Delta Airlines 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

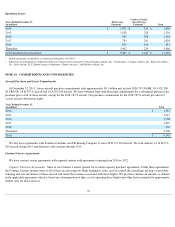

Domestic Slots. In December 2011, we and US Airways exchanged takeoff and landing rights at LaGuardia Airport ("LaGuardia") and

Reagan National airports. Under the agreement, (1) we acquired 132 slot pairs at LaGuardia from US Airways and (2) US Airways acquired

from us 42 slot pairs at Reagan National and $67 million in cash. Additionally, we divested 16 slot pairs at LaGuardia and eight slot pairs at

Reagan National to airlines with limited or no service at those airports and received $90 million in cash proceeds from the sale of the divested

slot pairs. The divestiture of these slot pairs resulted in the recognition of a $43 million gain during the December 2011 quarter in restructuring

and other items on our Consolidated Statement of Operations. This gain was offset by a $50 million

impairment charge recorded on our Moscow

slots, for a net $7 million loss recorded during 2011.

The 132 slot pairs at LaGuardia acquired in 2011 were recorded at fair value. We estimated their fair value using a combination of limited

market transactions and the lease savings method, which is an income approach. These assets are classified in Level 3 of the fair value hierarchy.

The carrying value related to the 42 slot pairs at Reagan National acquired by US Airways was removed from our indefinite-lived intangible

assets. In approving the transaction, the Department of Transportation restricted our use of the exchanged slots. We recorded a $78 million

deferred gain in December 2011. We recognized this deferred gain in 2012 as the restrictions lapsed.

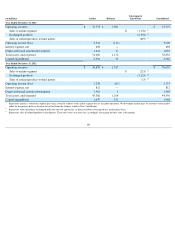

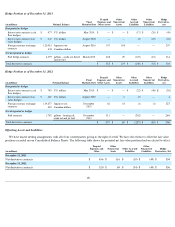

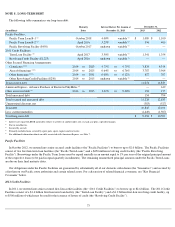

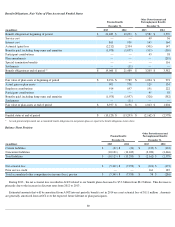

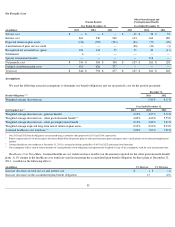

Definite

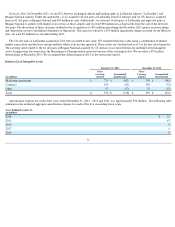

-Lived Intangible Assets

Amortization expense for each of the years ended December 31, 2013 , 2012 and 2011 was approximately $70 million

. The following table

summarizes the estimated aggregate amortization expense for each of the five succeeding fiscal years:

71

December 31, 2013

December 31, 2012

(in millions)

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Marketing agreements

$

730

$

(602

)

$

730

$

(545

)

Contracts

193

(83

)

193

(72

)

Other

53

(53

)

53

(53

)

Total

$

976

$

(738

)

$

976

$

(670

)

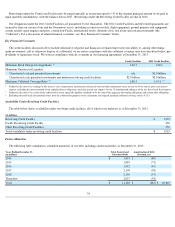

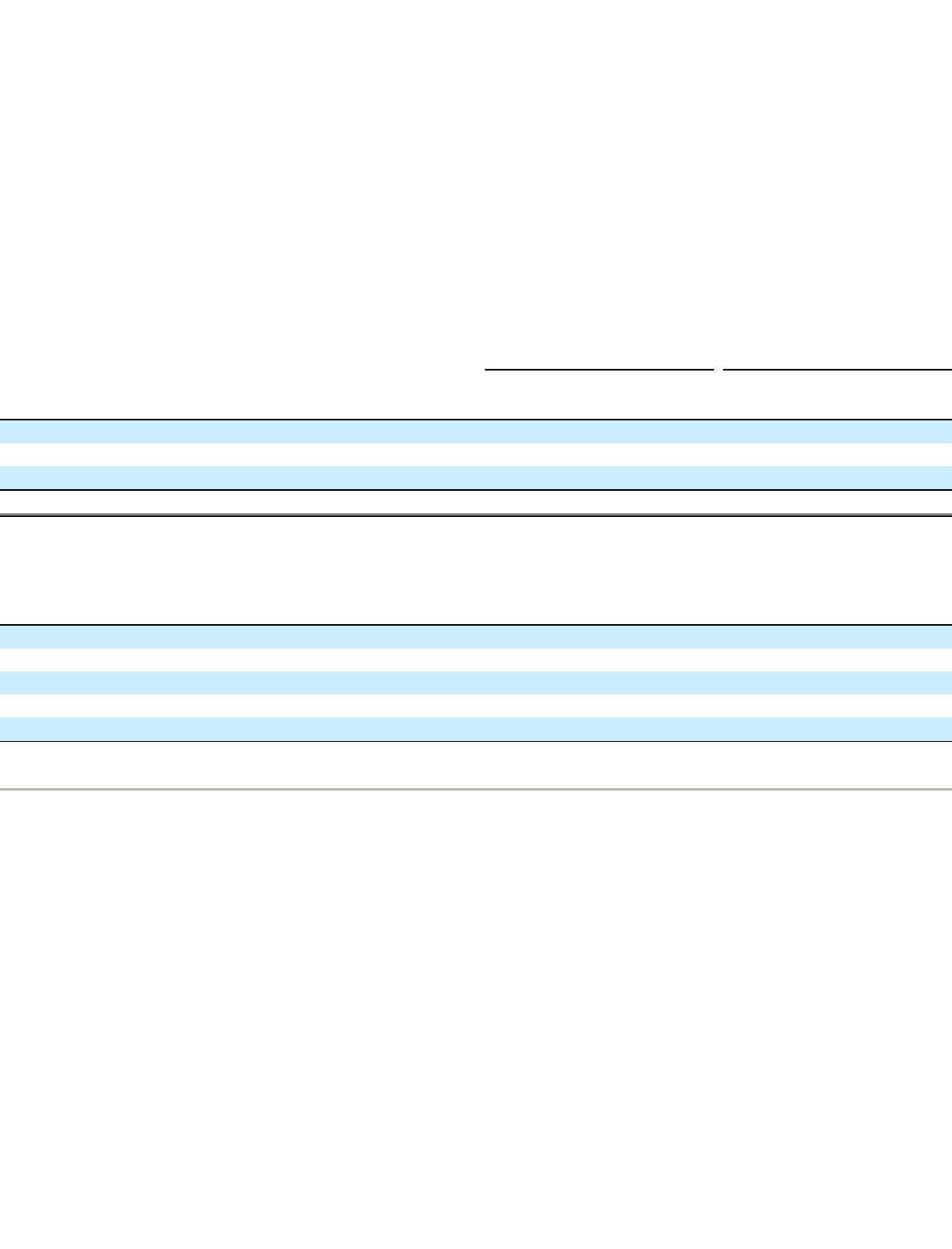

Years Ending December 31,

(in millions)

2014

$

67

2015

67

2016

9

2017

9

2018

8