Express Scripts 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

65

Impairment of long lived assets. We evaluate whether events and circumstances have occurred which

indicate the remaining estimated useful life of long lived assets, including other intangible assets, may warrant

revision or the remaining balance of an asset may not be recoverable. The measurement of possible impairment is

based on a comparison of the fair value of the related assets to the carrying value using discount rates that reflect the

inherent risk of the underlying business. Impairment losses, if any, would be recorded to the extent the carrying

value of the assets exceeds the implied fair value resulting from this calculation (see Note 4 and Note 8).

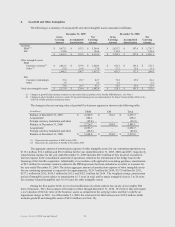

Goodwill. Goodwill is evaluated for impairment annually or when events or circumstances occur

indicating that goodwill might be impaired. In addition, we evaluate whether events or circumstances have occurred

that may indicate an impairment in goodwill. The measurement of possible impairment is based on a comparison of

the fair value of each reporting unit to the carrying value of the reporting unit’s assets. Impairment losses, if any,

would be determined based on the fair value of the individual assets and liabilities of the reporting unit, using

discount rates that reflect the inherent risk of the underlying business. We would record an impairment charge to the

extent the carrying value of goodwill exceeds the implied fair value of goodwill resulting from this calculation. This

valuation process involves assumptions based upon management’s best estimates and judgments that approximate

the market conditions experienced for our reporting units at the time the impairment assessment is made. These

assumptions include but are not limited to earnings and cash flow projections, discount rate and peer company

comparability. Actual results may differ from these estimates due to the inherent uncertainty involved in such

estimates. During 2009, the valuations of certain reporting units in our EM segment yielded fair values relatively

close to the carrying value. However, no impairment existed for any of our reporting units at December 31, 2009 or

2008.

During the first quarter 2010, we received notification of a client contract loss in one of our smaller EM

lines of business. The client contract will remain in effect through December 31, 2010. We believe this will require

a re-evaluation of the fair value of the business’ assets as compared to the carrying values and there could be an

impairment charge in 2010. As of December 31, 2009, the total assets for this business were $39.8 million which

includes goodwill and intangible assets of $23.9 million (see Note 14).

Other intangible assets. Other intangible assets include, but are not limited to, customer contracts and

relationships, non-compete agreements, deferred financing fees, trade names and certain advance discounts paid to

clients under contractual agreements. Other intangible assets, excluding customer contracts, customer relationships

and trade names, are recorded at cost. Customer contracts and relationships are valued at fair market value when

acquired using the income method. Customer contracts and relationships related to the PBM agreement with

WellPoint, Inc. (“WellPoint") are being amortized using a modified pattern of benefit method over an estimated

useful life of 15 years. All other intangible assets, excluding trade names which have an indefinite life, are

amortized on a straight-line basis, which approximates the pattern of benefit, over periods from 1 to 20 years (see

Note 8).

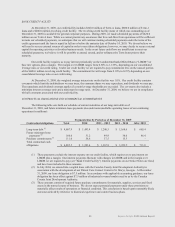

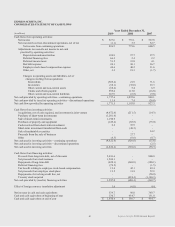

The amount of other intangible assets reported is net of accumulated amortization of $238.4 million and

$195.5 million at December 31, 2009 and 2008, respectively. Amortization expense for our continuing operations

for customer-related intangibles and non-compete agreements included in selling, general and administrative

expense was $35.2 million for the year ended December 31, 2009 and $33.7 million for the years ended 2008 and

2007, respectively. We have entered into a 10-year contract with WellPoint under which we will provide pharmacy

benefit management services to WellPoint and its designated affiliates (“NextRx” or “the PBM agreement”). In

accordance with applicable accounting guidance, amortization expense for our continuing operations of $9.5 million

(for one month in 2009) for customer contracts related to the PBM agreement has been included as an offset to

revenue for the year ended December 31, 2009. Amortization expense for our continuing operations for deferred

financing fees included in interest expense was $4.0 million, $2.4 million and $2.2 million in 2009, 2008 and 2007,

respectively. Amortization expense for our continuing operations for advance discounts paid to customers is

recorded against revenue and was $0.1 million, $0.6 million and $2.8 million in 2009, 2008 and 2007, respectively.

Self-insurance reserves. We maintain insurance coverage for claims that arise in the normal course of

business. Where insurance coverage is not available, or, in our judgment, is not cost-effective, we maintain self-

insurance reserves to reduce our exposure to future legal costs, settlements and judgments. Self-insured losses are

accrued based upon estimates of the aggregate liability for the costs of uninsured claims incurred using certain

actuarial assumptions followed in the insurance industry and our historical experience (see Note 13). It is not

possible to predict with certainty the outcome of these claims, and we can give no assurances any losses, in excess

of our insurance and any self-insurance reserves, will not be material.