Delta Airlines 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

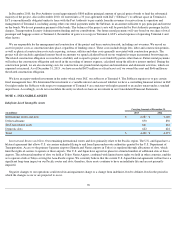

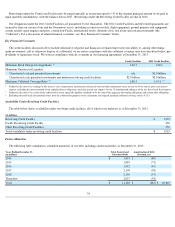

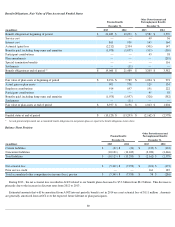

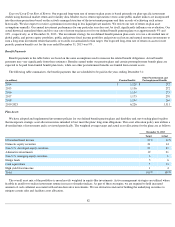

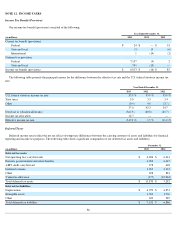

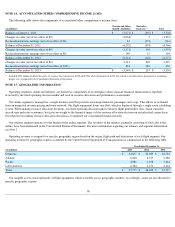

Benefit Obligations, Fair Value of Plan Assets and Funded Status

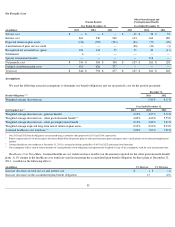

Balance Sheet Position

During 2013 , the net actuarial loss recorded in AOCI related to our benefit plans decreased to $5.3 billion from $8.2 billion

. This decrease is

primarily due to the increase in discount rates from 2012 to 2013 .

Estimated amounts that will be amortized from AOCI into net periodic benefit cost in 2014 are a net actuarial loss of $111 million . Amounts

are generally amortized from AOCI over the expected future lifetime of plan participants.

80

Pension Benefits

Other Postretirement and

Postemployment Benefits

December 31,

December 31,

(in millions) 2013 2012

2013 2012

Benefit obligation at beginning of period

$

21,489

$

19,293

$

3,582

$

3,570

Service cost

—

—

49

56

Interest cost

861

930

143

164

Actuarial (gain) loss

(2,212

)

2,334

(301

)

147

Benefits paid, including lump sums and annuities

(1,078

)

(1,057

)

(313

)

(310

)

Participant contributions

—

—

45

58

Plan amendments

—

—

—

(

219

)

Special termination benefits

—

—

—

116

Settlements

—

(

11

)

—

—

Benefit obligation at end of period

(1)

$

19,060

$

21,489

$

3,205

$

3,582

Fair value of plan assets at beginning of period

$

8,196

$

7,789

$

1,004

$

972

Actual gain on plan assets

905

778

129

134

Employer contributions

914

697

191

222

Participant contributions

—

—

45

58

Benefits paid, including lump sums and annuities

(1,078

)

(1,057

)

(326

)

(382

)

Settlements

—

(

11

)

—

—

Fair value of plan assets at end of period

$

8,937

$

8,196

$

1,043

$

1,004

Funded status at end of period

$

(10,123

)

$

(13,293

)

$

(2,162

)

$

(2,578

)

(1)

At each period-

end presented, our accumulated benefit obligations for our pension plans are equal to the benefit obligations shown above.

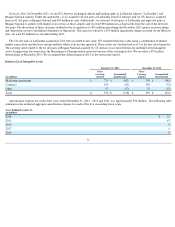

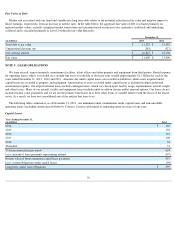

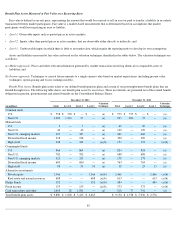

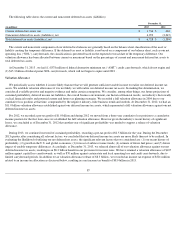

Pension Benefits Other Postretirement and

Postemployment Benefits

December 31, December 31,

(in millions) 2013 2012 2013 2012

Current liabilities

$

(22

)

$

(24

)

$

(139

)

$

(132

)

Noncurrent liabilities

(10,101

)

(13,269

)

(2,023

)

(2,446

)

Total liabilities

$

(10,123

)

$

(13,293

)

$

(2,162

)

$

(2,578

)

Net actuarial loss

$

(5,349

)

$

(7,958

)

$

(103

)

$

(473

)

Prior service credit

—

—

161

187

Total accumulated other comprehensive income (loss), pre-tax

$

(5,349

)

$

(7,958

)

$

58

$

(286

)