Express Scripts 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

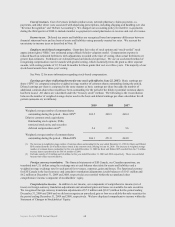

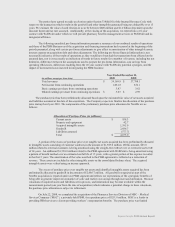

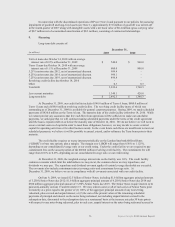

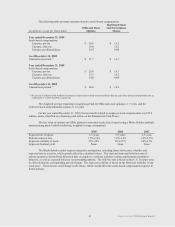

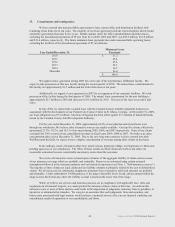

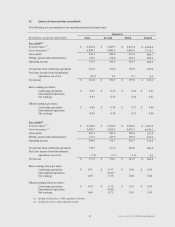

A reconciliation of the statutory federal income tax rate and the effective tax rate follows (the effect of

foreign taxes on the effective tax rate for 2009, 2008, and 2007 is immaterial):

Year Ended December 31,

2009

2008

2007

Statutory federal income tax rate

35.0%

35.0%

35.0%

State taxes, net of federal benefit

1.7

0.8

0.9

Non-deductible penalty

-

-

0.4

Other, net

0.2

-

0.1

Effective tax rate

36.9%

35.8%

36.4%

Our effective tax rate increased to 36.9% for the year ended December 31, 2009, as compared to 35.8% for

the year ended December 31, 2008. Our 2009 effective tax rate reflects an increase in certain state income tax rates

due to enacted law changes as well as the impact of our recent acquisition of NextRx. Our 2008 effective rate

includes discrete tax adjustments resulting in a net tax benefit of $7.7 million attributable to lapses in the applicable

statutes of limitations, favorable audit resolutions, and changes in our unrecognized tax benefits. Our 2007 effective

rate reflects a nondeductible penalty of $10.5 million relating to the settlement of a legal matter.

The effective tax rate recognized in discontinued operations was 42.5%, (9.3%), and 29.7% as of December

31, 2009, 2008, and 2007, respectively. The corresponding net tax provision was $0.7 million and $0.3 million in

2009 and 2008, respectively with a net tax benefit of $13.8 million in 2007. Our 2009 effective tax rate reflects the

impact of changes in state effective rates on deferred tax assets and liabilities while the 2008 effective tax rate

reflects the unfavorable impact of valuation allowances recorded against state net operating loss carryforwards.

