Express Scripts 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report 80

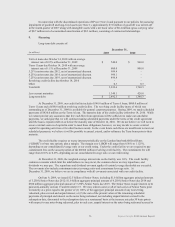

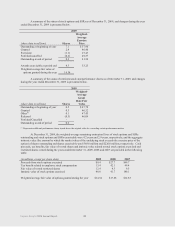

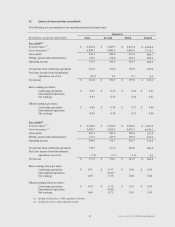

During 2009, we granted to certain officers and employees approximately 288,000 restricted stock units

and performance shares with a weighted average fair market value of $46.52. The restricted stock units have three-

year graded vesting and the performance shares cliff vest at the end of three years. Prior to vesting, these shares are

subject to forfeiture to us without consideration upon termination of employment under certain circumstances. The

original value of the performance share grants are subject to a multiplier of up to 2.5 based on certain performance

metrics. During 2009, approximately 86,500 additional performance shares were granted to certain officers for

exceeding certain performance metrics. The total number of non-vested restricted stock and performance share

awards was 600,000 and 518,000 at December 31, 2009 and 2008, respectively. Unearned compensation relating to

these awards is amortized to non-cash compensation expense over the estimated vesting periods. As of December

31, 2009, 2008, and 2007, unearned compensation related to restricted stock and performance shares was $16.7

million, $14.2 million and $13.6 million, respectively. We recorded pre-tax compensation expense related to

restricted stock and performance share grants of $16.2 million, $16.3 million and $9.3 million in 2009, 2008, and

2007, respectively.

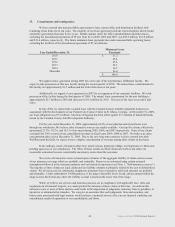

During 2009, we granted to certain officers and employees approximately 2,422,000 stock options with a

weighted average Black-Scholes value of $14.54 per share. The SSRs and stock options have three-year graded

vesting. Due to the nature of the awards, we use the same valuation methods and accounting treatments for SSRs

and stock options.

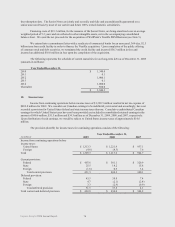

The provisions of the 2000 LTIP allow employees to use shares to cover tax withholding on stock awards.

Upon vesting of restricted stock and performance shares, employees have taxable income subject to statutory

withholding requirements. The number of shares issued to employees may be reduced by the number of shares

having a market value equal to our minimum statutory withholding for federal, state and local tax purposes.

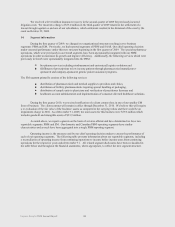

As a result of the Board’s adoption and stockholder approval of the 2000 LTIP, no additional awards will

be granted under either of our 1992 amended and restated stock option plan (discussed below) or under our 1994

amended and restated stock option plan (discussed below). However, these plans are still in existence as there are

outstanding grants under these plans.

In April 1992, we adopted a stock option plan that we amended and restated in 1995 and amended in 1999,

which provided for the grant of nonqualified stock options and incentive stock options to our officers and key

employees selected by the Compensation Committee of the Board of Directors. In June 1994, the Board of

Directors adopted the Express Scripts, Inc. 1994 Stock Option Plan, also amended and restated in 1995 and amended

in 1997, 1998 and 1999. Under either plan, the exercise price of the options was not less than the fair market value

of the shares at the time of grant, and the options typically vested over a five-year period from the date of grant.

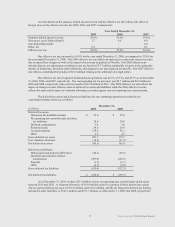

In April 1992, we also adopted a stock option plan that was amended and restated in 1995 and amended in

1996 and 1999 that provided for the grant of nonqualified stock options to purchase 48,000 shares to each director

who is not an employee of ours or our affiliates. In addition, the second amendment to the plan gave each non-

employee director who was serving in such capacity as of the date of the second amendment the option to purchase

2,500 additional shares. The second amendment options vested over three years. The plan provides that the options

vest over a two-, three- or five-year period from the date of grant depending upon the circumstances of the grant.