Express Scripts 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

69

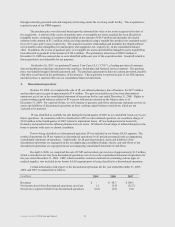

New accounting guidance. In December 2007, the Financial Accounting Standards Board (“FASB”)

revised the authoritative guidance for business combinations. The guidance changes the definitions of a business

and a business combination, and will result in more transactions recorded as business combinations. Certain

acquired contingencies will be recorded initially at fair value on the acquisition date, transaction and restructuring

costs generally will be expensed as incurred and in partial acquisitions, companies generally will record 100 percent

of the assets and liabilities at fair value, including goodwill. In April 2009, the FASB amended guidance which

clarifies the accounting for assets acquired and liabilities assumed in a business combination that arise from

contingencies. The guidance is effective as of January 1, 2009. We have accounted for the NextRx business

combination, and will account for all future business combinations, under this guidance (see Note 3).

In April 2008, the FASB issued authoritative guidance which intends to improve the consistency between

the useful life of an intangible asset and the period of expected cash flows used to measure the fair value of the asset.

The guidance is effective for fiscal years beginning after December 15, 2008. These provisions were applied to

intangible assets acquired as part of the NextRx business combination and will be applied to future intangible assets

acquired.

In May 2009, the FASB issued authoritative guidance which establishes standards of accounting for events

that occur after the balance sheet date and disclosures of events that occur after the balance sheet date but before

financial statements are issued. The guidance requires disclosure of the date through which an entity has evaluated

subsequent events and the basis for the date. This guidance is effective for interim or annual financial periods

ending after June 15, 2009. We have evaluated subsequent events through February 24, 2010, the date of the

financial statements issuance. Adoption of the guidance does not have an impact on financial position, results of

operations, or cash flows.

In June 2009, the FASB issued authoritative guidance which identifies the sources of accounting principles

and the framework for selecting the principles used in the preparation of financial statements of nongovernmental

entities that are presented in conformity with generally accepted accounting principles (“GAAP”) in the United

States. This guidance is effective for financial statements issued for interim and annual periods ending after

September 15, 2009. Adoption of the guidance does not have an impact on financial position, results of operations,

or cash flows.

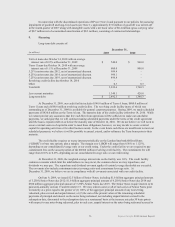

2. Fair value measurements

In September 2006, the FASB issued authoritative guidance which defines fair value, establishes guidelines

for measuring fair value and expands disclosures regarding fair value measurements. This guidance applies

whenever another standard requires (or permits) assets or liabilities to be measured at fair value. This guidance does

not expand the use of fair value to any new circumstances. Our adoption of the guidance did not have a material

impact on our consolidated financial position, results of operations or cash flows.

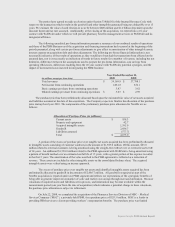

The guidance establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring

fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets for

identical assets or liabilities; Level 2, defined as inputs other than quoted prices for similar assets and liabilities in

active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which

little or no market data exists, therefore, requiring an entity to develop its own assumptions.

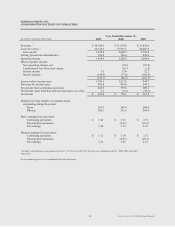

Financial assets accounted for at fair value on a recurring basis at December 31, 2009 and 2008 include

cash equivalents of $909.8 million and $471.2 million, restricted cash and investments of $9.1 million and $4.8

million, and trading securities of $11.4 million and $12.8 million (included in other assets), respectively. These

assets are carried at fair value based on quoted market prices for identical securities (Level 1 inputs). Cash

equivalents include investments in AAA-rated money market mutual funds with weighted average maturities of less

than 90 days.

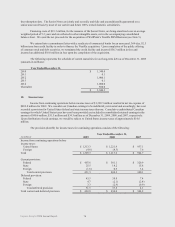

As of December 31, 2009 and 2008, short-term investments, included in prepaid expenses and other current

assets in the consolidated balance sheet, consisted of our investment in the Reserve Primary Fund (the “Primary

Fund”), which is a money market fund. The estimated fair value of our investment in the Primary Fund was $1.9

million and $8.4 million as of December 31, 2009 and 2008, respectively. We recognized an unrealized loss of $2.0

million in the third quarter of 2008, when the net asset value of the Primary Fund decreased below $1 per share. We

received cash distributions from the Primary Fund of $6.5 million during 2009 and $38.9 million during 2008. We

assessed the fair value of the underlying collateral for the Primary Fund through evaluation of the liquidation value

of assets held by the Primary Fund, which is classified within Level 3 of the fair value hierarchy. There were no