Express Scripts 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

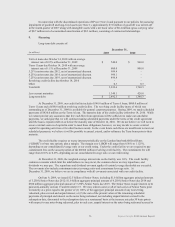

5. Non-operating charges, net

The non-operating charge of $2.0 million during the year ended December 31, 2008 represents an

unrealized loss on shares held in the Reserve Primary Fund (See Note 2).

On December 18, 2006, we announced a proposal to acquire all of the outstanding shares of Caremark Rx,

Inc. (“Caremark”) common stock. On March 16, 2007, Caremark shareholders approved a merger agreement with

CVS Corporation (“CVS”) and we subsequently withdrew our proposal to acquire Caremark. We incurred legal and

other professional fees (which do not include internal costs) of $27.2 million as a result of the proposed acquisition.

These expenses were partially offset by a $4.4 million special dividend paid by CVS Caremark Corporation (“CVS

Caremark”) on Caremark stock we owned prior to the CVS Caremark merger and by a non-operating gain of

$4.2 million resulting from the sale of our shares of CVS Caremark stock in the second quarter of 2007.

6. Joint venture

On July 1, 2008, the merger of RxHub and SureScripts was announced. We are one of the founders of

RxHub, an electronic exchange enabling physicians who use electronic prescribing technology to link to

pharmacies, PBM companies and health plans. The new organization enables physicians to securely access health

information through a fast and efficient health exchange when caring for their patients. We retain one-sixth

ownership in the merged company. Due to the decreased ownership percentage, the investment is recorded under

the cost method, under which dividends are the basis of recognition of earnings from an investment. RxHub has not

paid any dividends to date. Prior to the merger, the investment in RxHub was recorded using the equity method of

accounting, which required our percentage interest in RxHub’s results to be recorded in our consolidated statement

of operations. Our percentage of RxHub’s loss for 2008 and 2007 was $0.3 million and $1.3 million, respectively,

and has been recorded in other (expense) income, net, in the consolidated statement of operations. Our investment

in RxHub (approximately $0.8 million at both December 31, 2009 and 2008) is recorded in other assets in our

consolidated balance sheet.

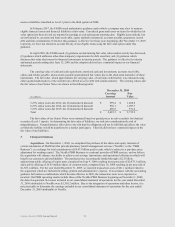

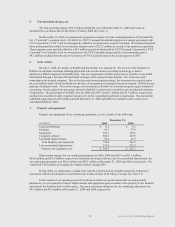

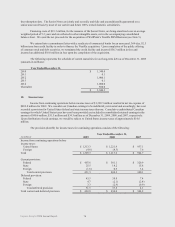

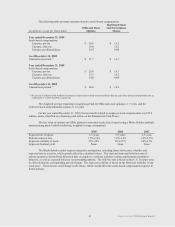

7. Property and equipment

Property and equipment of our continuing operations, at cost, consists of the following:

December 31,

(in millions)

2009

2008

Land and buildings

$ 11.2

$ 6.3

Furniture

41.3

37.9

Equipment

305.1

198.8

Computer software

305.2

249.8

Leasehold improvements

65.2

51.9

Total Property and equipment

728.0

544.7

Less accumulated depreciation

373.9

322.5

Property and equipment, net

$ 354.1

$ 222.2

Depreciation expense for our continuing operations in 2009, 2008 and 2007 was $65.1 million,

$64.0 million and $63.8 million, respectively. Internally developed software, net of accumulated depreciation, for

our continuing operations was $62.9 million and $55.5 million at December 31, 2009 and 2008, respectively. We

capitalized $24.0 million of internally developed software during 2009.

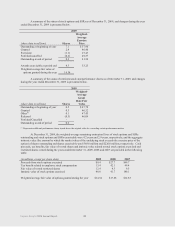

In July 2004, we entered into a capital lease with the Camden County Joint Development Authority in

association with the development of our Patient Care Contact Center in St. Marys, Georgia (see Note 13).

Under certain of our operating leases for facilities in which we operate home delivery and specialty

pharmacies, we are required to remove improvements and equipment upon surrender of the property to the landlord

and convert the facilities back to office space. Our asset retirement obligation for our continuing operations was

$5.5 million and $6.3 million at December 31, 2009 and 2008, respectively.

73