Delta Airlines 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

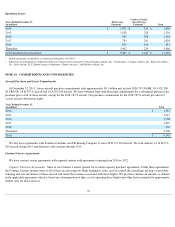

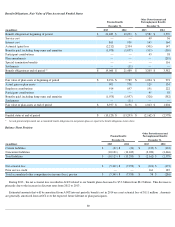

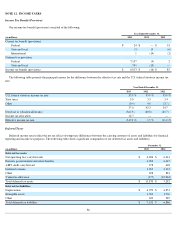

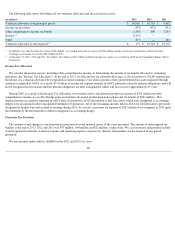

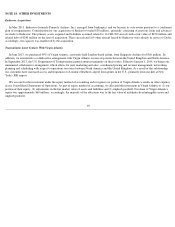

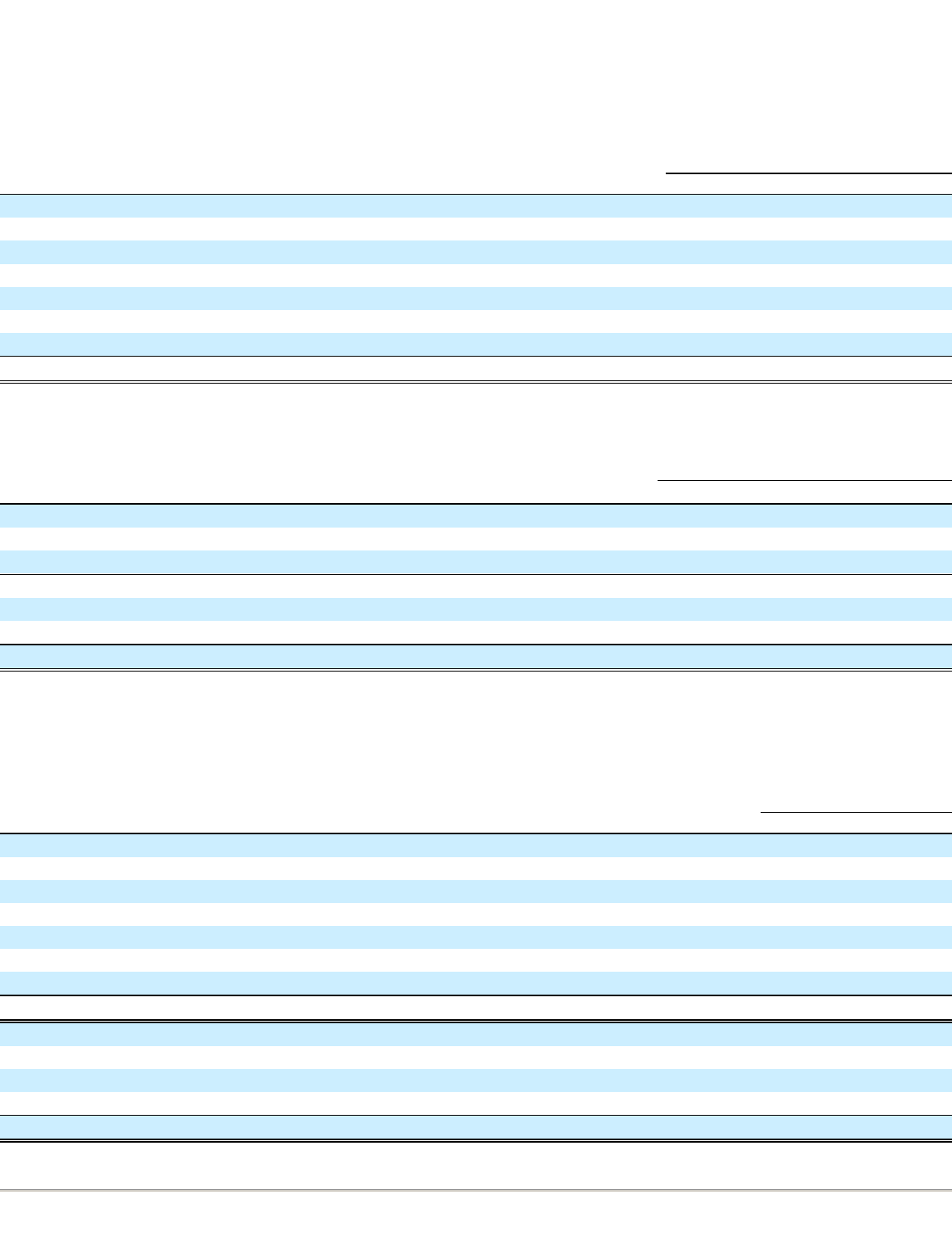

NOTE 12 . INCOME TAXES

Income Tax Benefit (Provision)

Our income tax benefit (provision) consisted of the following:

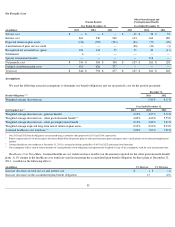

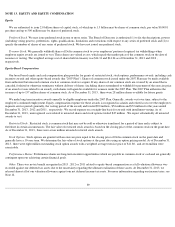

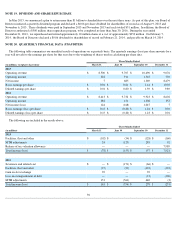

The following table presents the principal reasons for the difference between the effective tax rate and the U.S. federal statutory income tax

rate:

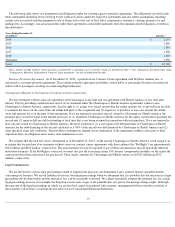

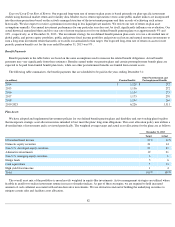

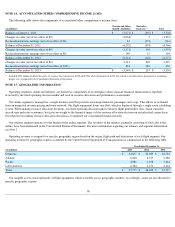

Deferred Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial

reporting and income tax purposes. The following table shows significant components of our deferred tax assets and liabilities:

86

Year Ended December 31,

(in millions) 2013 2012 2011

Current tax benefit (provision):

Federal

$

24

$

—

$

91

State and local

(3

)

15

(6

)

International

1

(14

)

(2

)

Deferred tax provision:

Federal

7,197

(4

)

2

State and local

794

(13

)

—

Income tax benefit (provision)

$

8,013

$

(16

)

$

85

Year Ended December 31,

2013 2012 2011

U.S. federal statutory income tax rate

35.0

%

35.0

%

35.0

%

State taxes

3.0

3.3

3.4

Other

(0.4

)

4.0

(3.7

)

37.6

42.3

34.7

Decrease in valuation allowance

(367.5

)

(40.8

)

(45.7

)

Income tax allocation

12.7

—

—

Effective income tax rate

(317.2

)%

1.5

%

(11.0

)%

December 31,

(in millions) 2013 2012

Deferred tax assets:

Net operating loss carryforwards

$

6,024

$

6,414

Pension, postretirement and other benefits

4,982

6,415

AMT credit carryforward

378

402

Deferred revenue

1,965

2,133

Other

698

881

Valuation allowance

(177

)

(10,963

)

Total deferred tax assets

$

13,870

$

5,282

Deferred tax liabilities:

Depreciation

$

4,799

$

4,851

Intangible assets

1,704

1,730

Other

639

285

Total deferred tax liabilities

$

7,142

$

6,866