Express Scripts 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

55

BANK CREDIT FACILITY

At December 31, 2009, our credit facility includes $540.0 million of Term A loans, $800.0 million of Term-1

loans and a $600.0 million revolving credit facility. The revolving credit facility (none of which was outstanding as of

December 31, 2009) is available for general corporate purposes. During 2009, we made scheduled payments of $420.0

million on our Term A loan. While we cannot provide any assurances that free cash flow from operations will be sufficient

to make our scheduled payments, we anticipate that we will continue making scheduled payments under the terms of the

credit agreement until the loan is repaid in full on or before the maturity date of October 14, 2010. We do not believe we

will need to secure external sources of capital in order to meet these obligations; however, we may decide to secure external

capital for operating activities or for other business needs. In the event future cash flows are insufficient to meet our

scheduled payments, we believe it will be possible to amend, extend, and/or refinance the Term loans prior to their

maturity.

Our credit facility requires us to pay interest periodically on the London Interbank Offered Rates (“LIBOR”) or

base rate options, plus a margin. The margin over LIBOR ranges from 0.50% to 1.125%, depending on our consolidated

leverage ratio or our credit rating. Under our credit facility we are required to pay commitment fees on the unused portion

of the $600.0 million revolving credit facility. The commitment fee will range from 0.10% to 0.25% depending on our

consolidated leverage ratio or our credit rating.

At December 31, 2009, the weighted average interest rate on the facility was 1.0%. Our credit facility contains

covenants which limit the indebtedness we may incur, the common shares we may repurchase, and dividends we may pay.

The repurchase and dividend covenant applies if certain leverage thresholds are exceeded. The covenants also include a

minimum interest coverage ratio and a maximum leverage ratio. At December 31, 2009, we believe we are in compliance

with all covenants associated with our credit facility.

