Express Scripts 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Express Scripts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Express Scripts 2009 Annual Report

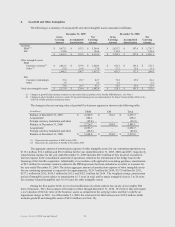

In connection with the discontinued operations of IP (see Note 4) and pursuant to our policies for assessing

impairment of goodwill and long-lived assets (see Note 1), approximately $7.0 million of goodwill was written off

in the fourth quarter of 2007 along with intangible assets with a net book value of $0.4 million (gross carrying value

of $0.7 million net of accumulated amortization of $0.3 million), consisting of contractual relationships.

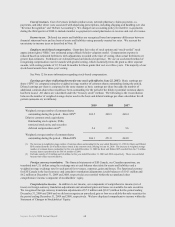

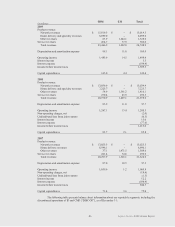

9. Financing

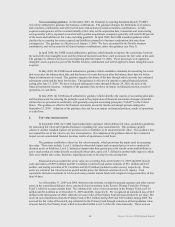

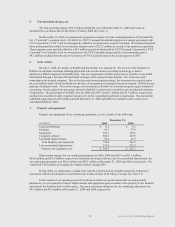

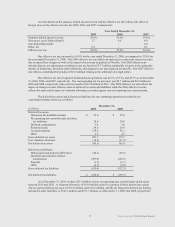

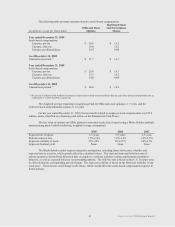

Long-term debt consists of:

December 31,

(in millions)

2009

2008

Term A loans due October 14, 2010 with an average

interest rate of 0.9% at December 31, 2009

$ 540.0

$ 960.0

Term-1 loans due October 14, 2010 with an average

interest rate of 1.1% at December 31, 2009

800.0

800.0

5.25% senior notes due 2012, net of unamortized discount

999.4

-

6.25% senior notes due 2014, net of unamortized discount

996.1

-

7.25% senior notes due 2019, net of unamortized discount

496.8

-

Revolving credit facility due October 14, 2010

-

-

Other

0.3

0.3

Total debt

3,832.6

1,760.3

Less current maturities

1,340.1

420.0

Long-term debt

$ 2,492.5

$ 1,340.3

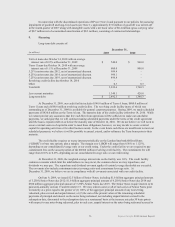

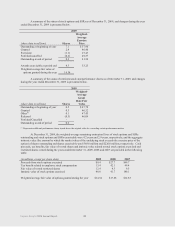

At December 31, 2009, our credit facility includes $540.0 million of Term A loans, $800.0 million of

Term-1 loans and a $600.0 million revolving credit facility. The revolving credit facility (none of which was

outstanding as of December 31, 2009) is available for general corporate purposes. During 2009, we made scheduled

payments of $420.0 million on the Term A loan. The maturity date of the credit facility is October 14, 2010. While

we cannot provide any assurances that free cash flow from operations will be sufficient to make our scheduled

payments, we anticipate that we will continue making scheduled payments under the terms of the credit agreement

until the loan is repaid in full on or before the maturity date of October 14, 2010. We do not believe we will need to

secure external sources of capital in order to meet these obligations; however, we may decide to secure external

capital for operating activities or for other business needs. In the event future cash flows are insufficient to meet our

scheduled payments, we believe it will be possible to amend, extend, and/or refinance the Term loans prior to their

maturity.

The credit facility requires us to pay interest periodically on the London Interbank Offered Rates

(“LIBOR”) or base rate options, plus a margin. The margin over LIBOR will range from 0.50% to 1.125%,

depending on our consolidated leverage ratio or our credit rating. Under the credit facility we are required to pay

commitment fees on the unused portion of the $600.0 million revolving credit facility. The commitment fee will

range from 0.10% to 0.25% depending on our consolidated leverage ratio or our credit rating.

At December 31, 2009, the weighted average interest rate on the facility was 1.0%. The credit facility

contains covenants which limit the indebtedness we may incur, the common shares we may repurchase, and

dividends we may pay. The repurchase and dividend covenant applies if certain leverage thresholds are exceeded.

The covenants also include a minimum interest coverage ratio and a maximum leverage ratio. At

December 31, 2009, we believe we are in compliance with all covenants associated with our credit facility.

On June 9, 2009, we issued $2.5 billion of Senior Notes, including $1.0 billion aggregate principal amount

of 5.250% Senior Notes due 2012; $1.0 billion aggregate principal amount of 6.250% Senior Notes due 2014 and

$500 million aggregate principal amount of 7.250% Senior Notes due 2019. The Senior Notes require interest to be

paid semi-annually on June 15 and December 15. We may redeem some or all of each series of Senior Notes prior

to maturity at a price equal to the greater of (1) 100% of the aggregate principal amount of any notes being

redeemed, plus accrued and unpaid interest; or (2) the sum of the present values of the remaining scheduled

payments of principal and interest on the notes being redeemed, not including unpaid interest accrued to the

redemption date, discounted to the redemption date on a semiannual basis at the treasury rate plus 50 basis points

with respect to any notes being redeemed, plus in each case, unpaid interest on the notes being redeemed accrued to

75