Express Scripts 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

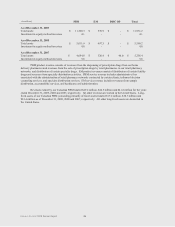

Express Scripts 2009 Annual Report 84

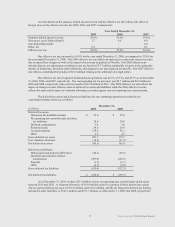

W

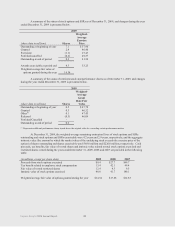

e received a $15.0 million insurance recovery in the second quarter of 2009 for previously incurred

l

itigation costs. We

i

ncurred a charge of

$

35.0 million in the third quarter of 2009 related to the settlement of a

l

awsuit brought against us and one of our subsidiaries, which settlement resulted in the dismissal of the case by the

c

ourt on October 22

,

2009

.

1

4

.

S

egment information

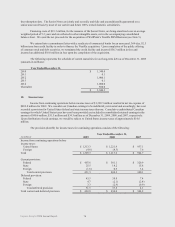

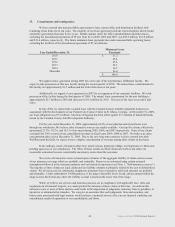

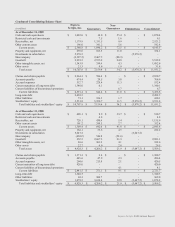

Durin

g

t

he first quarter of 2009, we changed ou

r

organizational structure resulting in two

bus

in

ess

s

egments: PBM and EM. Previously, we had reported segments of PBM and SAAS. Our chief operating decisio

n

m

aker assessed performance under this new structure begi

n

ning i

n

t

he first quarter of 2009. Th

e

s

pecialty p

h

armac

y

o

perations, which were previously in our SAAS segment, have been operationally integrated with our PBM

o

perations in order to maximize its growth and improve efficiency. Additionally, the followi

n

g services which were

previously in SAAS were operationally integrated into the PBM

:

b

i

o

-

pharma services including reimbursement and customized logistics solutions and

fulfillment of prescriptions to low

-

i

ncome patients through pharmaceutical manufactur

e

r

-

s

ponsored and compan

y

-

s

ponsored generic patient assistance programs

.

The EM segment primarily consists of the following services

:

distribution of pharmaceuticals and medical supplies to providers and clinics,

distribution of fertility pharmaceuticals

r

equiring special handling or packaging,

distribution of sample units to physicians and verification of practitioner licensure and

h

ealthcare account administration and implementation of consume

r

-

d

ir

ec

t

ed

h

e

alth

c

ar

e

so

l

u

ti

o

n

s.

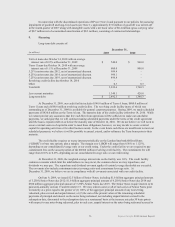

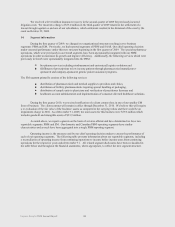

During the first quarter 20

1

0

,

we received notification of a client contract loss in one of our smaller EM

l

ines of business. The client contract will remain in effect through December 31, 2010. We believe this will require

a r

e

-

ev

al

u

ati

o

n

o

f th

e

fair

v

al

ue

o

f th

e

bus

in

ess’

a

sse

t

s

as compared to the carrying values and there could be an

i

mpairment charge in 2010. As of December 31, 2009, the total assets for this business were $39.8 million which

i

ncludes goodwill and intangible assets of $23.9 millio

n

.

A

s noted above, we report segments on the basis of services offered and have determined we have two

r

eportable segments: PBM and EM. Our domestic and Canadian PBM operating segments have simila

r

c

haracteristics and as such have been aggregated into a single PBM reporting segment.

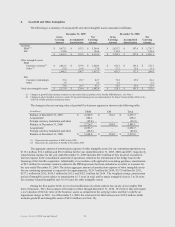

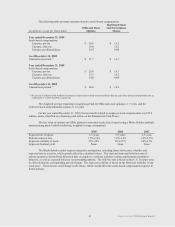

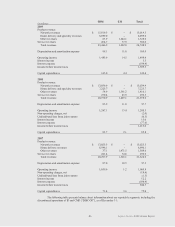

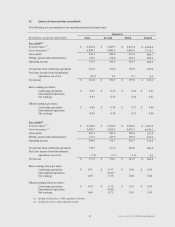

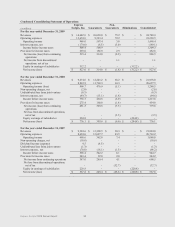

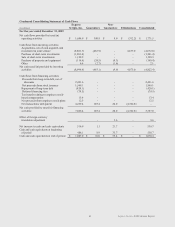

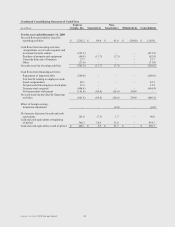

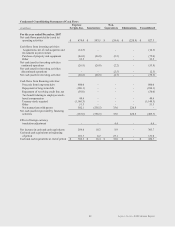

Operating income is the measure used by our chief operating decision maker to assess the performance of

each of our operating segments. The following table presents information about our reportable segments

,

including

a reconciliation of operating inco

m

e from continuing operations to income before income taxes from continuing

o

perations for the respective years ended December 31.

A

ll

re

lat

ed

s

egment disclosure

s

h

a

ve

bee

n r

ec

la

ss

ifi

ed

i

n

t

h

e

ta

b

l

e

be

l

ow

and throughout the financial statements, where app

r

opriate,

t

o reflect the new segment structure.