Express Scripts 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

through internally generated cash and temporary borrowings under the revolving credit facility. This acquisition is

reported as part of our PBM segment.

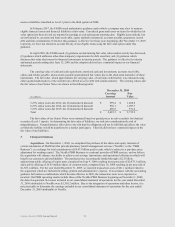

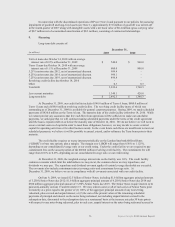

The purchase price was allocated based upon the estimated fair value of net assets acquired at the date of

the acquisition. A portion of the excess of purchase price over tangible net assets acquired has been allocated to

intangible assets, consisting of customer relationships in the amount of $28.9 million and internally developed

software in the amount of $1.2 million, which are being amortized using a straight-line method over estimated useful

lives of 15 years and 5 years, respectively. The acquired customer relationships and internally developed software

are included in other intangibles, net and property and equipment, net, respectively, in the consolidated balance

sheet. In addition, the excess of purchase price over tangible net assets and identified intangible assets acquired has

been allocated to goodwill in the amount of $194.6 million. The preliminary allocation of $208.2 million at

December 31, 2008 was reduced due to costs identified within one year of the acquisition date. Goodwill related to

this acquisition is not deductible for tax purposes.

On October 10, 2007, we purchased Connect Your Care, LLC (“CYC”), a leading provider of consumer

directed healthcare technology solutions to the employer, health plan and financial services markets. The purchase

price was funded through internally generated cash. The purchase agreement includes an earnout provision, payable

after three years based on the performance of the business. This acquisition is reported as part of our EM segment,

and did not have a material effect on our consolidated financial statements.

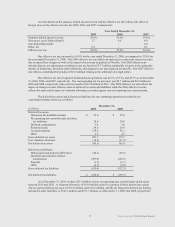

4. Discontinued operations

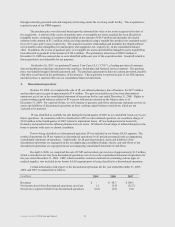

On June 30, 2008, we completed the sale of IP, our infusion pharmacy line of business, for $27.5 million

and recorded a pre-tax gain of approximately $7.4 million. The gain is included in net loss from discontinued

operations, net of tax in the consolidated statement of operations for the year ended December 31, 2008. Rights to

certain working capital balances related to IP were not sold and are retained on the balance sheet as of

December 31, 2009. For a period of time, we will continue to generate cash flows and income statement activity on

assets and liabilities of discontinued operations as these working capital balances wind down, which are not

expected to be material.

IP was identified as available for sale during the fourth quarter of 2007 as we considered it non-core to our

future operations. In connection with the classification of IP as a discontinued operation, we recorded a charge of

$34.0 million in the fourth quarter of 2007 related to impairment losses. IP was headquartered in Louisville,

Kentucky and operated twelve infusion pharmacies in six states. IP offered a broad range of infused therapies in the

home to patients with acute or chronic conditions.

Prior to being classified as a discontinued operation, IP was included in our former SAAS segment. The

results of operations for IP are reported as discontinued operations for all periods presented in the accompanying

consolidated statements of operations. Additionally, for all periods presented, assets and liabilities of the

discontinued operations are segregated in the accompanying consolidated balance sheets, and cash flows of our

discontinued operations are segregated in our accompanying consolidated statement of cash flows.

On April 4, 2008, we completed the sale of CMP and recorded a pre-tax loss of approximately $1.3 million

which is included in net loss from discontinued operations, net of tax in the consolidated statement of operations for

the year ended December 31, 2008. CMP, which assembles customer medical kits containing various types of

medical supplies, was included in our former SAAS segment prior to being classified as a discontinued operation.

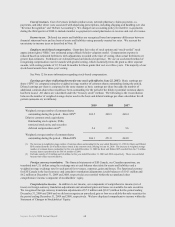

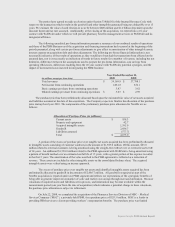

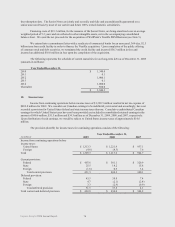

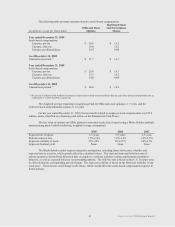

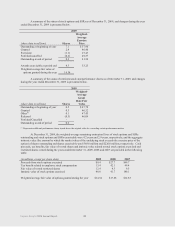

Certain information with respect to the discontinued operations for the year ended December 31, 2009,

2008, and 2007 is summarized as follows:

(in millions)

2009

2008

2007

Revenues

$ -

$ 44.7

$ 108.3

Net income (loss) from discontinued operations, net of tax

1.1

(3.5)

(32.7)

Income tax (expense) benefit from discontinued operations

(0.8)

(0.3)

14.0

72