Express Scripts 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

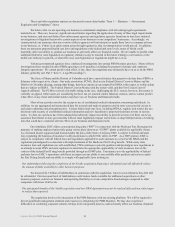

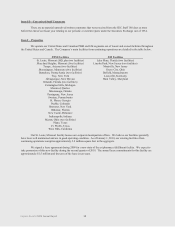

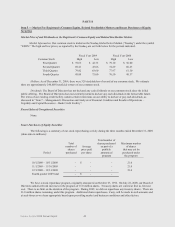

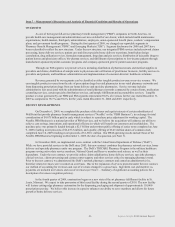

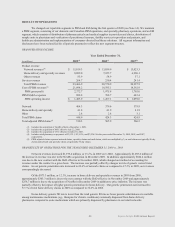

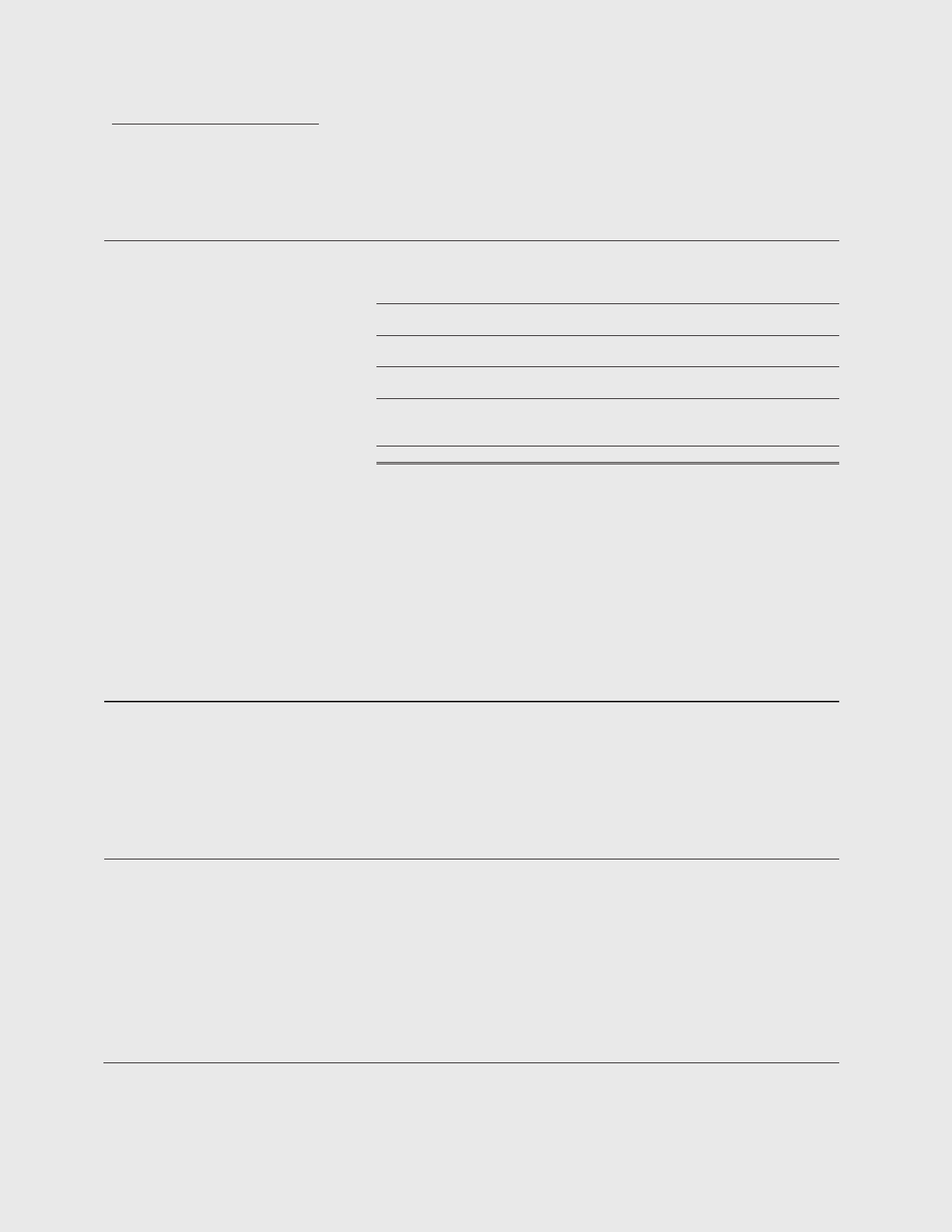

Item 6 – Selected Financial Data

The following selected financial data should be read in conjunction with our consolidated financial statements,

including the related notes, and “Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of

Operations”.

