Express Scripts 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

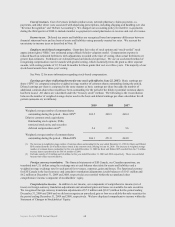

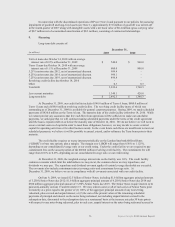

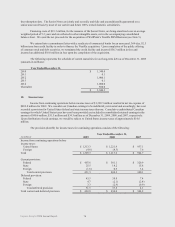

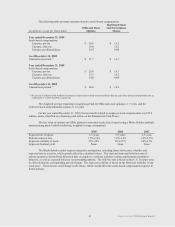

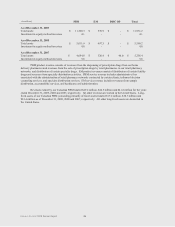

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

(in millions)

2009

2008

2007

Balance at January 1

$ 40.4

$ 28.4

$ 23.5

Additions for tax positions related to prior years

11.1

7.9

2.5

Reductions for tax positions related to prior years

(2.2)

-

(6.7)

Additions for tax positions related to the current year

12.9

9.2

10.2

Reductions for tax positions related to the current year

-

-

(0.1)

Reductions attributable to settlements with taxing authorities

(0.2)

(2.1)

-

Reductions as a result of a lapse of the applicable statute of limitations

(5.9)

(3.0)

(1.0)

Balance at December 31

$ 56.1

$ 40.4

$ 28.4

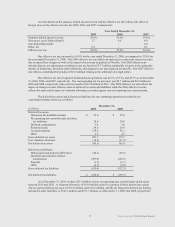

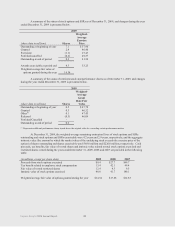

Included in our unrecognized tax benefits are $12.1 million of uncertain tax positions that would impact our

effective tax rate if recognized. We do not expect any significant increases or decreases to our unrecognized tax

benefits within 12 months of December 31, 2009.

We have recorded $0.7 million, $0.9 million, and $4.1 million of interest expense in our consolidated

statement of operations as of December 31, 2009, 2008, and 2007, respectively, resulting in $5.7 million and $5.0

million of accrued interest in our consolidated balance sheet as of December 31, 2009 and 2008, respectively.

Interest was computed on the difference between the tax position recognized in accordance with accounting

guidance and the amount previously taken or expected to be taken in our tax returns.

Our U.S. federal income tax returns for tax years 2005 and beyond remain subject to examination by the

Internal Revenue Service (“IRS”). The IRS commenced an examination of our consolidated 2005 – 2007 federal

income tax returns in the third quarter of 2009 that is anticipated to be concluded in 2011. We agreed to extend the

statute of limitations for our 2005 federal income tax return to September 15, 2010. Our state income tax returns for

2005 and beyond, as well as certain returns prior to 2005, also remain subject to examination by various state

authorities with the latest statute expiring on November 15, 2013.

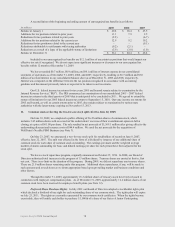

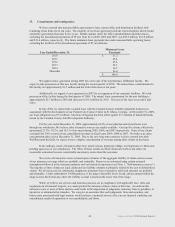

11. Common stock (reflecting the two-for-one stock split effective June 22, 2007)

On June 10, 2009, we completed a public offering of 26.45 million shares of common stock, which

includes 3.45 million shares sold as a result of the underwriters’ exercise of their overallotment option in full at

closing, at a price of $61.00 per share. The sale resulted in net proceeds of $1,569.1 million after giving effect to the

underwriting discount and issuance costs of $44.4 million. We used the net proceeds for the acquisition of

WellPoint’s NextRx PBM Business (see Note 3).

On May 23, 2007, we announced a two-for-one stock split for stockholders of record on June 8, 2007,

effective June 22, 2007. The split was effected in the form of a dividend by issuance of one additional share of

common stock for each share of common stock outstanding. The earnings per share and the weighted average

number of shares outstanding for basic and diluted earnings per share for each period have been adjusted for the

stock split.

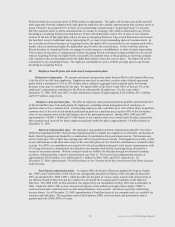

We have a stock repurchase program, originally announced on October 25, 1996. In 2008, our Board of

Directors authorized total increases in the program of 15 million shares. Treasury shares are carried at first in, first

out cost. There is no limit on the duration of the program. During 2009, we did not repurchase any treasury shares.

There are 21.0 million shares remaining under this program. Additional share repurchases, if any, will be made in

such amounts and at such times as we deem appropriate based upon prevailing market and business conditions and

other factors.

Through December 31, 2009, approximately 18.2 million shares of treasury stock have been reissued in

connection with employee compensation plans. As of December 31, 2009, approximately 12.4 million shares of our

common stock have been reserved for employee benefit plans (see Note 12).

Preferred Share Purchase Rights. In July 2001 our Board of Directors adopted a stockholder rights plan

which declared a dividend of one right for each outstanding share of our common stock. The rights plan will expire

on July 25, 2011. The rights are currently represented by our common stock certificates. When the rights become

exercisable, they will entitle each holder to purchase 1/1,000th of a share of our Series A Junior Participating

78