Express Scripts 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

45

Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

As one of the largest full-service pharmacy benefit management (“PBM”) companies in North America, we

provide health care management and administration services on behalf of our clients, which include health maintenance

organizations, health insurers, third-party administrators, employers, union-sponsored benefit plans, workers’ compensation

plans, and government health programs. During the first quarter of 2009, we changed our reportable segments to

Pharmacy Benefit Management (“PBM”) and Emerging Markets (“EM”). Segment disclosures for 2008 and 2007 have

been reclassified to reflect the new structure. Under the new structure, our integrated PBM services include network claims

processing, home delivery services, patient care and direct specialty home delivery to patients, benefit plan design

consultation, drug utilization review, formulary management, drug data analysis services, distribution of injectable drugs to

patient homes and physicians offices, bio-pharma services, and fulfillment of prescriptions to low-income patients through

manufacturer-sponsored patient assistance programs and company-sponsored generic patient assistance programs.

Through our EM segment, we provide services including distribution of pharmaceuticals and medical supplies to

providers and clinics, distribution of sample units to physicians and verification of practitioner licensure, fertility services to

providers and patients, and healthcare administration and implementation of consumer-directed healthcare solutions.

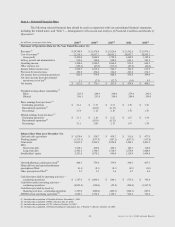

Revenue generated by our segments can be classified as either tangible product revenue or service revenue. We

earn tangible product revenue from the sale of prescription drugs by retail pharmacies in our retail pharmacy networks and

from dispensing prescription drugs from our home delivery and specialty pharmacies. Service revenue includes

administrative fees associated with the administration of retail pharmacy networks contracted by certain clients, medication

counseling services, certain specialty distribution services, and sample fulfillment and accountability services. Tangible

product revenue generated by our PBM and EM segments represented 98.8% of revenues for the year ended December 31,

2009 as compared to 98.7% and 98.6% for the years ended December 31, 2008 and 2007, respectively.

RECENT DEVELOPMENTS

On December 1, 2009, we completed the purchase of the shares and equity interests of certain subsidiaries of

WellPoint that provide pharmacy benefit management services (“NextRx” or the “PBM Business”), in exchange for total

consideration of $4.675 billion paid in cash, which is subject to a purchase price adjustment for working capital. The

NextRx PBM Business is a national provider of PBM services, and we believe the acquisition will enhance our ability to

achieve cost savings, innovations, and operational efficiencies which will benefit our customers and stockholders. The

purchase price was primarily funded through a $2.5 billion underwritten public offering of senior notes completed on June

9, 2009 resulting in net proceeds of $2,478.3 million, and a public offering of 26.45 million shares of common stock

completed June 10, 2009 resulting in net proceeds of $1,569.1 million. Our PBM operating results include those of the

NextRx PBM Business beginning on December 1, 2009, the date of acquisition (see Note 3).

In November 2009, we implemented a new contract with the United States Department of Defense (“DoD”).

While we have provided services to the DoD since 2003, this new contract combines the pharmacy network services, home

delivery and specialty pharmacy under one program. The DoD’s TRICARE Pharmacy Program is the military healthcare

program serving active-duty service members, National Guard and Reserve members and retirees, as well as their

dependents. Under the new contract, we provide online claims adjudication, home delivery services, specialty pharmacy

clinical services, claims processing and contact center support, and other services critical to managing pharmacy trend.

Prior to the new contract, we administered the DoD’s network pharmacy contracts and earned an administrative fee,

therefore related revenues were recorded on a net basis. Due to the expansion of services provided under the new contract,

our method of accounting for revenues and cost of revenues changed to a gross basis. Ingredient cost and member co-

payments are included in revenues and cost of revenues (see Note 1 – Summary of significant accounting policies for a

description of revenue recognition policies).

In the fourth quarter of 2009, construction began on a new state of the art pharmacy fulfillment facility in St.

Louis, Missouri. We expect to take possession of this leased facility during the second quarter of 2010. The new facility

will feature cutting-edge pharmacy automation for the dispensing, packaging and shipment of approximately 110,000

prescriptions per day. We believe this increase in capacity enhances our ability to serve members and allows for future

growth of home delivery services.