Delta Airlines 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

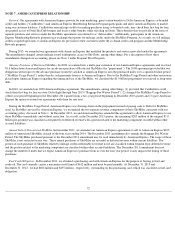

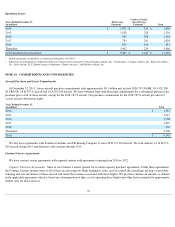

Labor unions periodically engage in organizing efforts to represent various groups of our employees, including at our operating subsidiaries,

that are not represented for collective bargaining purposes.

War-Risk Insurance Contingency

As a result of the terrorist attacks on September 11, 2001, aviation insurers significantly (1) reduced the maximum amount of insurance

coverage available to commercial air carriers for liability to persons (other than employees or passengers) for claims from acts of terrorism, war

or similar events and (2) increased the premiums for such coverage. Since September 24, 2001, the U.S. government has been providing U.S.

airlines with war-risk insurance to cover losses, including those resulting from terrorism, to passengers, third parties (ground damage) and the

aircraft hull. The U.S. Secretary of Transportation has extended coverage through September 30, 2014, and we expect the coverage to be further

extended. The withdrawal of government support of airline war-risk insurance would require us to obtain war-risk insurance coverage

commercially. Such commercial insurance could have substantially less desirable coverage than currently provided by the U.S. government, may

not be adequate to protect our risk of loss from future acts of terrorism or, may result in a material increase to our operating expense.

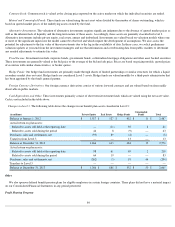

Other

We have certain contracts for goods and services that require us to pay a penalty, acquire inventory specific to us or purchase contract

specific equipment, as defined by each respective contract, if we terminate the contract without cause prior to its expiration date. Because these

obligations are contingent on our termination of the contract without cause prior to its expiration date, no obligation would exist unless such a

termination occurs.

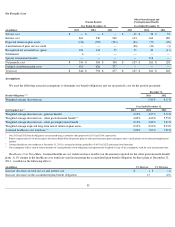

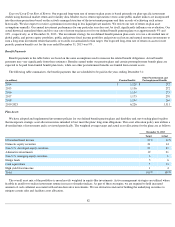

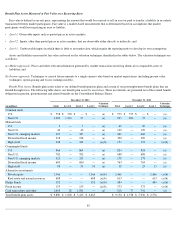

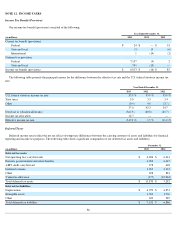

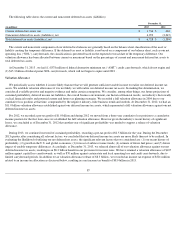

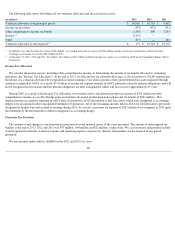

NOTE 11 . EMPLOYEE BENEFIT PLANS

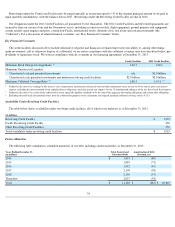

We sponsor defined benefit and defined contribution pension plans, healthcare plans and disability and survivorship plans for eligible

employees and retirees and their eligible family members.

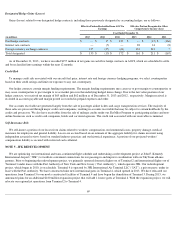

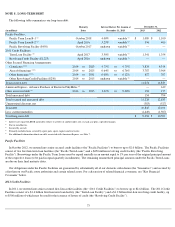

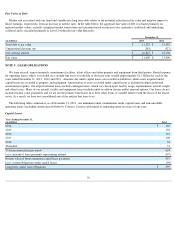

Defined Benefit Pension Plans. We sponsor defined benefit pension plans for eligible employees and retirees. These plans are closed to new

entrants and frozen for future benefit accruals. The Pension Protection Act of 2006 allows commercial airlines to elect alternative funding rules

(“Alternative Funding Rules”) for defined benefit plans that are frozen. Delta elected the Alternative Funding Rules under which the unfunded

liability for a frozen defined benefit plan may be amortized over a fixed 17-year period and is calculated using an 8.85% discount rate. We

estimate the funding under these plans will total approximately $925 million in 2014, which includes $250 million of contributions above the

minimum funding requirements.

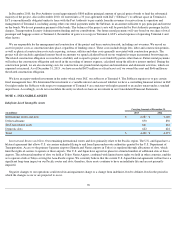

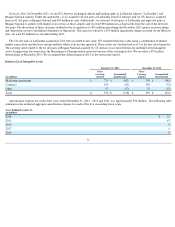

Defined Contribution Pension Plans. Delta sponsors several defined contribution plans. These plans generally cover different employee

groups and employer contributions vary by plan. The cost associated with our defined contribution pension plans is shown in the tables below.

Postretirement Healthcare Plans. We sponsor healthcare plans that provide benefits to eligible retirees and their dependents who are under

age 65 . We have generally eliminated company-paid post age 65 healthcare coverage, except for (1) subsidies available to a limited group of

retirees and their dependents and (2) a group of retirees who retired prior to 1987. Benefits under these plans are funded from current assets and

employee contributions. During 2012, we remeasured our postretirement healthcare obligation to account for changes to retiree medical benefits

resulting from the final integration of wages and benefits following our merger with Northwest Airlines and the voluntary workforce reduction

programs offered to eligible employees. As a result, we recorded $116 million of special termination benefits in restructuring and other items

(see Note 16).

Postemployment Plans. We provide certain other welfare benefits to eligible former or inactive employees after employment but before

retirement, primarily as part of the disability and survivorship plans. Substantially all employees are eligible for benefits under these plans in the

event of death and/or disability.

79