Delta Airlines 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

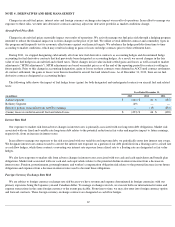

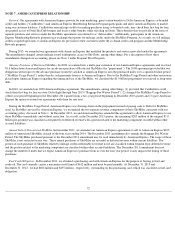

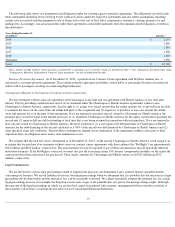

In December 2010, the Port Authority issued approximately $800 million principal amount of special project bonds to fund the substantial

majority of the project. Also in December 2010, we entered into a 33 year agreement with IAT (“Sublease”) to sublease space in Terminal 4.

IAT is unconditionally obligated under its lease with the Port Authority to pay rentals from the revenues it receives from its operation and

management of Terminal 4, including among others our rental payments under the Sublease, in an amount sufficient to pay principal and interest

on the bonds. We do not guarantee payment of the bonds. The balance of the project costs will be provided by Port Authority passenger facility

charges, Transportation Security Administration funding and our contributions. Our future rental payments will vary based on our share of total

passenger and baggage counts at Terminal 4, the number of gates we occupy in Terminal 4, IAT's actual expenses of operating Terminal 4 and

other factors.

We are responsible for the management and construction of the project and bear construction risk, including cost overruns. We record an

asset for project costs as construction takes place, regardless of funding source. These costs include design fees, labor and construction permits,

as well as physical construction costs such as paving, systems, utilities and other costs generally associated with construction projects. The

project will also include capitalized interest based on amounts we spend calculated based on our weighted average incremental borrowing rate.

The related construction obligation is recorded as a liability and is equal to project costs funded by parties other than us. Future rental payments

will reduce the construction obligation and result in the recording of interest expense, calculated using the effective interest method. During the

construction period, we are also incurring costs for construction site ground rental expense and remediation and abatement activities, which are

expensed as incurred. As of December 31, 2013 , we have recorded $675 million as a fixed asset as if we owned the asset and $646 million as

the related construction obligation.

We have an equity-method investment in the entity which owns IAT, our sublessor at Terminal 4. The Sublease requires us to pay certain

fixed management fees. We determined the investment is a variable interest and assessed whether we have a controlling financial interest in IAT.

Our rights under the Sublease with respect to management of Terminal 4 are consistent with rights granted to an anchor tenant under a standard

airport lease. Accordingly, we do not consolidate the entity in which we have an investment in our Consolidated Financial Statements.

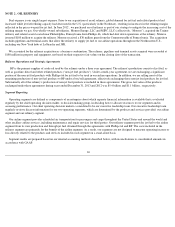

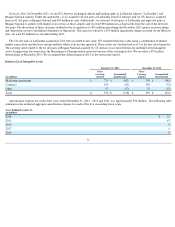

NOTE 6 . INTANGIBLE ASSETS

Indefinite

-Lived Intangible Assets

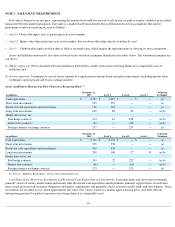

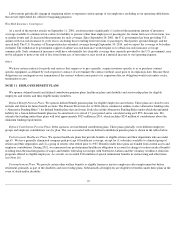

International Routes and Slots. Our remaining international routes and slots primarily relate to the Pacific region. The U.S. and Japan have a

bilateral agreement that allows U.S. air carriers unlimited flying to and from Japan under route authorities granted by the U.S. Department of

Transportation. Access to the primary Japanese airports (Haneda and Narita airports in Tokyo) is regulated through allocations of slots, which

limit the rights of carriers to operate at these airports. The U.S. and Japan have agreed on plans for a limited number of additional slots at these

airports. The substantial number of slots we hold at Tokyo Narita Airport, combined with limited-

entry rights we hold in other countries, enables

us to operate a hub at Tokyo serving the Asia-Pacific region. We currently believe that the current U.S.-

Japan bilateral agreement will not have a

significant long-term impact on our Pacific routes and slots; therefore, these assets continue to have an indefinite life and are not presently

impaired.

Negative changes to our operations could result in an impairment charge or a change from indefinite-lived to definite-lived in the period in

which the changes occur or are projected to occur.

70

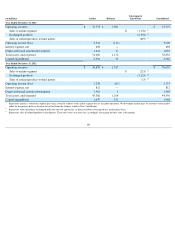

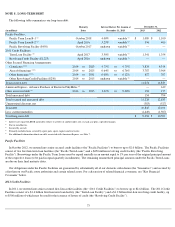

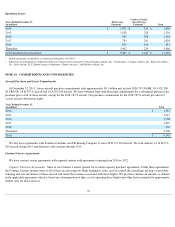

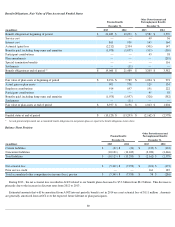

Carrying Amount at December 31,

(in millions) 2013 2012

International routes and slots

$

2,287

$

2,240

Delta tradename

850

850

SkyTeam related assets

661

661

Domestic slots

622

622

Total

$

4,420

$

4,373