Delta Airlines 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

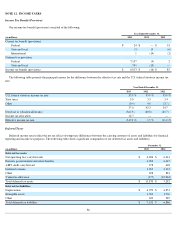

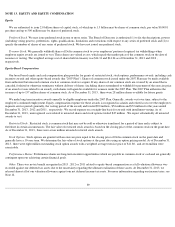

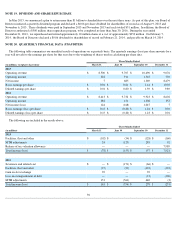

NOTE 13 . EQUITY AND EQUITY COMPENSATION

Equity

We are authorized to issue 2.0 billion shares of capital stock, of which up to 1.5 billion may be shares of common stock, par value $0.0001

per share and up to 500 million may be shares of preferred stock.

Preferred Stock. We may issue preferred stock in one or more series. The Board of Directors is authorized (1) to fix the descriptions, powers

(including voting powers), preferences, rights, qualifications, limitations and restrictions with respect to any series of preferred stock and (2) to

specify the number of shares of any series of preferred stock. We have not issued any preferred stock.

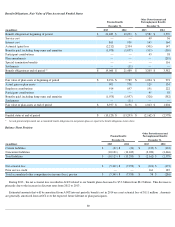

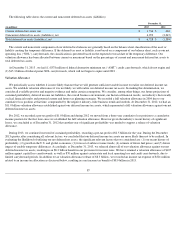

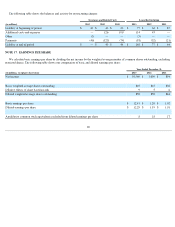

Treasury Stock. We generally withhold shares of Delta common stock to cover employees' portion of required tax withholdings when

employee equity awards are issued or vest. These shares are valued at cost, which equals the market price of the common stock on the date of

issuance or vesting. The weighted average cost of shares held in treasury was $14.31 and $14.24 as of December 31, 2013 and 2012 ,

respectively.

Equity

-Based Compensation

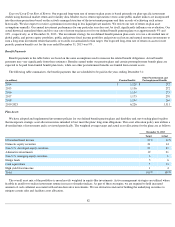

Our broad based equity and cash compensation plan provides for grants of restricted stock, stock options, performance awards, including cash

incentive awards and other equity-based awards (the "2007 Plan"). Shares of common stock issued under the 2007 Plan may be made available

from authorized but unissued common stock or common stock we acquire. If any shares of our common stock are covered by an award that is

canceled, forfeited or otherwise terminates without delivery of shares (including shares surrendered or withheld for payment of the exercise price

of an award or taxes related to an award), such shares will again be available for issuance under the 2007 Plan. The 2007 Plan authorizes the

issuance of up to 157 million shares of common stock. As of December 31, 2013 , there were 28 million shares available for future grants.

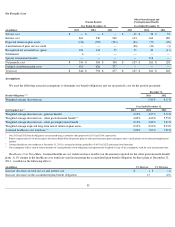

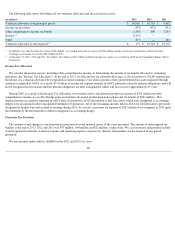

We make long term incentive awards annually to eligible employees under the 2007 Plan. Generally, awards vest over time, subject to the

employee's continued employment. Equity compensation expense for these awards is recognized in salaries and related costs over the employee's

requisite service period (generally, the vesting period of the award) and totaled $90 million , $54 million and $72 million for the years ended

December 31, 2013 , 2012 and 2011 , respectively. We record expense on a straight-line basis for awards with installment vesting. As of

December 31, 2013 , unrecognized costs related to unvested shares and stock options totaled $45 million . We expect substantially all unvested

awards to vest.

Restricted Stock . Restricted stock is common stock that may not be sold or otherwise transferred for a period of time and is subject to

forfeiture in certain circumstances. The fair value of restricted stock awards is based on the closing price of the common stock on the grant date.

As of December 31, 2013 , there were seven million unvested restricted stock awards.

Stock Options. Stock options are granted with an exercise price equal to the closing price of Delta common stock on the grant date and

generally have a 10-year term. We determine the fair value of stock options at the grant date using an option pricing model. As of December 31,

2013 , there were eight million outstanding stock option awards with a weighted average exercise price of $11.80 , and seven million were

exercisable.

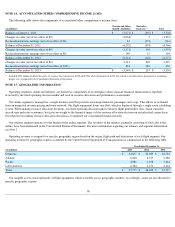

Performance Shares. Performance shares are long-term incentive opportunities which are payable in common stock or cash and are generally

contingent upon our achieving certain financial goals.

Other. There was no tax benefit recognized in 2013 , 2012 or 2011 related to equity-based compensation as a full valuation allowance was

recorded against our deferred tax assets due to the uncertainty regarding the ultimate realization of those assets. At December 31, 2013, we

released almost all of our valuation allowance against our net deferred income tax assets. For more information regarding our income taxes, see

Note 12.

89