Express Scripts 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

The parties have agreed to make an election under Section 338(h)(10

)

of the Internal Revenue Code with

r

espect to the transaction which results in the goodwill and other intangibles

g

enerated being tax deductible over 15

years. We estimate the value of such election to us to be between $800 million and $1.2 billion dep

e

n

dent upon the

d

i

scou

nt fa

c

t

o

r an

d

tax rat

e

a

ssu

m

ed.

A

dditionally, a

t

the closing of the acquisition, we entered into a 1

0

-

yea

r

c

ontract with WellPoint under which we will provide pharmacy benefits management services to WellPoint and its

designated affil

i

at

es.

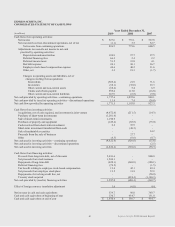

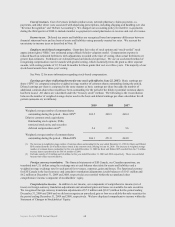

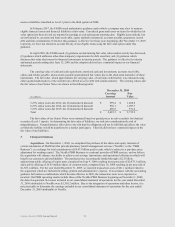

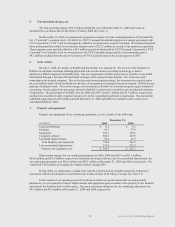

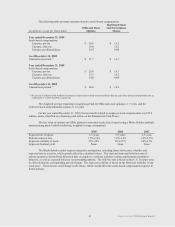

The following unaudited pro forma information presents a summary of our combined results of operations

an

d

th

ose

o

f

t

he PBM Business as if the acquisitio

n

and financing transaction

s

h

ad occurred at the beginning of the

periods presented, along with certain pro forma adjustments to give effect to amortization of other intangible assets,

i

nterest expense on acquisition debt and other adjustments. The following pro forma financial info

r

m

ati

o

n i

s

n

o

t

n

ecessarily indicative of the results of operations as they would have been had the transactions been effected on the

assumed date, nor is it necessarily an indication of trends in future result

s

for a number of reasons, including but not

li

m

ited to, differences between the assumptions used to prepare the pro forma information, cost savings fro

m

o

perating efficiencies, differences resulting from the 1

0

-

year contract with WellPoint, potential synergies, and the

i

mpact of incremental costs incu

r

red in integrating the PBM business

:

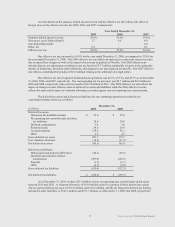

Year Ended December 31

,

(in millions, except per share data

)

200

9

2008

T

o

tal r

eve

n

ues

$

3

9,

169.8

$

37

,

788.1

Ne

t in

co

m

e

from continuing operations 1

,

061.8 832

.

1

B

asic earnings per shar

e

from continuing operations 3

.

8

7

3

.0

2

Diluted earnings per shar

e

from continuing operations

$

3

.

8

3

$

2.9

9

The purchase price has been preliminarily allocated based upon the estimated fair value of net assets acquired

an

d

lia

b

iliti

es

a

ssu

m

ed

at the date of the acquisition. The Company expects to finaliz

e

t

h

e

all

oc

ati

o

n

o

f

t

h

e

purcha

se

price during fiscal year 201

0

.

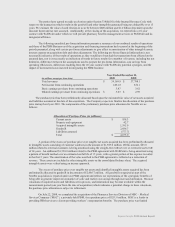

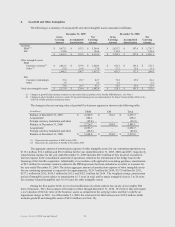

The components of the preliminary purchase price allocation fo

r

N

e

xtR

x

ar

e

a

s

f

o

ll

ows:

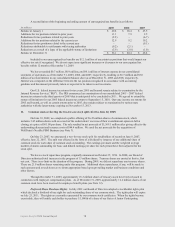

A

ll

oc

ati

o

n

o

f P

u

r

c

ha

se

Pri

ce

(

in milli

o

ns

)

:

C

urrent assets

$

9

38.

3

Propert

y

and equipment

4

2.

7

A

cquired intangible assets 1

,

585.

0

G

oodwill 2

,

686.

7

Lia

b

iliti

es

a

ssu

m

ed

(

577.

7

)

T

o

tal

$

4,

675.

0

A

portion of the excess of purchase price over tangible net assets acquired has been preliminarily allocated

t

o intangible asset

s

c

onsisting of custome

r

c

ontracts in the amount of $1

,

585.

0

m

illi

on

.

O

f thi

s

am

ou

nt

,

$

65.0

m

illi

o

n r

e

lat

ed

t

o

e

xt

e

rnal

cus

t

o

m

e

r

s

i

s

be

i

n

g amortized using the straight

-

line method over an estimated useful lif

e

f

f

o

f 10 years. An additional $1,520.0 million related to the PBM agreement with WellPoint is being amortized using

a pattern of benefit method over an estimated useful life of 15 years, with a greater portion of the expense recorded

i

n the first 5 years. The amortization of the value ascribed to the PBM agreement is reflected as a reduction of

reve

n

ue.

These assets are included in other intangible asset

s

o

n th

e

co

n

so

li

d

at

ed

b

alan

ce

s

hee

t

.

The acquired

i

ntangible assets were valued using an income approach

.

The excess of purchase price over tangible net assets and identified intangible assets acquired has bee

n

preliminarily allocated to goodwill in the amount of $2

,

686.

7

m

illi

o

n

.

A

ll goodwill recognized as part of the

NextRx acquisition is

r

eport

e

d under our PBM segment and

r

eflects our expectations of the synergistic benefits of

being able to generate improved economies of scale and realize cost savings through increased utilization

.

Bec

a

use

v

aluations of acquired assets and liabilities are in p

r

o

cess, and information may become available within the

m

easurement period (one year from the date of acquisition) which indicates a potential change to these valuations,

t

he purchase price allocation is subject to refinement

.

On July 22, 2008, we complet

e

d the acquisition of the Pharmac

y

S

ervices Division of M

SC

–

M

ed

i

c

al

Services Company (“MSC”

)

,

a privately held PBM

,

for a purchase price of $251.0

m

illi

on

.

M

SC

is a leader i

n

providing PBM services to clients providing worker

s

’

c

ompensation benefits. The purchase price was funded

71