Delta Airlines 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

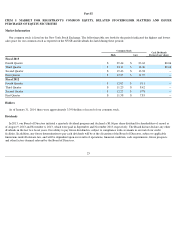

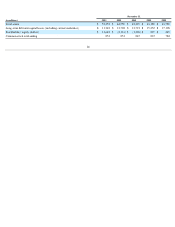

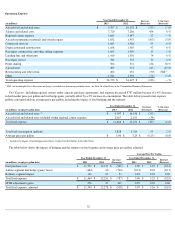

In May 2013, we announced a plan to return more than $1 billion to shareholders over the next three years. As part of this plan, our Board of

Directors initiated a quarterly dividend program and declared a $0.06 per share dividend for shareholders of record as of August 9, 2013 and

November 6, 2013. These dividends were paid in

September 2013 and November 2013 and each totaled $51 million . In addition, the Board of

Directors authorized a $500 million share repurchase program, to be completed no later than June 30, 2016 . During 2013 , we repurchased and

retired approximately 10 million shares at a cost of approximately $250 million . On February 7, 2014, our Board of Directors declared a $0.06

dividend for shareholders of record on February 21, 2014 and payable on March 14, 2014.

Network Strategy

We are implementing several strategies that are designed to strengthen and expand our global network and presence. These include our

investment in and joint venture with Virgin Atlantic, improvements at our hubs at LaGuardia and JFK in New York and the creation of an

international gateway in Seattle.

Virgin Atlantic Investment. In 2013, we purchased a 49% interest in Virgin Atlantic from Singapore Airlines for $360 million. We also

entered into an agreement with Virgin Atlantic with respect to operations on non-stop routes between the United Kingdom and North America.

In September 2013, the U.S. Department of Transportation granted antitrust immunity on these routes.The antitrust immunized relationship

allows for joint marketing and sales, coordinated pricing and revenue management, network planning and scheduling with respect to operations

on routes between North America and the United Kingdom. Virgin Atlantic has a significant presence at London's Heathrow airport, the airport

of choice for business travelers traveling to and from London. Along with our state of the art facility at JFK, we believe our relationship with

Virgin Atlantic will provide our customers with superior service and connectivity between New York and London. Beginning January 1, 2014,

we began working under the immunized relationship and published our first coordinated schedule that becomes effective April 2014.

LaGuardia. During December 2011, we closed transactions with US Airways in which we received takeoff and landing rights (each a "slot

pair") at LaGuardia in exchange for slot pairs at Reagan National. This exchange allowed us to create a new domestic hub at LaGuardia. We

have increased capacity at LaGuardia by approximately 50% since March 2012, adding 123 new flights and a total of 31 new destinations. We

currently operate about 277 daily flights between LaGuardia and 65 cities, more than any other airline.

We are investing approximately $200 million in a renovation and expansion project at LaGuardia to enhance the customer experience. In

2012, we opened the connector linking Terminals C and D and a new SkyClub in Terminal C. We are also expanding security lanes and a

baggage handling system in both terminals as well as an enhanced SkyClub in Terminal D.

JFK. While our expanded LaGuardia schedule is focused on providing industry-

leading domestic service, we are optimizing our international

and trans-continental flight schedule and undertaking a redevelopment project at JFK to facilitate convenient connections for our passengers and

improve coordination with our SkyTeam alliance partners. Prior to beginning the redevelopment project, we primarily operated domestic flights

out of Terminal 2 and international flights out of Terminal 3. Our initial five-year project to expand and enhance Terminal 4, which began in

2010, is on schedule. We have constructed nine new international gates in Terminal 4, which opened in 2013. We have relocated our operations

from Terminal 3 to our newly constructed facilities at Terminal 4 and have begun the demolition of Terminal 3. During 2013, we announced

plans for an additional $180 million expansion project that will add 11 more gates at Terminal 4. With the additional expansion, we will relocate

our regional jet operations from Terminal 2 to Terminal 4. We expect that passengers will benefit from an enhanced customer experience and

improved operational performance, including reduced taxi times and better on-time performance.

Seattle International Gateway Expansion. Seattle is one of Delta’s fastest-growing international gateways. We have recently expanded

service in Seattle, with additional frequencies and destinations, both domestically and internationally. We have invested in our facilities,

including a renovated lobby, a new Delta SkyClub and many other customer enhancements. By expanding in Seattle, we will have improved

service for our local customers and increased connection into Asia.

Maintaining Cost Performance

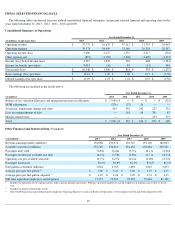

Beginning in 2012, we implemented a cost initiatives program, which is expected to stem the rate of cost growth to less than 2% cost

inflation annually. These initiatives are designed to improve our cost efficiency while maintaining our operational performance and revenue

generation. An important component is the fleet restructuring initiative to retire older, less efficient aircraft from our fleet.

28