Delta Airlines 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 . SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

Delta Air Lines, Inc., a Delaware corporation, provides scheduled air transportation for passengers and cargo throughout the United States

(“U.S.”) and around the world. Our Consolidated Financial Statements include the accounts of Delta Air Lines, Inc. and our wholly-owned

subsidiaries and have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”). We do not consolidate

the financial statements of any company in which we have an ownership interest of 50% or less. We are not the primary beneficiary of, nor do

we have a controlling financial interest in, any variable interest entity. Accordingly, we have not consolidated any variable interest entity. We

reclassified certain prior period amounts, none of which were material, to conform to the current period presentation.

We have marketing alliances with other airlines to enhance our access to domestic and international markets. These arrangements may

include codesharing, reciprocal frequent flyer program benefits, shared or reciprocal access to passenger lounges, joint promotions, common use

of airport gates and ticket counters, ticket office co-location and other marketing agreements. We have received antitrust immunity for certain

marketing arrangements, which enables us to offer a more integrated route network and develop common sales, marketing and discount

programs for customers. Some of our marketing arrangements provide for the sharing of revenues and expenses. Revenues and expenses

associated with collaborative arrangements are presented on a gross basis in the applicable line items on our Consolidated Statements of

Operations.

As described in Note 18 , we became the sole owner of Endeavor Air, Inc. ("Endeavor"), formerly Pinnacle Airlines, Inc., on May 1, 2013,

pursuant to a confirmed plan of reorganization in the bankruptcy cases of Endeavor and its affiliates. Prior to this acquisition, Endeavor served as

a regional carrier under a capacity purchase agreement where we purchased all of Endeavor's seat inventory and marketed it under the Delta

tradename. Accordingly, Endeavor's passenger revenue was included in regional carriers passenger revenue in Delta's Consolidated Statements

of Operations. All of the expenses Delta incurred under this arrangement were included in contract carrier arrangements expense. Subsequent to

this acquisition, we have maintained this presentation and have re-titled contract carrier arrangements expense as regional carrier expense to

reflect the inclusion of a wholly-owned regional carrier. This presentation aligns with the regional revenue presentation on the Consolidated

Statements of Operations.

Use of Estimates

We are required to make estimates and assumptions when preparing our Consolidated Financial Statements in accordance with GAAP. These

estimates and assumptions affect the amounts reported in our Consolidated Financial Statements and the accompanying notes. Actual results

could differ materially from those estimates.

Recent Accounting Standards

Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income

Recently issued accounting guidance revises the reporting of items reclassified out of accumulated other comprehensive income and is

effective for fiscal years beginning after December 15, 2012. We adopted this guidance in the March 2013 quarter and have presented amounts

reclassified out of accumulated other comprehensive income in a note to the financial statements. For more information about accumulated other

comprehensive income (loss), see Note 14.

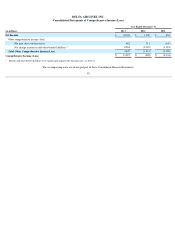

Presentation of Comprehensive Income

In June 2011, the Financial Accounting Standards Board ("FASB") issued "Presentation of Comprehensive Income." The standard revises the

presentation and prominence of the items reported in other comprehensive income and is effective retrospectively for fiscal years beginning after

December 15, 2011. We adopted this standard in 2012 and have presented comprehensive income in our Consolidated Statements of

Comprehensive Income (Loss).

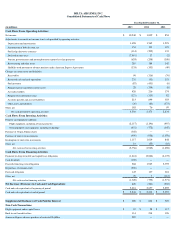

Cash and Cash Equivalents and Short-Term Investments

Short-term, highly liquid investments with maturities of three months or less when purchased are classified as cash and cash equivalents.

Investments with maturities of greater than three months, but not in excess of one year, when purchased are classified as short-term investments.

56