Delta Airlines 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

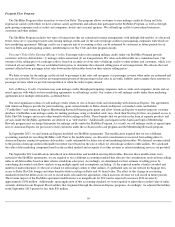

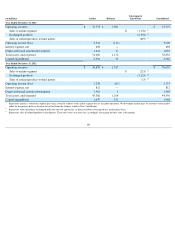

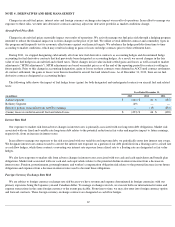

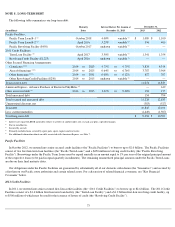

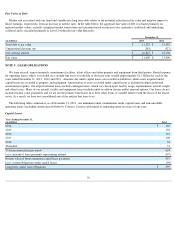

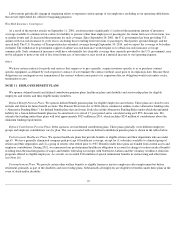

Designated Hedge Gains (Losses)

Gains (losses) related to our designated hedge contracts, including those previously designated as accounting hedges, are as follows:

As of December 31, 2013 , we have recorded $157 million of net gains on cash flow hedge contracts in AOCI, which are scheduled to settle

and be reclassified into earnings within the next 12 months.

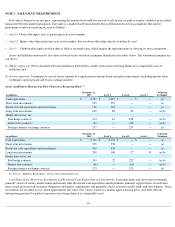

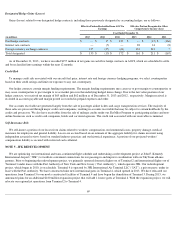

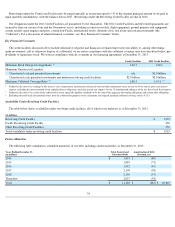

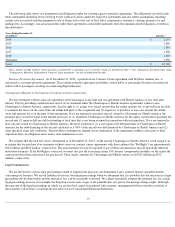

Credit Risk

To manage credit risk associated with our aircraft fuel price, interest rate and foreign currency hedging programs, we select counterparties

based on their credit ratings and limit our exposure to any one counterparty.

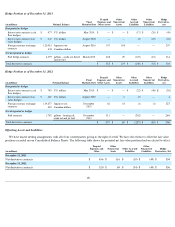

Our hedge contracts contain margin funding requirements.

The margin funding requirements may cause us to post margin to counterparties or

may cause counterparties to post margin to us as market prices in the underlying hedged items change. Due to the fair value position of our

hedge contracts, we received net margin of $65 million and $62 million as of December 31, 2013 and 2012 , respectively. Margin received is

recorded in accounts payable and margin posted is recorded in prepaid expenses and other.

Our accounts receivable are generated largely from the sale of passenger airline tickets and cargo transportation services. The majority of

these sales are processed through major credit card companies, resulting in accounts receivable that may be subject to certain holdbacks by the

credit card processors. We also have receivables from the sale of mileage credits under our SkyMiles Program to participating airlines and non-

airline businesses such as credit card companies, hotels and car rental agencies. The credit risk associated with our receivables is minimal.

Self

-Insurance Risk

We self-insure a portion of our losses from claims related to workers' compensation, environmental issues, property damage, medical

insurance for employees and general liability. Losses are accrued based on an estimate of the aggregate liability for claims incurred, using

independent actuarial reviews based on standard industry practices and our historical experience. A portion of our projected workers'

compensation liability is secured with restricted cash collateral.

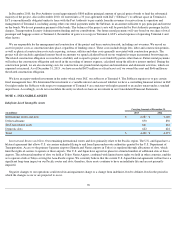

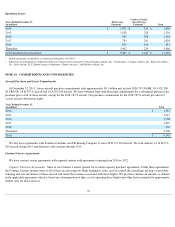

NOTE 5 . JFK REDEVELOPMENT

We are optimizing our international and trans-continental flight schedule and undertaking a redevelopment project at John F. Kennedy

International Airport (“JFK”) to facilitate convenient connections for our passengers and improve coordination with our SkyTeam alliance

partners. Prior to beginning the redevelopment project, we primarily operated domestic flights out of Terminal 2 and international flights out of

Terminal 3 under leases with the Port Authority of New York and New Jersey (“Port Authority”), which operates JFK. Our redevelopment

project, which began in 2010, is on schedule. Terminal 4 is operated by JFK International Air Terminal LLC (“IAT”), a private party, under its

lease with the Port Authority. We have constructed nine new international gates in Terminal 4, which opened in 2013. We have relocated our

operations from Terminal 3 to our newly constructed facilities at Terminal 4 and have begun the demolition of Terminal 3. During 2013, we

announced plans for an additional $180 million expansion project that will add 11 more gates at Terminal 4. With the expansion project, we will

relocate our regional jet operations from Terminal 2 to Terminal 4.

69

Effective Portion Reclassified from AOCI to

Earnings

Effective Portion Recognized in Other

Comprehensive Income (Loss)

Year Ended December 31,

(in millions) 2013 2012 2011

2013 2012 2011

Fuel hedge contracts

$

—

$

15

$

233

$

—

$

(

15

)

$

(166

)

Interest rate contracts

—

(

5

)

—

28

14

(8

)

Foreign currency exchange contracts

135

(25

)

(61

)

133

212

7

Total designated

$

135

$

(15

)

$

172

$

161

$

211

$

(167

)