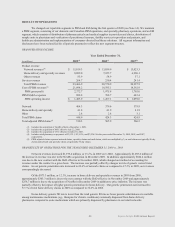

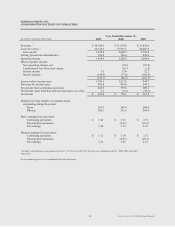

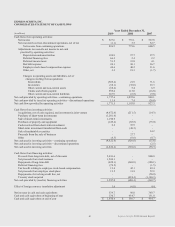

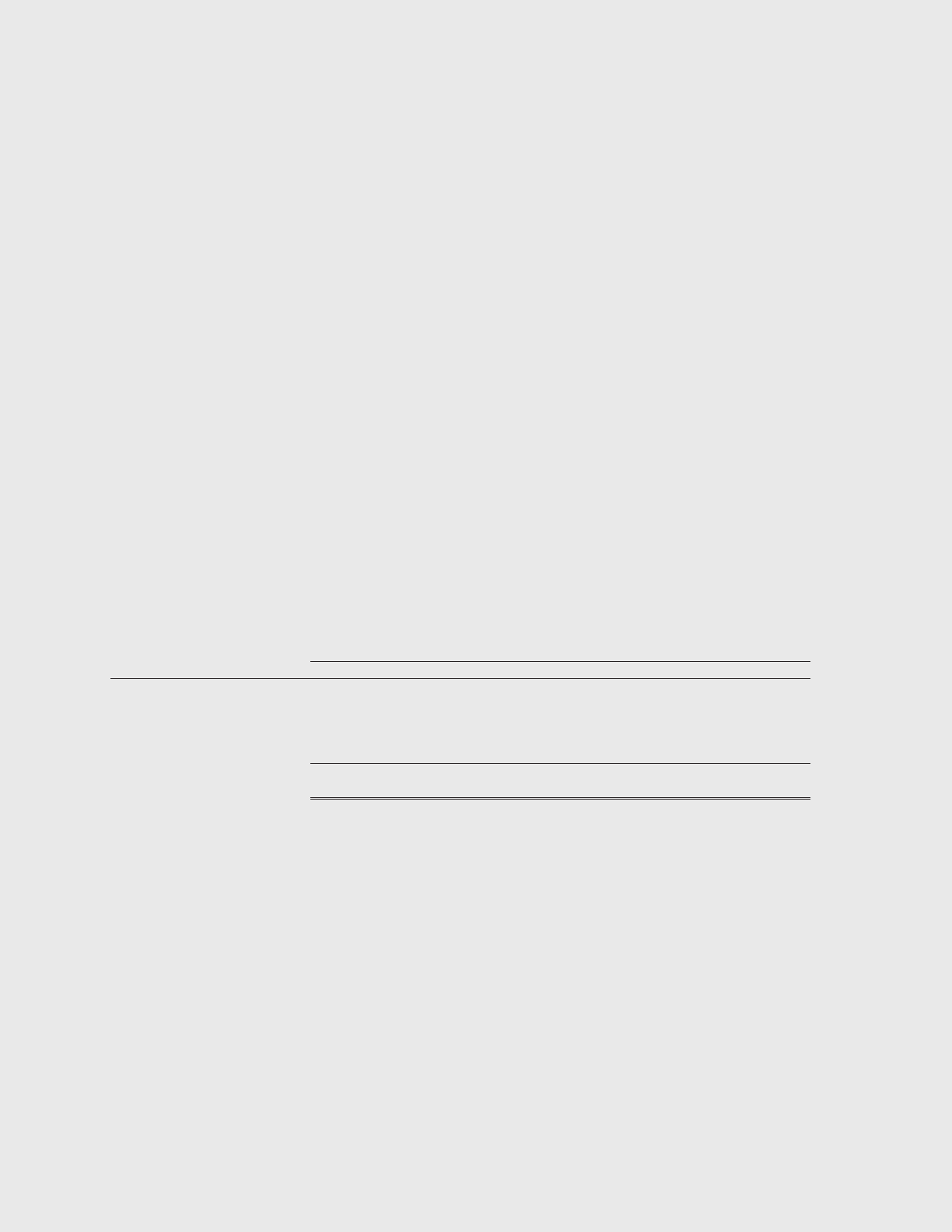

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS

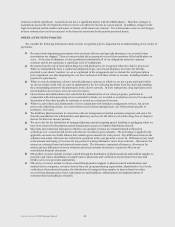

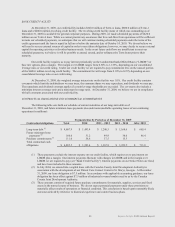

The following table sets forth our schedule of current maturities of our long-term debt as of

December 31, 2009, and future minimum lease payments due under noncancellable operating leases of our continuing

operations (in millions):

Payments Due by Period as of December 31, 2009

Contractual obligations

Total

2010

2011 – 2012

2013 – 2014

After 2015

Long-term debt (1)

$ 4,607.9

$ 1,493.4

$ 1,280.5

$ 1,168.6

$ 665.4

Future minimum lease

payments

(2)

166.0

31.2

49.8

38.6

46.4

Purchase commitments (3)

111.6

58.8

37.5

15.3

-

Total contractual cash

obligations

$ 4,885.5

$ 1,583.4

$ 1,367.8

$ 1,222.5

$ 711.8

(1) These payments exclude the interest expense on our credit facility, which requires us to pay interest on

LIBOR plus a margin. Our interest payments fluctuate with changes in LIBOR and in the margin over

LIBOR we are required to pay (see “Bank Credit Facility”). Interest payments on our Senior Notes are fixed,

and have been included in these amounts.

(2) In July 2004, we entered into a capital lease with the Camden County Joint Development Authority in

association with the development of our Patient Care Contact Center in St. Marys, Georgia. At December

31, 2009, our lease obligation is $7.5 million. In accordance with applicable accounting guidance, our lease

obligation has been offset against $7.5 million of industrial revenue bonds issued to us by the Camden

County Joint Development Authority.

(3) These amounts consist of required future purchase commitments for materials, supplies, services and fixed

assets in the normal course of business. We do not expect potential payments under these provisions to

materially affect results of operations or financial condition. This conclusion is based upon reasonably likely

outcomes derived by reference to historical experience and current business plans.