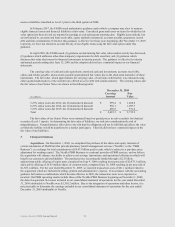

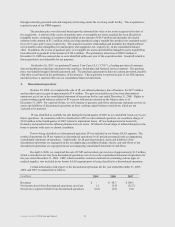

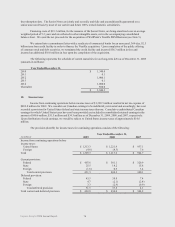

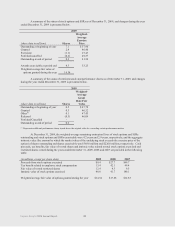

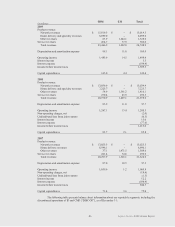

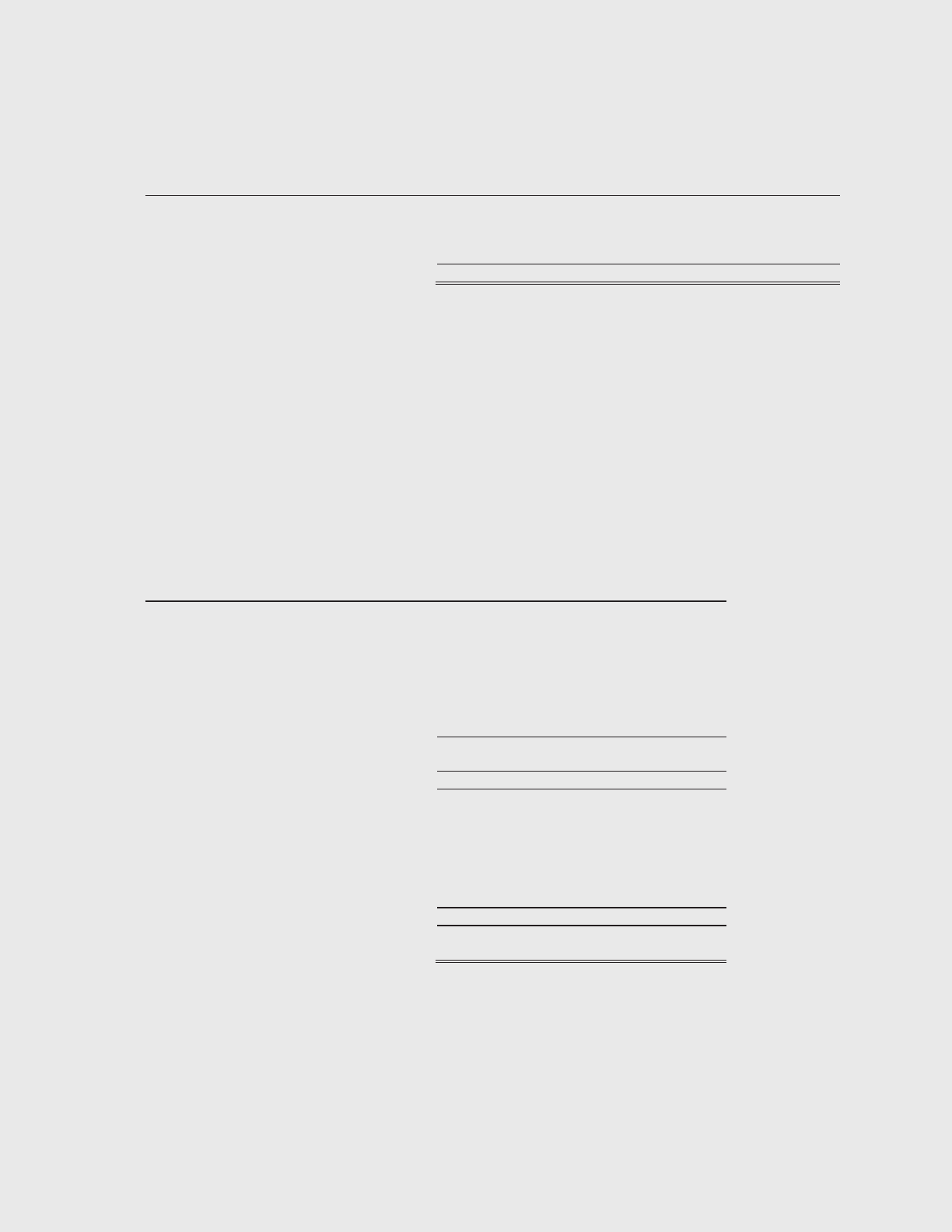

The deferred tax assets and deferred tax liabilities for our continuing operations recorded in our

consolidated balance sheet are as follows:

December 31,

(in millions)

2009

2008

Deferred tax assets:

Allowance for doubtful accounts

$ 25.6

$ 25.0

Net operating loss carryforwards and other

tax attributes

24.6

24.0

Deferred compensation

3.4

3.0

Restricted stock

34.6

26.0

Accrued expenses

114.0

91.2

Other

2.9

4.3

Gross deferred tax assets

205.1

173.5

Less valuation allowance

(16.1)

(11.7)

Net deferred tax assets

189.0

161.8

Deferred tax liabilities:

Depreciation and property differences

(42.1)

(29.3)

Goodwill and customer contract

amortization

(367.9)

(323.9)

Prepaids

(1.5)

(1.1)

Other

(4.1)

(3.0)

Gross deferred tax liabilities

(415.6)

(357.3)

Net deferred tax liabilities

$ (226.6)

$ (195.5)

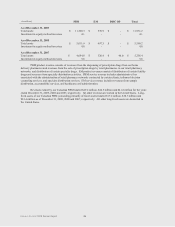

As of December 31, 2009, we have $21.4 million of state net operating loss carryforwards which expire

between 2010 and 2029. A valuation allowance of $14.0 million exists for a portion of these deferred tax assets.

The net current deferred tax asset is $135.0 million and $118.2 million, and the net long-term deferred tax liability,

included in other liabilities, is $361.6 million and $313.7 million as of December 31, 2009 and 2008, respectively.

77