Express Scripts 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

67

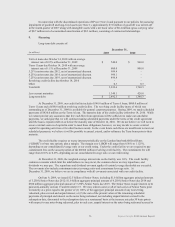

In retail pharmacy transactions, amounts paid to pharmacies and amounts charged to clients are always

exclusive of the applicable co-payment. Retail pharmacy co-payments, which we instructed retail pharmacies to

collect from members, of $3.1 billion, $3.2 billion and $3.6 billion for the years ended December 31, 2009, 2008,

and 2007, respectively, are included in revenues and cost of revenues. We changed our accounting policy for

member co-payments during the third quarter of 2008 to include member co-payments to retail pharmacies in

revenue and cost of revenue. Retail pharmacy co-payments decreased in the years ended December 31, 2009, 2008,

and 2007 as compared to prior periods due to the expected loss of discount card programs and other low margin

clients. Additionally, the decrease is due to the increase in generic utilization.

We bill our clients based upon the billing schedules established in client contracts. At the end of a period,

any unbilled revenues related to the sale of prescription drugs that have been adjudicated with retail pharmacies are

estimated based on the amount we will pay to the pharmacies and historical gross margin. Those amounts due from

our clients are recorded as revenue as they are contractually due to us for past transactions. Adjustments are made to

these estimated revenues to reflect actual billings at the time clients are billed; historically, these adjustments have

not been material.

In accordance with applicable accounting guidance, amortization of $9.5 million, for customer contracts

related to the PBM agreement with WellPoint has been included as an offset to revenues for the year ended

December 31, 2009.

Revenues from our EM segment are earned from the distribution of pharmaceuticals and medical supplies

to providers and clinics and fertility services to providers and patients. These revenues are recognized at the point of

shipment. At the time of shipment, we have performed substantially all of our obligations under our customer

contracts and do not experience a significant level of reshipments. Appropriate reserves are recorded for discounts

and contractual allowances which are estimated based on historical collections over a recent period. Any differences

between our estimates and actual collections are reflected in operations in the period in which payment is received.

Differences may result in the amount and timing of our revenues for any period if actual performance varies from

our estimates. Allowances for returns are estimated based on historical return trends.

Revenues from our EM segment also are derived from sample fulfillment and sample accountability

services. Revenues include administrative fees received from these programs as well as fees for verification of

practitioner licensure. We also administer sample card programs for certain manufacturers and include the

ingredient costs of those drug samples dispensed from retail pharmacies in EM revenues, and the associated costs

for these sample card programs in cost of revenues. Because manufacturers are independently obligated to pay us

and we have an independent contractual obligation to pay our network pharmacy providers for free samples

dispensed to patients under sample card programs, we include the total payments from these manufacturers

(including ingredient costs) as revenue, and payments to the network pharmacy provider as cost of revenue. These

transactions require us to assume credit risk.

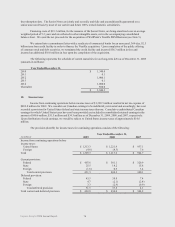

Rebate accounting. We administer a rebate program through which we receive rebates and administrative fees

from pharmaceutical manufacturers. Rebates and administrative fees earned for the administration of this program,

performed in conjunction with claim processing and home delivery services provided to clients, are recorded as a

reduction of cost of revenue and the portion of the rebate and administrative fees payable to customers is treated as a

reduction of revenue. The portion of rebates and administrative fees payable to clients is estimated based on historical

and/or anticipated sharing percentages. These estimates are adjusted to actual when amounts are paid to clients. We

record rebates and administrative fees receivable from the manufacturer and payable to clients when the prescriptions

covered under contractual agreements with the manufacturers are dispensed; these amounts are not dependent upon

future pharmaceutical sales. Rebates and administrative fees billed to manufacturers are determinable when the drug is

dispensed. We pay all or a contractually agreed upon portion of such rebates to our clients.

In connection with the acquisition of certain subsidiaries of WellPoint that provide pharmacy benefit

management services (“NextRx” or the “PBM Business”), we are administering the run-off of their market share

performance rebate program. Estimates for rebates receivable are accrued monthly based on the terms of the applicable

contract, historical data and current utilization. These rebates are billed to pharmaceutical manufacturers on a quarterly

basis. The portion of rebates payable to customers is estimated monthly based on historical and/or anticipated share

percentages and our estimates of rebates receivable from pharmaceutical manufacturers. Effective January 1, 2010,

rebates will no longer be administered through this market share rebate program. They will be administered under our

rebate program discussed above.