the United States of America ("U.S. GAAP") and with the instructions to Form 10-K and Regulation S-X. The Company's normal reporting period is based on a calendar year. Summary of Significant Accounting Policies Principles of Consolidation. The consolidated financial...

-

Page 85

.../losses from the sale of property, plant and equipment are recognized in current operations. Goodwill and Intangible Assets. Goodwill represents the excess of purchase price over the fair value of identifiable net assets of businesses, including franchisees, acquired by the Company. Goodwill and...

-

Page 86

...discounts associated with the Gold Card program. For an annual fee, the card provides customers with a 20% discount on all products purchased, both on the date the card is purchased and certain specified days of every month. The Company also sells gift cards to its customers. Revenue from gift cards...

-

Page 87

...The Company bills franchisees and third-party customers shipping and transportation costs and reflects these charges in revenue. The unreimbursed costs that are associated with these costs are included in cost of sales. Research and Development. Research and development costs arising from internally...

-

Page 88

... tax benefits. Self-Insurance. The Company has procured insurance for: (1) general liability; (2) product liability; (3) directors and officers liability; and (4) property insurance. The Company is self-insured for: (1) medical benefits; (2) worker's compensation coverage in the State of New York...

-

Page 89

... respectively, related to the IPO, the Secondary Offering, and other strategic alternative costs. Financial Instruments and Derivatives. As part of the Company's financial risk management program, it has historically used certain derivative financial instruments to reduce its exposure to market risk...

-

Page 90

... on Company's consolidated financial statements. NOTE 3. INVENTORIES, NET The net carrying value of inventories consisted of the following:

December 31, 2011 2010 (in thousands)

Finished product ready for sale Work-in-process, bulk product and raw materials Packaging supplies NOTE 4. INCOME TAXES...

-

Page 91

... between the Company's effective tax rate for financial reporting purposes and the federal statutory tax

Year ended December 31, 2011 2010 2009

Percent of pretax earnings: Statutory federal tax rate Increase (reduction) resulting from: State income tax, net of federal tax benefit Other permanent...

-

Page 92

... unrecognized tax benefits will significantly increase or decrease within the next 12 months. Holdings files a consolidated federal tax return and various consolidated and separate tax returns as prescribed by the tax laws of the state and local jurisdictions in which it and its subsidiaries operate...

-

Page 93

... position could require the use of cash. Favorable resolution would be recognized as a reduction to its effective income tax rate in the period of resolution. NOTE 5. GOODWILL, BRANDS, AND OTHER INTANGIBLE ASSETS, NET For each of the years ended December 31, 2011, 2010 and 2009, the Company acquired...

-

Page 94

...11,467 637,877

$

$

Gold Card

Retail Brand

Franchise Operating Other Brand Agreements Intangibles (in thousands)

Total

Balance at December 31, 2009 Acquired franchise stores Amortization expense Balance at December 31, 2010 Acquired franchise stores Acquisition of LuckyVitamin.com Amortization...

-

Page 95

...28,063 38,672 104,525

$

$

35,467 25,656 46,970 108,093

Deferred revenue consists primarily of Gold Card membership fees and gift card deferrals. Other current liabilities consist of the liabilities related to accrued taxes, benefits, workers compensation, accrued interest and other occupancy. 90

-

Page 96

... balance of the initial original issue discount of $2.6 million. The Company's net interest expense is as follows:

For the year ended December 31, 2011 2010 (in thousands) 2009

Senior Credit Facility: Term Loan Revolver Early extinguishment of debt Deferred financing fees amortization Mortgage OID...

-

Page 97

... first full quarter ending six months after the closing date of the Senior Credit Facility, borrowings under the Revolving Credit Facility shall have an applicable margin of 1.75% for ABR Loans and 2.75% for Eurodollar Loans provided our consolidated net senior secured leverage ratio is not greater...

-

Page 98

...values of the Company's financial instruments are as follows:

Year Ended December 31, 2011 Carrying Amount Fair Value Carrying Amount (in thousands) 2010 Fair Value

Cash and cash equivalents Receivables, net Franchise notes receivable, net Accounts payable Long-term debt (including current portion...

