Express Scripts 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

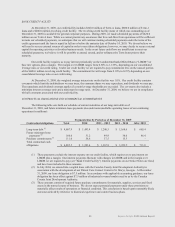

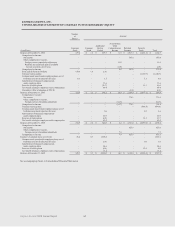

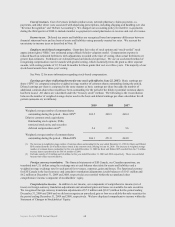

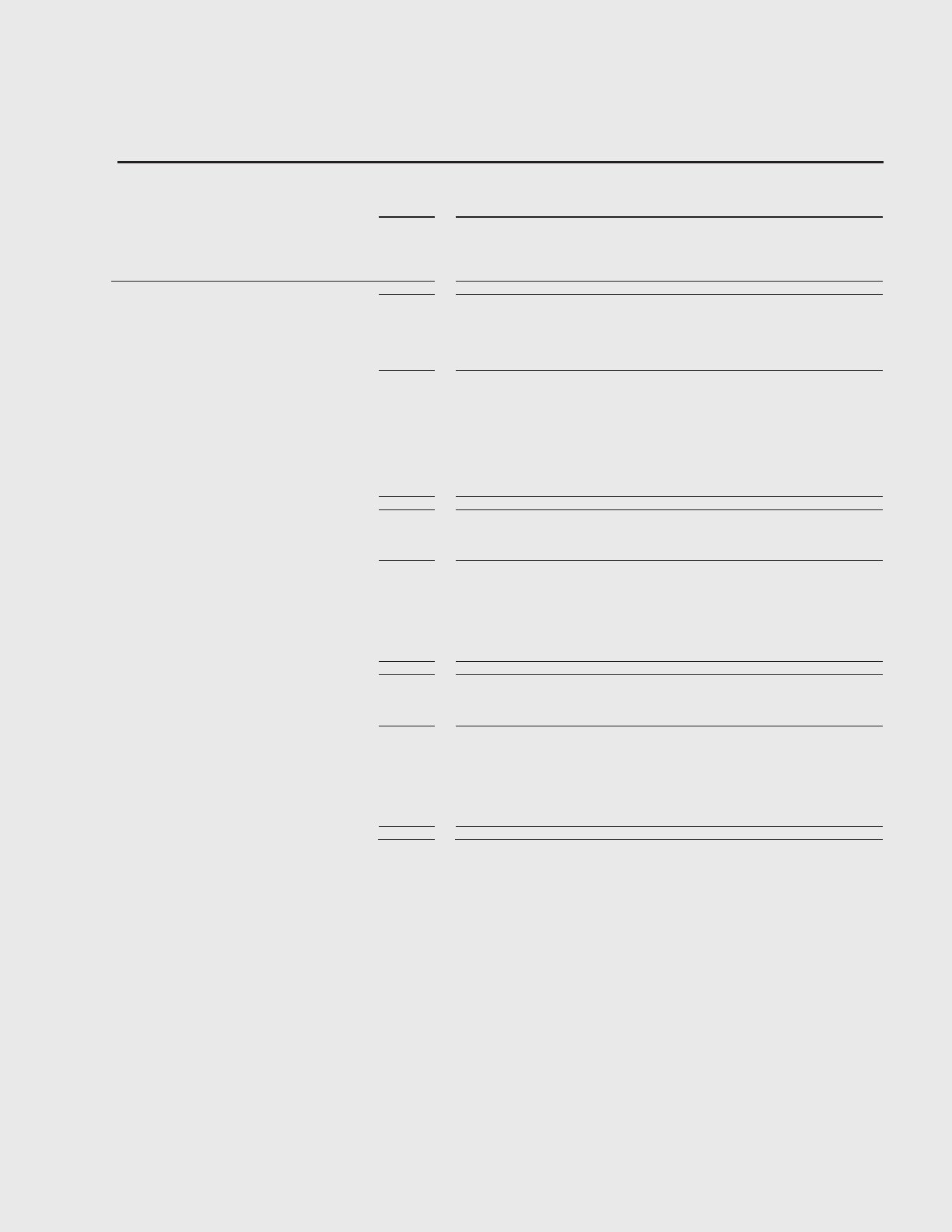

EXPRESS SCRIPTS, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Number

of

Shares

Amount

(in millions)

Common

Stock

Common

Stock

Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income

Retained

Earnings

Treasury

Stock

Total

Balance at December 31, 2006

159.4

$ 1.6

$ 495.3

$ 11.9

$ 2,017.3

$ (1,401.2)

$ 1,124.9

Comprehensive income:

Net income

-

-

-

-

567.8

-

567.8

Other comprehensive income,

Foreign currency translation adjustment

-

-

-

11.0

-

-

11.0

Realized and unrealized gain on available

for sale securities; net of taxes

-

-

-

(2.0)

-

-

(2.0)

Comprehensive income

-

-

-

9.0

567.8

-

576.8

Stock split in form of dividend

159.4

1.6

(1.6)

-

-

-

-

Treasury stock acquired

-

-

-

-

-

(1,140.3)

(1,140.3)

Common stock issued under employee plans, net of

forfeitures and stock redeemed for taxes

0.1

-

1.5

-

-

3.1

4.6

Amortization of unearned compensation

under employee plans

-

-

31.6

-

-

-

31.6

Exercise of stock options

-

-

(11.7)

-

-

61.3

49.6

Tax benefit relating to employee stock compensation

-

-

49.4

-

-

-

49.4

Cumulative effect of adoption of FIN 48

-

-

-

-

(0.2)

-

(0.2)

Balance at December 31, 2007

318.9

$ 3.2

$ 564.5

$ 20.9

$ 2,584.9

$ (2,477.1)

$ 696.4

Comprehensive income:

Net income

-

-

-

-

776.1

-

776.1

Other comprehensive income,

Foreign currency translation adjustment

-

-

-

(14.7)

-

-

(14.7)

Comprehensive income

-

-

-

(14.7)

776.1

-

761.4

Treasury stock acquired

-

-

-

-

-

(494.4)

(494.4)

Common stock issued under employee plans, net of

forfeitures and stock redeemed for taxes

-

-

0.6

-

-

4.0

4.6

Amortization of unearned compensation

under employee plans

-

-

40.3

-

-

-

40.3

Exercise of stock options

-

-

(6.8)

-

-

34.5

27.7

Tax benefit relating to employee stock compensation

-

-

42.2

-

-

-

42.2

Balance at December 31, 2008

318.9

$ 3.2

$ 640.8

$ 6.2

$ 3,361.0

$ (2,933.0)

$ 1,078.2

Comprehensive income:

Net income

-

-

-

-

827.6

-

827.6

Other comprehensive income,

Foreign currency translation adjustment

-

-

-

7.9

-

-

7.9

Comprehensive income

-

-

-

7.9

827.6

-

835.5

Issuance of common stock, net of costs

26.4

0.3

1,568.8

-

-

-

1,569.1

Common stock issued under employee plans, net of

forfeitures and stock redeemed for taxes

-

-

(3.0)

-

-

6.0

3.0

Amortization of unearned compensation

under employee plans

-

-

44.6

-

-

-

44.6

Exercise of stock options

-

-

(4.6)

-

-

12.6

8.0

Tax benefit relating to employee stock compensation

-

-

13.4

-

-

-

13.4

Balance at December 31, 2009

345.3

$ 3.5

$ 2,260.0

$ 14.1

$ 4,188.6

$ (2,914.4)

$ 3,551.8

See accompanying Notes to Consolidated Financial Statements

60