Express Scripts 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report 54

ACQUISITIONS AND RELATED TRANSACTIONS

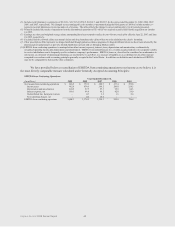

On December 1, 2009, we completed the purchase of the shares and equity interests of certain subsidiaries of

WellPoint that provide pharmacy benefit management services (“NextRx” or the “PBM Business”), in exchange for total

consideration of $4.675 billion paid in cash, which is subject to a purchase price adjustment for working capital. The

NextRx PBM Business is a national provider of PBM services, and we believe the acquisition will enhance our ability to

achieve cost savings, innovations, and operational efficiencies which will benefit our customers and stockholders. The

purchase price was primarily funded through a $2.5 billion underwritten public offering of senior notes completed on June

9, 2009 resulting in net proceeds of $2,478.3 million, and a public offering of 26.45 million shares of common stock

completed June 10, 2009 resulting in net proceeds of $1,569.1 million. Our PBM operating results include those of the

NextRx PBM Business beginning on December 1, 2009, the date of acquisition (see Note 3).

On July 22, 2008, we completed the acquisition of the Pharmacy Services Division of MSC - Medical Services

Company (“MSC”), a privately held PBM, for a purchase price of $251.0 million, which includes a purchase price

adjustment for working capital and transaction costs. MSC is a leader in providing PBM services to clients providing

workers’ compensation benefits. The purchase price was funded through internally generated cash and temporary

borrowings under our revolving credit facility. This acquisition is reported as part of our PBM segment and did not have a

material effect on our consolidated financial statements (see Note 3).

We are one of the founders of RxHub, an electronic exchange enabling physicians who use electronic prescribing

technology to link to pharmacies, PBM companies, and health plans. On July 1, 2008, the merger of RxHub and

SureScripts was announced. The new organization will enable physicians to securely access health information when

caring for their patients through a fast and efficient health exchange. We have retained one-sixth ownership in the merged

company. Due to the decreased ownership percentage, the investment is being recorded using the cost method, under

which dividends are the basis of recognition of earnings from an investment. This change did not have a material effect on

our consolidated financial statements (see Note 6).

On October 10, 2007, we purchased CYC, a leading provider of consumer directed healthcare technology

solutions to the employer, health plan and financial services markets. The purchase price was funded through internally

generated cash. The purchase agreement includes an earnout provision, payable after three years based on the performance

of the business. This acquisition is reported as part of our EM segment, and did not have a material effect on our

consolidated financial statements.

We regularly review potential acquisitions and affiliation opportunities. We believe available cash resources, bank

financing or the issuance of additional common stock or other securities could be used to finance future acquisitions or

affiliations. There can be no assurance we will make new acquisitions or establish new affiliations in 2010 or thereafter.

(see “Liquidity and Capital Resources – Acquisitions and Related Transactions”).

SENIOR NOTES

On June 9, 2009, we issued $2.5 billion of Senior Notes, including $1.0 billion aggregate principal amount of

5.250% Senior Notes due 2012; $1.0 billion aggregate principal amount of 6.250% Senior Notes due 2014 and $500

million aggregate principal amount of 7.250% Senior Notes due 2019. The Senior Notes require interest to be paid semi-

annually on June 15 and December 15. We may redeem some or all of each series of Senior Notes prior to maturity at a

price equal to the greater of (1) 100% of the aggregate principal amount of any notes being redeemed, plus accrued and

unpaid interest; or (2) the sum of the present values of the remaining scheduled payments of principal and interest on the

notes being redeemed, not including unpaid interest accrued to the redemption date, discounted to the redemption date on a

semiannual basis at the treasury rate plus 50 basis points with respect to any notes being redeemed, plus in each case,

unpaid interest on the notes being redeemed accrued to the redemption date. The Senior Notes are jointly and severally and

fully and unconditionally guaranteed on a senior unsecured basis by most of our current and future 100% owned domestic

subsidiaries (see Note 16).

Financing costs of $13.3 million are being amortized over an average weighted period of 5.2 years and are

reflected in other intangible assets, net in the consolidated balance sheet as of December 31, 2009. We used the net

proceeds for the acquisition of WellPoint’s NextRx PBM Business (see Note 3).