Express Scripts 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

79

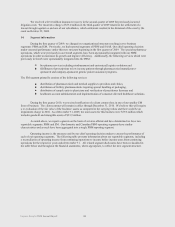

Preferred Stock for an exercise price of $300 (subject to adjustment). The rights will become exercisable and will

trade separately from the common stock only upon the tenth day after a public announcement that a person, entity or

group (“Person”) has acquired 15% or more of our outstanding common stock (“Acquiring Person”) or ten days

after the commencement or public announcement of a tender or exchange offer which would result in any Person

becoming an Acquiring Person; provided that any Person who beneficially owned 15% or more of our common

stock as of the date of the rights plan will not become an Acquiring Person so long as such Person does not become

the beneficial owner of additional shares representing 2% or more of our outstanding shares of common stock. In

the event that any Person becomes an Acquiring Person, the rights will be exercisable for our common stock with a

market value (as determined under the rights plan) equal to twice the exercise price. In the event that, after any

Person becomes an Acquiring Person, we engage in certain mergers, consolidations, or sales of assets representing

50% or more of our assets or earning power with an Acquiring Person (or Persons acting on behalf of or in concert

with an Acquiring Person), the rights will be exercisable for common stock of the acquiring or surviving company

with a market value (as determined under the rights plan) equal to twice the exercise price. The rights will not be

exercisable by any Acquiring Person. The rights are redeemable at a price of $0.01 per right prior to any Person

becoming an Acquiring Person.

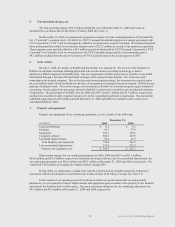

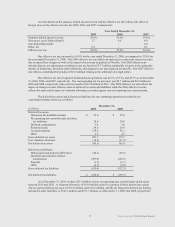

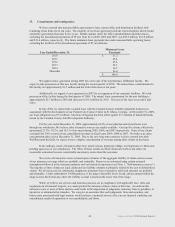

12. Employee benefit plans and stock-based compensation plans

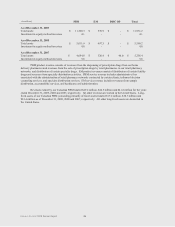

Retirement savings plan. We sponsor retirement savings plans under Section 401(k) of the Internal Revenue

Code for all of our full-time employees. Employees may elect to enter into a written salary deferral agreement

under which a maximum of 15% to 25% of their salary, subject to aggregate limits required under the Internal

Revenue Code, may be contributed to the plan. We match 200% of the first 1% and 100% of the next 3% of the

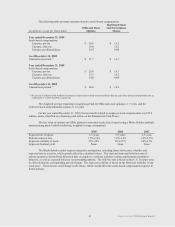

employees’ compensation contributed to the Plan for substantially all employees. For the years ended

December 31, 2009, 2008, and 2007, we had contribution expense of approximately $22.0 million, $19.7 million

and $17.9 million, respectively.

Employee stock purchase plan. We offer an employee stock purchase plan that qualifies under Section 423

of the Internal Revenue Code and permits all employees, excluding certain management level employees, to

purchase shares of our common stock. Participating employees may contribute up to 10% of their salary to purchase

common stock at the end of each monthly participation period at a purchase price equal to 95% of the fair market

value of our common stock on the last business day of the participation period. During 2009, 2008 and 2007,

approximately 130,000, 118,000 and 131,000 shares of our common stock were issued under the plan, respectively.

Our common stock reserved for future employee purchases under the plan is approximately 1.4 million shares at

December 31, 2009.

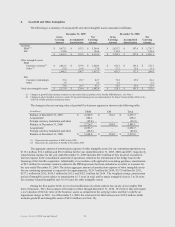

Deferred compensation plan. We maintain a non-qualified deferred compensation plan (the “Executive

Deferred Compensation Plan”) that provides benefits payable to eligible key employees at retirement, termination or

death. Benefit payments are funded by a combination of contributions from participants and us. Participants may

elect to defer up to 50% of their base earnings and 100% of specific bonus awards. Participants become fully vested

in our contributions on the third anniversary of the end of the plan year for which the contribution is credited to their

account. For 2009, our contribution was equal to 6% of each qualified participant’s total annual compensation, with

25% being allocated as a hypothetical investment in our common stock and the remaining being allocated to a

variety of investment options. We have chosen to fund our liability for this plan through investments in trading

securities, which primarily consists of mutual funds (see Note 1). We incurred net compensation expense of

approximately $(0.6) million, $1.8 million and $1.1 million in 2009, 2008, and 2007, respectively. At

December 31, 2009, approximately 3.0 million shares of our Common Stock have been reserved for future issuance

under the plan.

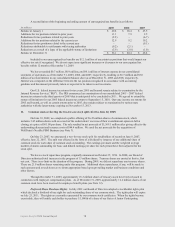

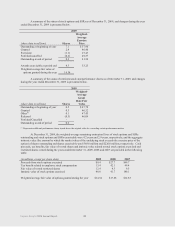

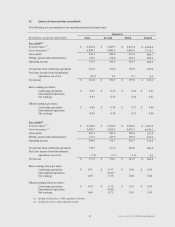

Stock-based compensation plans. In August 2000, the Board of Directors adopted the Express Scripts,

Inc. 2000 Long-Term Incentive Plan which was subsequently amended in February 2001 and again in December

2001 (as amended, the “2000 LTIP”), which provides for the grant of various equity awards with various terms to

our officers, Board of Directors and key employees selected by the Compensation Committee of the Board of

Directors. The 2000 LTIP, as then amended, was approved by our stockholders in May 2001 and, as amended, in

2006. Under the 2000 LTIP, we have issued stock options, stock-settled stock appreciation rights (“SSRs”),

restricted stock units, restricted stock awards and performance share awards. Awards are typically settled using

treasury shares. As of December 31, 2009, approximately 8.0 million shares of our common stock are available for

issuance under this plan. The maximum term of stock options, SSRs, restricted stock and performance shares

granted under the 2000 LTIP is 10 years.