Express Scripts 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

the redemption date. The Senior Notes are jointly and severally and fully and unconditionally guaranteed on a

senior unsecured basis by most of our current and future 100% owned domestic subsidiaries.

Financing costs of $13.3 million, for the issuance of the Senior Notes, are being amortized over an average

weighted period of 5.2 years and are reflected in other intangible assets, net in the accompanying consolidated

balance sheet. We used the net proceeds for the acquisition of WellPoint’s NextRx PBM Business (see Note 3).

We entered into a commitment letter with a syndicate of commercial banks for an unsecured, 364-day, $2.5

billion term loan credit facility in order to finance the NextRx acquisition. Upon completion of the public offering

of common stock and debt securities, we terminated the credit facility and incurred $56.3 million in fees and

incurred an additional $10.0 million in fees upon the completion of the acquisition.

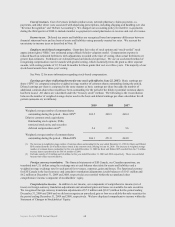

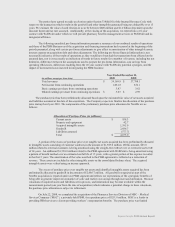

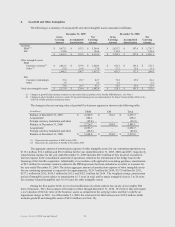

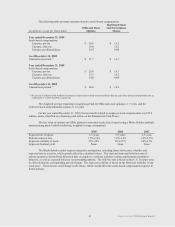

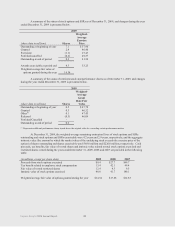

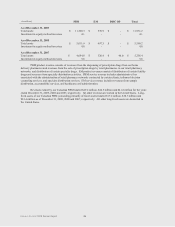

The following represents the schedule of current maturities for our long-term debt as of December 31, 2009

(amounts in millions):

Year Ended December 31,

2010

$ 1,340.0

2011

0.1

2012

1,000.1

2013

0.1

2014

1,000.0

Thereafter

500.0

$ 3,840.3

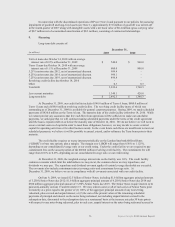

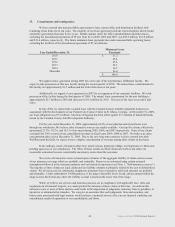

10. Income taxes

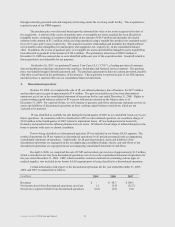

Income from continuing operations before income taxes of $1,309.3 million resulted in net tax expense of

$482.8 million for 2009. We consider our Canadian earnings to be indefinitely reinvested and accordingly, have not

recorded a provision for United States federal and state income taxes thereon. Cumulative undistributed Canadian

earnings for which United States taxes have not been provided are included in consolidated retained earnings in the

amount of $40.6 million, $31.5 million and $34.3 million as of December 31, 2009, 2008, and 2007, respectively.

Upon distribution of such earnings, we would be subject to United States income taxes of approximately $14.6

million.

