Express Scripts 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

83

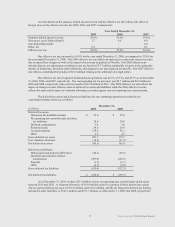

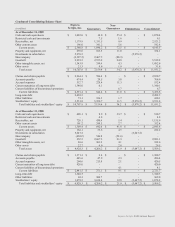

13. Commitments and contingencies

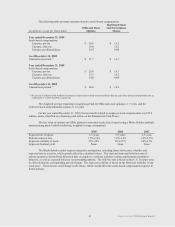

We have entered into noncancellable agreements to lease certain office and distribution facilities with

remaining terms from one to ten years. The majority of our lease agreements include renewal options which would

extend the agreements from one to five years. Rental expense under the office and distribution facilities leases,

excluding the discontinued operations of IP (see Note 4), in 2009, 2008 and 2007, was $29.6 million, $31.0 million

and $31.6 million, respectively. The future minimum lease payments due under noncancellable operating leases,

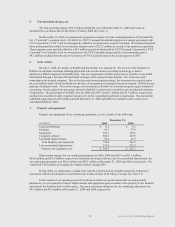

excluding the facilities of the discontinued operations of IP (in millions):

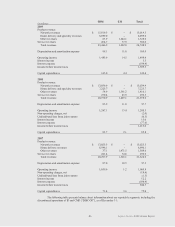

Year Ended December 31,

Minimum Lease

Payments

2010

$ 31.2

2011

26.4

2012

23.4

2013

22.1

2014

16.5

Thereafter

46.4

$ 166.0

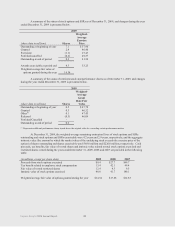

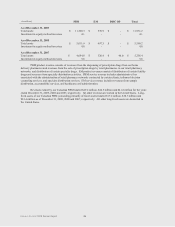

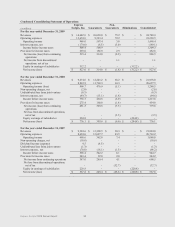

We signed a lease agreement during 2009 for a new state of the art pharmacy fulfillment facility. We

expect to take possession of this new facility during the second quarter of 2010. The annual lease commitments for

this facility are approximately $1.5 million and the term of the lease is ten years.

Additionally, we signed a lease agreement in 2007 for an expansion of our corporate facilities. We took

possession of the facility during the first quarter of 2009. The annual lease commitment for the new building is

approximately $2.7 million in 2010 and increases to $3.2 million by 2018. The term of the lease is ten and a half

years.

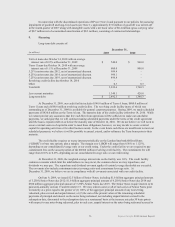

In July 2004, we entered into a capital lease with the Camden County Joint Development Authority in

association with the development of our Patient Care Contact Center in St. Marys, Georgia. At December 31, 2009,

our lease obligation was $7.5 million. Our lease obligation has been offset against $7.5 million of industrial bonds

issued by the Camden County Joint Development Authority.

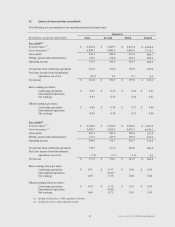

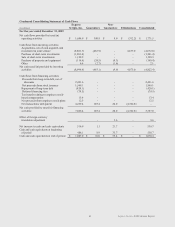

For the year ended December 31, 2009, approximately 68.6% of our pharmaceutical purchases were

through one wholesaler. We believe other alternative sources are readily available. Our top five clients collectively

represented 23.7%, 18.2%, and 18.1% of revenues during 2009, 2008, and 2007 respectively. None of our clients

accounted for 10% or more of our consolidated revenues in fiscal years 2009, 2008 or 2007. We believe no other

concentration risks exist at December 31, 2009. Due to the new long-term contracts we have entered into with

WellPoint and the DoD, we expect to have a higher concentration of revenues among these clients in the future.

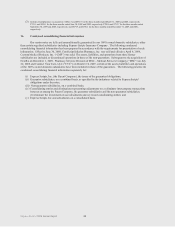

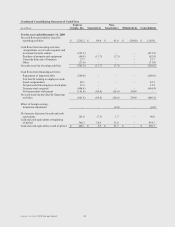

In the ordinary course of business there have arisen various legal proceedings, investigations or claims now

pending against us or our subsidiaries. The effect of these actions on future financial results is not subject to

reasonable estimation because considerable uncertainty exists about the outcomes.

We accrue self-insurance reserves based upon estimates of the aggregate liability of claim costs in excess

of our insurance coverage which are probable and estimable. Reserves are estimated using certain actuarial

assumptions followed in the insurance industry and our historical experience (see Note 1, “Self-insurance reserves”).

The majority of these claims are legal claims and our liability estimate is primarily related to the cost to defend these

claims. We do not accrue for settlements, judgments, monetary fines or penalties until such amounts are probable

and estimable. Under authoritative FASB guidance, if the range of possible loss is broad, and no amount within the

range is more likely than any other, the liability accrual is based on the lower end of the range.

While we believe our services and business practices are in compliance with applicable laws, rules and

regulations in all material respects, we cannot predict the outcome of these claims at this time. An unfavorable

outcome in one or more of these matters could result in the imposition of judgments, monetary fines or penalties, or

injunctive or administrative remedies. We can give no assurance that such judgments, fines and remedies, and

future costs associated with legal matters, would not have a material adverse effect on our financial condition, our

consolidated results of operations or our consolidated cash flows.