-

Page 99

... rata share of landlord allocated common operating expenses. Most retail leases also require additional rentals based on a percentage of sales in excess of specified levels. According to the individual lease specifications, real estate taxes, insurance and other related costs may be included in the...

-

Page 100

...'s business, financial condition, results of operations or cash flows. As a manufacturer and retailer of nutritional supplements and other consumer products that are ingested by consumers or applied to their bodies, the Company has been and is currently subjected to various product liability claims...

-

Page 101

...the accompanying financial statements. Romero Claim. On April 27, 2009, plaintiff J.C. Romero, a professional baseball player, filed a complaint against, among others, the Company, in Superior Court of New Jersey (Law Division/ Camden County). Plaintiff alleges that he purchased from a GNC store and...

-

Page 102

... at this time, no liability has been accrued in the accompanying financial statements. On July 16, 2010, a second, similar wage and hour complaint was filed by Jennifer Mell and Jose Munoz, on behalf of themselves and all others similarly situated against GNC Corporation (U.S. District Court...

-

Page 103

.... The Company believes it has complied with, and is currently complying with, its environmental obligations pursuant to environmental and health and safety laws and regulations and that any liabilities for noncompliance will not have a material adverse effect on its business or financial performance...

-

Page 104

...-BASED COMPENSATION PLANS The Company has outstanding stock-based compensation awards that were granted by the Compensation Committee (the "Compensation Committee") of Holdings' Board of Directors (the "Board") under the following two stock-based employee compensation plans: • • the GNC Holdings...

-

Page 105

... enterprise value of the Company, discounted to reflect the lack of liquidity and control associated with the stock. Since the consummation of the IPO, the fair value of the stock has been based upon the closing price of the Class A common stock as reported on the New York Stock Exchange (the "NYSE...

-

Page 106

... 30 days of service and part time employees who have completed 1,000 hours of service are eligible to participate in the plan. The plan provides for employee contributions of 1% to 80% of individual compensation into deferred savings, subject to IRS limitations. The plan provides for Company...

-

Page 107

.../Wholesale. The Retail reportable segment includes the Company's corporate store operations in the United States, Canada, Puerto Rico and its GNC.com and LuckyVitamin.com businesses. The Franchise reportable segment represents the Company's franchise operations, both domestically and internationally...

-

Page 108

... consolidated revenue.

Year ended December 31, 2011 2010 (in thousands) 2009

Operating income: Retail Franchise Manufacturing/Wholesale Unallocated corporate and other costs: Warehousing and distribution costs Corporate costs Sub total unallocated corporate and other costs Total operating income...

-

Page 109

... expenditures: Retail Franchise Manufacturing / Wholesale Corporate / Other Total capital expenditures Total assets Retail Franchise Manufacturing / Wholesale Corporate / Other Total assets Geographic areas Total revenues: United States Foreign Total revenues Long-lived assets: United States Foreign...

-

Page 110

... product sales to franchisees, royalties, franchise fees and interest income on the financing of the franchise locations. The Company enters into franchise agreements with initial terms of ten years. The Company charges franchisees three types of flat franchise fees associated with stores: initial...

-

Page 111

Table of Contents NOTE 17. FRANCHISE REVENUE (Continued) The following is a summary of the Company's franchise revenue by type:

Year ended December 31, 2011 2010 (in thousands) 2009

Product sales Royalties Franchise fees Other Total franchise revenue NOTE 18. FAIR VALUE MEASUREMENTS

$

$

275,026...

-

Page 112

... of the aggregate annual management fee that would have been payable to ACOF Operating Manager during the remainder of the term of the fee agreement. The amount of such payment was $5.6 million. No further payments will be made pursuant to the Management Services Agreement. Special Dividend Prior to...