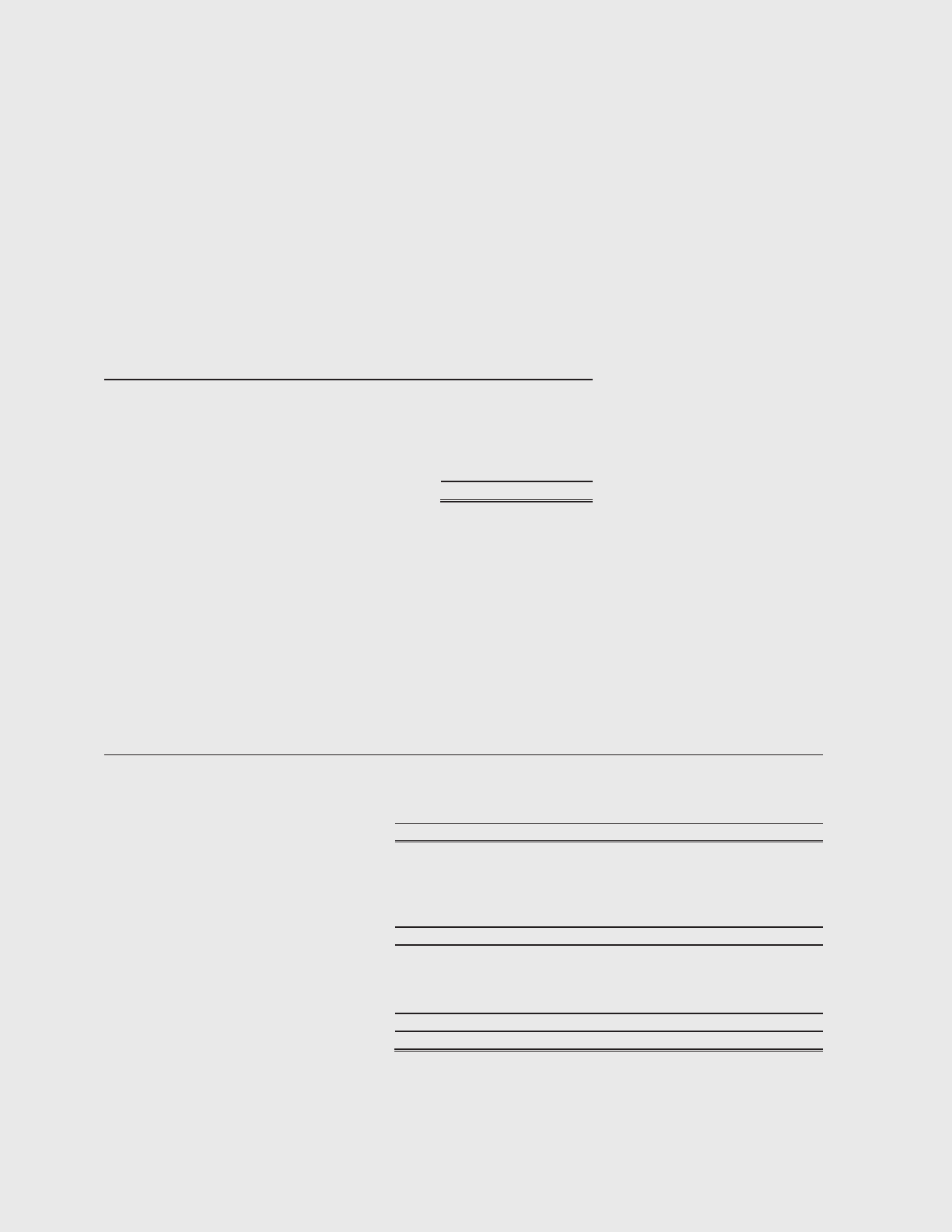

The provision (benefit) for income taxes for continuing operations consists of the following:

Year Ended December 31,

(in millions)

2009

2008

2007

Income from continuing operations before

income taxes:

United States

$ 1,313.3

$ 1,221.9

$ 937.1

Foreign

(4.0)

(8.3)

7.6

Total

$ 1,309.3

$ 1,213.6

$ 944.7

Current provision:

Federal

$ 407.6

$ 381.1

$ 320.9

State

25.5

18.2

15.8

Foreign

(1.8)

0.9

3.4

Total current provision

431.3

400.2

340.1

Deferred provision:

Federal

43.5

38.8

7.4

State

4.7

(2.1)

(2.4)

Foreign

3.3

(2.9)

(0.9)

Total deferred provision

51.5

33.8

4.1

Total current and deferred provision

$ 482.8

$ 434.0

$ 344.2

76