Express Scripts 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

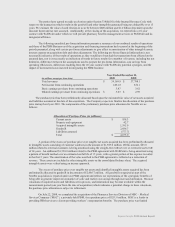

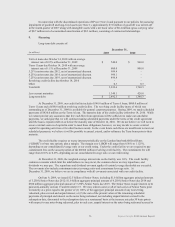

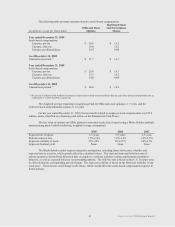

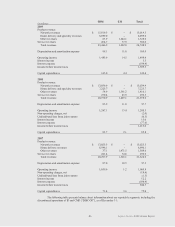

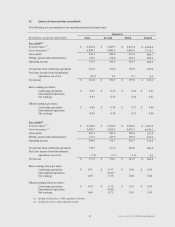

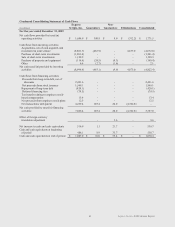

The following table presents amounts related to stock-based compensation:

(in millions, except per share data)

SSRs and Stock

Options

Restricted Stock

and Performance

Shares

Year ended December 31, 2009

Stock-based compensation:

Expense, pre-tax

$ 28.6

$ 16.2

Expense, after tax

18.0

10.2

Expense per diluted share

0.07

0.04

As of December 31, 2009

Unamortized portion(1)

$ 21.7

$ 16.7

Year ended December 31, 2008

Stock-based compensation:

Expense, pre-tax

$ 23.8

$ 16.3

Expense, after tax

15.3

10.5

Expense per diluted share

0.06

0.04

As of December 31, 2008

Unamortized portion(1)

$ 20.6

$ 14.2

(1) We have $0.3 million and $0.4 million of unearned compensation related to unvested shares that are part of our deferred compensation plan as

of December 31, 2009 and 2008, respectively.

The weighted average remaining recognition period for SSRs and stock options is 1.7 years, and for

restricted stock and performance shares is 1.6 years.

For the year ended December 31, 2009, the tax benefit related to employee stock compensation was $13.4

million, and is classified as a financing cash inflow on the Statement of Cash Flows.

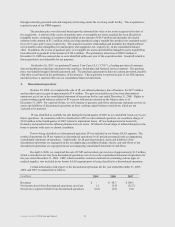

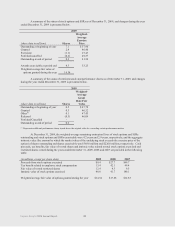

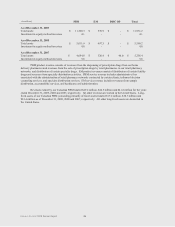

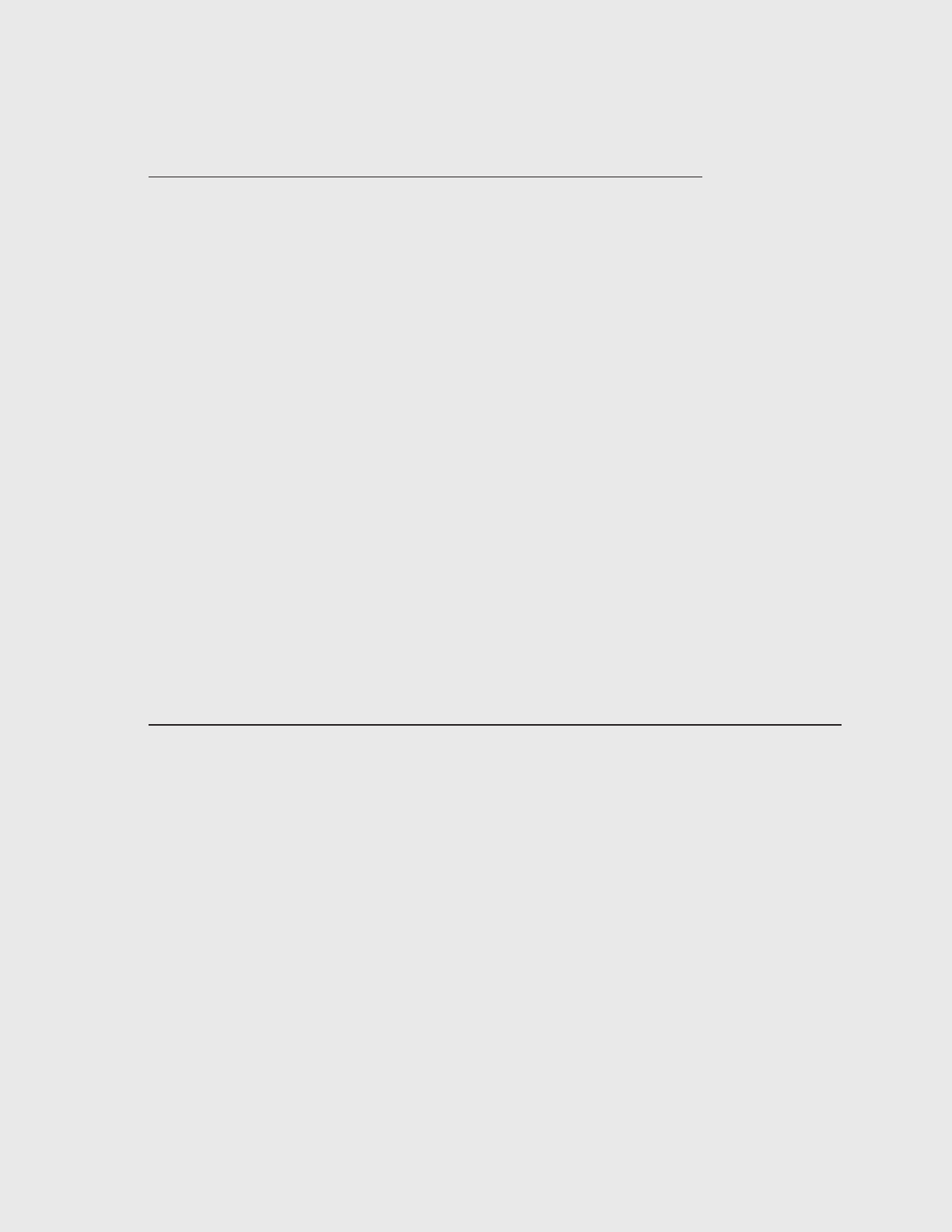

The fair value of options and SSRs granted is estimated on the date of grant using a Black-Scholes multiple

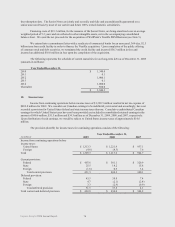

option-pricing model with the following weighted average assumptions:

2009

2008

2007

Expected life of option

3-5 years

3-5 years

3-5 years

Risk-free interest rate

1.3%-2.4%

1.6%-3.4%

3.8%-5.2%

Expected volatility of stock

35%-39%

30%-37%

29%-31%

Expected dividend yield

None

None

None

The Black-Scholes model requires subjective assumptions, including future stock price volatility and

expected time to exercise, which greatly affect the calculated values. The expected term and forfeiture rate of

options granted is derived from historical data on employee exercises and post-vesting employment termination

behavior, as well as expected behavior on outstanding options. The risk-free rate is based on the U.S. Treasury rates

in effect during the corresponding period of grant. The expected volatility is based on the historical volatility of our

stock price. These factors could change in the future, which would affect the stock-based compensation expense in

future periods.

81