-

Page 113

..., General Nutrition Centres Company, the Company's wholly owned subsidiary, was party, as lessee, to 18 lease agreements with Cadillac Fairview Corporation ("Cadillac Fairview"), as lessor, and 1 lease agreement with Ontrea, Inc. ("Ontrea"), as lessor, with respect to properties located in Canada...

-

Page 114

...") and Chief Financial Officer ("CFO"), has evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this Annual Report. Disclosure controls and procedures are designed to provide...

-

Page 115

...public accounting firm, PricewaterhouseCoopers LLP, has audited the effectiveness of our internal control over financial reporting as of December 31, 2011, as stated in their report, which is included in Item 8, "Financial Statements and Supplementary Data" of this Annual Report. Changes in Internal...

-

Page 116

...Contents

PART III Item 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT AND CORPORATE GOVERNANCE

Information with respect to this Item will be included in our Proxy Statement to be filed on March 8, 2012, which is incorporated herein by reference. Item 11. EXECUTIVE COMPENSATION

Information...

-

Page 117

... filed as part of this Annual Report: (1) Financial statements filed in Part II, Item 8 of this Annual Report: • • Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets As of December 31, 2011 and December 31, 2010 • Consolidated Statements of Income For the years...

-

Page 118

... for the allowance for doubtful accounts represent: accounts receivable reserve adjustments, resulting from applying our standard policy; reductions to franchise receivable reserves for franchise take-backs and customer product returns; and the collection of previously reserved receivables. 113...

-

Page 119

... 4.2 to Holdings' Current Report on Form 8-K (File No. 001-35113), filed April 12, 2011.) Mortgage, Assignment of Leases, Rents and Contracts, Security Agreement and Fixture Filing, dated March 23, 1999, from Gustine Sixth Avenue Associates, Ltd., as Mortgagor, to Allstate Life Insurance Company, as...

-

Page 120

... Agreement, dated as of March 3, 2009, by and between Centers and Gerald J. Stubenhofer, Jr. (Incorporated by reference to Exhibit 10.19.2 to Centers' Annual Report on Form 10-K (File No. 333-144396), filed March 11, 2010.) Form of Indemnification Agreement between Holdings and each of our directors...

-

Page 121

... Centers' Pre-Effective Amendment No. 1 to its Registration Statement on Form S-4 (File No. 333-114502), filed August 9, 2004.)†Amended and Restated GNC/Rite Aid Retail Agreement, dated July 31, 2007, between Nutra Sales Corporation (f/k/a General Nutrition Sales Corporation) and Rite Aid Hdqtrs...

-

Page 122

...of Contents

101.PRE 101.DEF * †Filed herewith

XBRL Taxonomy Extension Presentation Linkbase XBRL Taxonomy Extension Definition Linkbase

Portions of this exhibit have been omitted pursuant to a request for confidential treatment. The omitted portions have been separately filed with the SEC. 117

-

Page 123

... the undersigned, thereunto duly authorized.

GNC HOLDINGS, INC. By: /s/ JOSEPH FORTUNATO

Joseph Fortunato President & Chief Executive Officer Dated: February 27, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on...

-

Page 124

... Director Dated: February 27, 2012

By:

/s/ DAVID B. KAPLAN David B. Kaplan Director Dated: February 27, 2012

By:

/s/ BRIAN KLOS Brian Klos Director Dated: February 27, 2012

By:

/s/ JOHANN O. KOSS Johann O. Koss Director Dated: February 27, 2012

By:

/s/ AMY B. LANE Amy B. Lane Director Dated...

-

Page 125

-

Page 126

... 10.15 FORM OF INDEMNIFICATION AGREEMENT(1) AGREEMENT, executed this [Note 2], among GNC Acquisition Holdings Inc., a Delaware corporation (the "Company"), and [Note 1] (the "Indemnitee"), and, with respect to its guarantee set forth on the signature pages hereto only, General Nutrition Centers, Inc...

-

Page 127

... then still in office who were either members of the Board at the beginning of such period or whose election or nomination for election was previously so approved including new members of the Board designated in or provided for in an agreement regarding the merger, consolidation or sale, transfer or...

