Delta Airlines 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

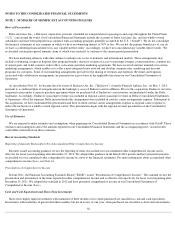

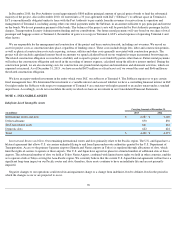

NOTE 2 . OIL REFINERY

Fuel expense is our single largest expense. Prior to our acquisition of an oil refinery, global demand for jet fuel and related products had

increased while jet fuel refining capacity had decreased in the U.S. (particularly in the Northeast), resulting in increases in the refining margin

reflected in the prices we paid for jet fuel. In June 2012

, we purchased an oil refinery as part of our strategy to mitigate the increasing cost of the

refining margin we pay. Our wholly-owned subsidiaries, Monroe Energy, LLC and MIPC, LLC (collectively, “Monroe”), acquired the Trainer

refinery and related assets located near Philadelphia, Pennsylvania from Phillips 66, which had shut down operations at the refinery. Monroe

invested $180 million to acquire the refinery. Monroe received a $30 million grant from the Commonwealth of Pennsylvania. The acquisition

includes pipelines and terminal assets that allow the refinery to supply jet fuel to our airline operations throughout the Northeastern U.S.,

including our New York hubs at LaGuardia and JFK.

We accounted for the refinery acquisition as a business combination. The refinery, pipelines and terminal assets acquired were recorded at

$180 million in property and equipment, net based on their respective fair values on the closing date of the transaction.

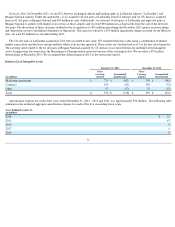

Refinery Operations and Strategic Agreements

BP is the primary supplier of crude oil used by the refinery under a three year agreement. The refinery's production consists of jet fuel, as

well as gasoline, diesel and other refined products ("non-jet fuel products"). Under a multi-year agreement, we are exchanging a significant

portion of the non-jet fuel products with Phillips 66 for jet fuel to be used in our airline operations. In addition, we are selling most of the

remaining production of non-jet fuel products to BP under a buy/sell agreement, effectively exchanging those non-jet fuel products for jet fuel.

Substantially all of the refinery's production of non-jet fuel products is included in these agreements. The gross fair value of the products

exchanged under these agreements during years ended December 31, 2013 and 2012 was $5.4 billion and $1.1 billion , respectively.

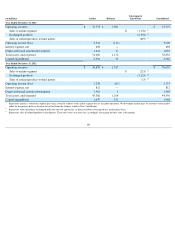

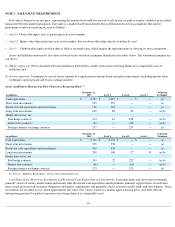

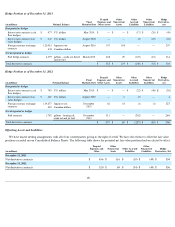

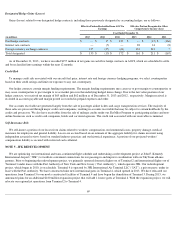

Segment Reporting

Operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated

regularly by the chief operating decision maker, or decision making group, in deciding how to allocate resources to our segments and in

assessing performance. Our chief operating decision maker is considered to be our executive leadership team. Our executive leadership team

regularly reviews discrete information for our two operating segments, which are determined by the products and services provided: our airline

segment and our refinery segment.

Our airline segment provides scheduled air transportation for passengers and cargo throughout the United States and around the world and

other ancillary airline services, including maintenance and repair services for third parties. Our refinery segment provides jet fuel to the airline

segment from its own production and through jet fuel obtained through the agreements with Phillips 66 and BP. The costs included in the

refinery segment are primarily for the benefit of the airline segment. As a result, our segments are not designed to measure operating income or

loss directly related to the products and services included in each segment on a stand-alone basis.

Segment results are prepared based on our internal accounting methods described below, with reconciliations to consolidated amounts in

accordance with GAAP.

63