(in millions, except per share data)

2009(1)

2008(2)

2007(3)

2006

2005(4)

Statement of Operations Data (for the Year Ended December 31):

Revenues (5)

$ 24,748.9

$ 21,978.0

$ 21,824.0

$ 21,562.6

$ 21,879.1

Cost of revenues(5)

22,318.5

19,937.1

20,065.2

20,093.7

20,693.3

Gross profit

2,430.4

2,040.9

1,758.8

1,468.9

1,185.8

Selling, general and administrative

932.0

760.4

698.0

643.1

543.5

Operating income

1,498.4

1,280.5

1,060.8

825.8

642.3

Other expense, net

(189.1)

(66.9)

(116.1)

(83.6)

(28.4)

Income before income taxes

1,309.3

1,213.6

944.7

742.2

613.9

Provision for income taxes

482.8

434.0

344.2

266.8

214.3

Net income from continuing operations

826.5

779.6

600.5

475.4

399.6

Net (loss) income from discontinued

operations, net of tax(6)

1.1

(3.5)

(32.7)

(1.0)

0.5

Net income

$ 827.6

$ 776.1

$ 567.8

$ 474.4

$ 400.1

Weighted average shares outstanding:(7)

Basic:

263.5

248.9

260.4

279.6

293.6

Diluted:

266.1

251.8

264.0

284.0

299.0

Basic earnings (loss) per share:(7)

Continuing operations

$ 3.14

$ 3.13

$ 2.31

$ 1.70

$ 1.36

Discontinued operations(6)

-

(0.01)

(0.13)

-

-

Net earnings

3.14

3.12

2.18

1.70

1.36

Diluted earnings (loss) per share:(7)

Continuing operations

$ 3.11

$ 3.10

$ 2.27

$ 1.67

$ 1.34

Discontinued operations(6)

-

(0.01)

(0.12)

-

-

Net earnings

3.11

3.08

2.15

1.67

1.34

Balance Sheet Data (as of December 31):

Cash and cash equivalents

$ 1,070.4

$ 530.7

$ 434.7

$ 131.0

$ 477.9

Working capital

(1,313.3)

(677.9)

(507.2)

(657.3)

(137.8)

Total assets

11,931.2

5,509.2

5,256.4

5,108.1

5,493.5

Debt:

Short-term debt

1,340.1

420.0

260.1

180.1

110.0

Long-term debt

2,492.5

1,340.3

1,760.3

1,270.4

1,400.5

Stockholders’ equity

3,551.8

1,078.2

696.4

1,124.9

1,464.8

Network pharmacy claims processed(8)

404.3

379.6

379.9

390.3

437.3

Home delivery and specialty pharmacy

prescriptions filled

41.8

41.9

41.9

42.2

41.0

Other prescriptions filled(9)

3.2

3.2

3.6

4.7

4.6

Cash flows provided by operating activities—

continuing operations

$ 1,757.6

$ 1,095.6

$ 848.1

$ 673.5

$ 795.8

Cash flows used in investing activities—

continuing operations

(4,822.4)

(320.6)

(55.8)

(100.8)

(1,367.5)

Cash flows provided by (used in)

financing activities—continuing operations

3,587.0

(680.4)

(469.7)

(904.7)

887.0

EBITDA from continuing operations(10)

1,608.3

1,378.2

1,158.3

925.6

726.6

(1) Includes the acquisition of NextRx effective December 1, 2009.

(2) Includes the acquisition of MSC effective July 22, 2008.

(3) Includes the acquisition of CYC effective October 10, 2007.

(4) Includes the acquisition of Priority Healthcare Corporation, Inc. (“Priority”) effective October 14, 2005.

43