-

Page 128

... related to the fact that Indemnitee is or was a director, officer, employee, agent or fiduciary of the Company, or is or was serving at the request of the Company as a director, officer, employee, trustee, agent or fiduciary of another corporation, partnership, joint venture, employee benefit plan...

-

Page 129

... Board who were directors immediately prior to such Change in Control) then with respect to all matters thereafter arising concerning the rights of Indemnitee to indemnity payments and Expense Advances under this Agreement or any other agreement or Company By-Law now or hereafter in effect relating...

-

Page 130

...payment of Expenses by the Company under this Agreement or any other agreement or Company ByLaw now or hereafter in effect relating to Claims for Indemnifiable Events and/or (ii) recovery under any directors' and officers' liability insurance policies maintained by the Company, regardless of whether...

-

Page 131

... Company's By-Laws and this Agreement, it is the intent of the parties hereto that Indemnitee shall enjoy by this Agreement the greater benefits so afforded by such change. 11. Liability Insurance. To the extent the Company maintains an insurance policy or policies providing directors' and officers...

-

Page 132

... all or substantially all of the business and/or assets of the Company, spouses, heirs, executors and personal and legal representatives. This Agreement shall continue in effect regardless of whether Indemnitee continues to serve as an officer or director of the Company or of any other enterprise at...

-

Page 133

... to the fullest extent permitted by law. 18. Governing Law. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Delaware applicable to contracts made and to be performed in such state without giving effect to the principles of conflicts of...

-

Page 134

IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective as of the date set forth above. GNC ACQUISITION HOLDINGS INC. By: Its:

-

Page 135

INDEMNITEE [Note 1]

-

Page 136

General Nutrition Centers, Inc. hereby unconditionally guarantees the due and punctual payment and performance of all obligations of the Company under this Agreement in accordance with the terms set forth herein. GENERAL NUTRITION CENTERS, INC. By: Name: Title:

-

Page 137

SCHEDULE Schedule to Notes in Form of Indemnification Agreement

Name (Note 1) Effective Date (Note 2)

Norman Axelrod Jeffrey P. Berger Andrew Claerhout Joseph Fortunato Michael Hines David B. Kaplan Brian Klos Johann O. Koss Amy B. Lane Romeo Leemrijse Richard Wallace

March 16, ...

-

Page 138

... General Nutrition Centers, Inc. GNC Funding, Inc. General Nutrition Corporation General Nutrition Investment Company GNC Puerto Rico, Inc. General Nutrition Centres Company GNC Columbia SAS Lucky Vitamin Corporation GNC Transportation, LLC Gustine Sixth Avenue Associates, Ltd. GNC Headquarters...

-

Page 139

QuickLinks

Exhibit 21.1 Subsidiaries of the Registrant

-

Page 140

... financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 27, 2012

/s/ JOSEPH M. FORTUNATO Joseph M. Fortunato Chief Executive Officer...

-

Page 141

QuickLinks

Exhibit 31.1 Certification of Chief Executive Officer of Periodic Report Pursuant to Rule 13a-14(a) and Rule 15d-14(a)

-

Page 142

...rapidly navigate through this document

Exhibit 31.2

Certification of Chief Financial Officer of Periodic Report Pursuant to Rule 13a-14(a) and Rule 15d-14(a) I, Michael M. Nuzzo, certify that: 1. I have reviewed this Annual Report on Form 10-K of GNC Holdings, Inc.;

2. Based on my knowledge, this...

-

Page 143

QuickLinks

Exhibit 31.2 Certification of Chief Financial Officer of Periodic Report Pursuant to Rule 13a-14(a) and Rule 15d-14(a)

-

Page 144

... the Annual Report on Form 10-K of GNC Holdings, Inc. (the "Company"), for the year ended December 31, 2011 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), Joseph M. Fortunato, as Chief Executive Officer of the Company and Michael M. Nuzzo, as Chief Financial...

-

Page 145

QuickLinks

Exhibit 32.1 Certification of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002