Express Scripts 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

53

L

IQUIDITY A

N

D

C

APITAL RE

SOU

R

C

E

S

O

PERATI

NG

C

A

S

H FL

OW

A

N

D

C

APITAL EXPE

N

DIT

U

RE

S

I

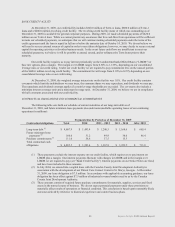

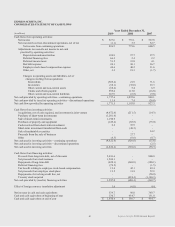

n 2009, net cash provided by continuing operations increased $

662

.0

m

illion to $1

,

75

7

.6

m

illion. Changes i

n

o

perating cash flows from continuing operations in 2009 were positively impacted by the following factors

:

Net income from continuing operations increased $

4

6.

9

m

illion in 2009 over 2008

.

I

n

c

l

uded

in n

e

t in

co

m

e

ar

e

n

on

-

c

ash charges

of

$

109.9 million related to depreciation and amortization,

$

66

.3

m

illi

o

n r

e

lat

ed

t

o

th

e

w

rit

e

-

off

o

f deferred financing fees

,

and $51.5 million related to deferred income taxe

s

.

The deferred tax provision from conti

n

u

i

ng operations increased $17.7 million 2009 over 2008 reflecting a net

c

hange in taxable temporary differences primarily attributable to tax deductible goodwill

.

C

hanges in working capital from continuing operations resulted in a cash inflow of $

6

31

.4

m

illi

on

i

n 200

9

c

ompared to $93.5 millio

n

i

n 2

008

.

These inflows were primarily related to the collection of receivables fro

m

c

lients and pharmaceutical manufacturers prior to year end, however the offsetting payments

t

o pharmacies and

c

lients were not made until after year end in accordance with the term

s

o

f our client, pharmacy and rebate

c

ontracts. Increases in inventory of $20.1 million for purchases at discounted rates partially offset this cash

i

nfl

ow.

I

n 2009

,

cash flows from disc

o

ntinued operations increased $

6

.

5 million from cash provided of

$

7.4 millio

n

i

n 2008 t

o

c

ash provided of $1

3

.

9 million in 2009

.

This was primarily due to the utilization of a tax benefit in the third quarter of

2009 offset by a decrease in accounts receivable due to the timing of collections as the balances wind down

.

I

n 2008, net cash provided by continuing operations increased $247.5 million to $1

,

095.

6

m

illion. Changes i

n

o

perating cash flows from continuing operations in 2008 were positively impacted by the following factors

:

Net income from continuing op

e

r

ations increased $179.1 million in 2008 over 2007

.

The deferred tax provision from continuing operations increa

s

ed $29.

7

m

illi

on

in

2008 over 2007, reflecting

c

hanges in the deferred tax provision caused by the first quarter 2007 impl

e

me

ntati

o

n

o

f

new

a

cc

o

unting guidanc

e

.

C

hanges in working capital from continuing operations resulted in a cash inflow of $93.5 millio

n

i

n 2

008

c

ompared to $77.2 millio

n

i

n 200

7

.

The change was driven by a

n

in

c

r

e

a

se

in n

e

t

c

a

s

h infl

ow

fr

om

c

laim

s

an

d

r

ebates payable year over year due to the timing of invoices and payments. This was sig

n

i

ficantly offset b

y

dec

r

e

a

ses

fr

om

i

nventory due to large purchases of inventory at discounted rates and

f

r

o

m a

ccou

nt

s

r

ece

i

v

a

b

l

e

due

t

o the timing of coll

ec

ti

o

n

s.

I

n 2008, cash flows from discontinued operations

i

ncreased $28.

2

m

illion from cash used of $20.8

m

illi

on

i

n 2007

to

c

ash provided of $7.

4

m

illion in 2008. This was primarily due to the sale of IP in 2008 and the collection of accounts

rece

i

v

a

b

l

e.

A

s a percent of accounts receivable, our allowance for doubtful accounts for continuing operations was 3.

7

%

an

d

6.

2

% at December 31

,

20

0

9

an

d

20

0

8

,

respectively. The decrease is primarily due to the increase i

n

t

h

e

a

ccou

nt

s

r

ece

i

v

a

b

l

e

b

alan

ce

fr

om

t

he NextRx acquisition

.

Our capital expenditures increased $63

.6

m

illion

,

o

r

74.1%

,

in 20

0

9

as compared to 20

0

8

,

an

d

i

ncreased $10

.

8

m

illion

,

o

r

1

4.4

%

,

in 20

0

8

as compared to 20

0

7

.

I

n the fourth quarter of 2009,

co

n

s

tr

uc

ti

on

began

o

n a new high volum

e

pharmacy fulfillment facility in St. Louis, Missouri. Capital expenditures related to this facility were $34.

0

m

illi

on

i

n 2009

and we expect approximately $31.0 million of expenditures in 2010.

W

e intend to continue t

o

in

ves

t in i

n

fra

s

tr

uc

t

u

r

e

an

d

tec

h

n

o

logy which we believe will provide efficiencies in operation

s

,

facilitate growth and enhance the ser

v

i

ce we provide

to

ou

r

c

li

e

nt

s.

W

e expect future capital expenditures will be funded primarily from operating cash flow or, to the extent

n

ecessary, with borrowings under our revolving credit facility, discussed below

.

S

T

OC

K REP

U

R

C

HA

S

E PR

OG

RAM (reflecting the tw

o

-

for

-

-

one stock split effective June 22, 2007

)

W

e have a stock repurchase program, originally announced on October 25

,

1996. On July 22, 2

008

,

our Board of

Dir

ec

t

o

r

s

a

u

th

o

riz

ed

t

o

tal

i

ncreases in the program of 15.

0

m

illion shares. Treasury shares are carried at first in, first out

cos

t

.

Th

e

r

e

i

s

n

o

limit

o

n th

e

du

rat

i

on of the program

.

During 2009, we did not repurchase any treasury share

s

.

Th

e

r

e

ar

e

21

.0

m

illion shares remaining under this program

.

A

dditional share repurchases, if any, will be made in such amounts and

at such times as we deem appropriate based upon prevailing market and business condition

s

an

d

o

th

e

r fa

c

t

o

r

s

.