Express Scripts 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report 52

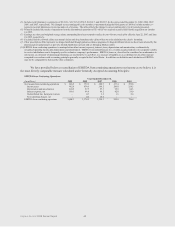

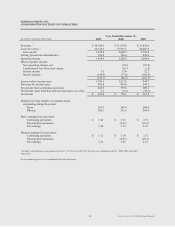

OTHER (EXPENSE) INCOME, NET

Net interest expense increased $124.5 million, or 192.7%, in 2009 as compared to 2008 primarily due to fees of

$66.3 million we incurred related to the termination of the bridge loan for the financing of the NextRx acquisition, $2.1

million of interest expense related to the bridge loan and $86.8 million of additional interest expense, financing fees and

amortization we incurred for the debt issuance completed in June 2009 to finance the acquisition of NextRx. This increase

was offset due to lower interest rates and less debt outstanding on the Term loans. Net interest expense decreased $31.6

million, or 32.8%, in 2008 as compared to 2007, due to lower interest rates and less debt outstanding.

The non-operating charge of $2.0 million during the year ended December 31, 2008 represents an unrealized loss

on shares held in the Reserve Primary Fund (see Note 2).

On December 18, 2006, we announced a proposal to acquire all of the outstanding shares of Caremark Rx, Inc.

(“Caremark”) common stock. On March 16, 2007, Caremark shareholders approved a merger agreement with CVS

Corporation (“CVS”) and we subsequently withdrew our proposal to acquire Caremark. We incurred legal and other

professional fees in 2007 (which do not include internal costs) of $27.2 million as a result of the proposed acquisition.

These expenses were partially offset by a $4.4 million special dividend paid by CVS Caremark Corporation (“CVS

Caremark”) on Caremark stock we owned prior to the CVS Caremark merger and by a non-operating gain of $4.2 million

resulting from the sale of our shares of CVS Caremark stock in the second quarter of 2007. We recognized net non-

operating charges in 2007 of $18.6 million.

PROVISION FOR INCOME TAXES

Our effective tax rate increased to 36.9% for the year ended December 31, 2009, as compared to 35.8% and 36.4%

for the year ended December 31, 2008 and 2007, respectively. Our 2009 effective rate reflects an increase in certain state

income tax rates due to enacted law changes as well as the impact of our recent acquisition of NextRx. Our 2008 effective

rate includes discrete tax adjustments resulting in a net tax benefit of $7.7 million attributable to lapses in the applicable

statutes of limitations, favorable audit resolutions, and changes in our unrecognized tax benefits. Our 2007 effective rate

reflects a nondeductible penalty of $10.5 million relating to the settlement of a legal matter.

NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF TAX

Net income from discontinued operations, net of tax, increased $4.6 million from a net loss of $3.5 million in 2008

to net income of $1.1 million in 2009. This increase is primarily due to the collection of outstanding accounts receivable

which were fully reserved as well as a gain on the disposition of assets.

Net loss from discontinued operations, net of tax, decreased $29.2 million from 2007 to 2008. This decrease is

primarily due to charges recorded in the fourth quarter of 2007 of $34.0 million from IP goodwill and intangible asset

impairment losses and the write-down of IP assets to fair market value (see “Critical Accounting Policies—Asset

Impairment”) and non-recurring charges of $2.0 million relating to the closure of six IP pharmacy sites. In addition, a pre-

tax gain on sale of IP of $7.4 million is offset by a pre-tax loss on sale of CMP for $1.3 million during the year ended

December 31, 2008.

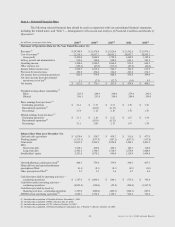

NET INCOME AND EARNINGS PER SHARE

Net income increased $51.5 million, or 6.6%, for the year ended December 31, 2009 over 2008 and increased

$208.3 million, or 36.7%, for the year ended December 31, 2008 over 2007.

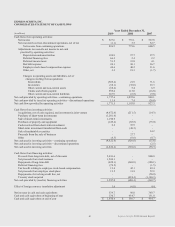

On May 23, 2007, we announced a two-for-one stock split for stockholders of record on June 8, 2007, effective

June 22, 2007. This split was effected in the form of a dividend by issuance of one additional share of common stock for

each share of common stock outstanding. The earnings per share and the weighted average number of shares outstanding

for basic and diluted earnings per share for each respective period have been adjusted for this stock split.

Basic and diluted earnings per share increased 0.6% and 1.0%, respectively for the year ended December 31, 2009

over 2008 primarily due to improved operating results partially offset by an increase in shares outstanding as a result of the

public offering in June 2009 (see Note 11). Basic and diluted earnings per share increased 43.1% and 43.3%, respectively,

for the year ended December 31, 2008 over 2007 primarily due to improved operating results, as well as the decrease in the

basic and diluted weighted average number of common shares, relating to the repurchase of 7.2 million shares in the year

ended December 31, 2008 (see “—Stock Repurchase Program”).