Delta Airlines 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

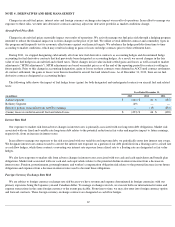

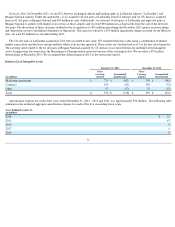

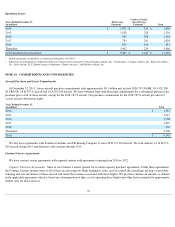

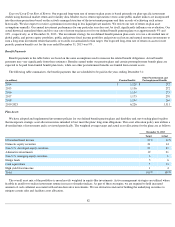

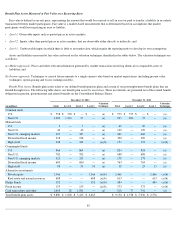

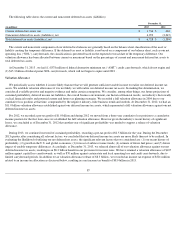

The following table shows our minimum fixed obligations under our existing capacity purchase agreements. The obligations set forth in the

table contemplate minimum levels of flying by the Contract Carriers under the respective agreements and also reflect assumptions regarding

certain costs associated with the minimum levels of flying such as the cost of fuel, labor, maintenance, insurance, catering, property tax and

landing fees. Accordingly, our actual payments under these agreements could differ materially from the minimum fixed obligations set forth in

the table below.

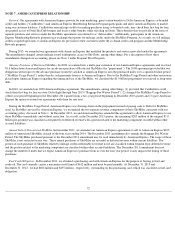

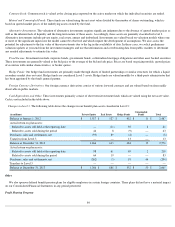

Revenue Proration Agreement . As of December 31, 2013 , a portion of our Contract Carrier agreement with SkyWest Airlines, Inc. is

structured as a revenue proration agreement. This revenue proration agreement establishes a fixed dollar or percentage division of revenues for

tickets sold to passengers traveling on connecting flight itineraries.

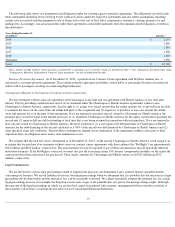

Contingencies Related to Termination of Contract Carrier Agreements

We may terminate without cause our agreement with Chautauqua at any time and our agreement with Shuttle America at any time after

January 2016 by providing certain advance notice. If we terminate either the Chautauqua or Shuttle America agreements without cause,

Chautauqua or Shuttle America, respectively, has the right to (1) assign to us leased aircraft that the airline operates for us, provided we are able

to continue the leases on the same terms the airline had prior to the assignment and (2) require us to purchase or lease any aircraft the airline

owns and operates for us at the time of the termination. If we are required to purchase aircraft owned by Chautauqua or Shuttle America, the

purchase price would be equal to the amount necessary to (1) reimburse Chautauqua or Shuttle America for the equity it provided to purchase the

aircraft and (2) repay in full any debt outstanding at such time that is not being assumed in connection with such purchase. If we are required to

lease aircraft owned by Chautauqua or Shuttle America, the lease would have (1) a rate equal to the debt payments of Chautauqua or Shuttle

America for the debt financing of the aircraft calculated as if 90% of the aircraft was debt financed by Chautauqua or Shuttle America and (2)

other specified terms and conditions . Because these contingencies depend on our termination of the agreements without cause prior to their

expiration dates, no obligation exists unless such termination occurs.

We estimate that the total fair values, determined as of December 31, 2013 , of the aircraft Chautauqua or Shuttle America could assign to us

or require that we purchase if we terminate without cause our contract carrier agreements with those airlines (the "Put Right") are approximately

$119 million and $294 million , respectively. The actual amount we may be required to pay in these circumstances may be materially different

from these estimates. If the Put Right is exercised, we must also pay the exercising carrier 10% interest (compounded monthly) on the equity the

carrier provided when it purchased the put aircraft. These equity amounts for Chautauqua and Shuttle America total $25 million and $52

million , respectively.

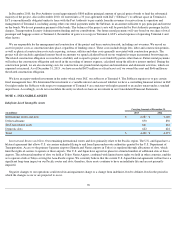

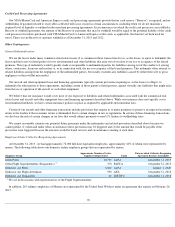

Legal Contingencies

We are involved in various legal proceedings related to employment practices, environmental issues, antitrust matters and other matters

concerning our business. We record liabilities for losses from legal proceedings when we determine that it is probable that the outcome in a legal

proceeding will be unfavorable and the amount of loss can be reasonably estimated. We cannot reasonably estimate the potential loss for certain

legal proceedings because, for example, the litigation is in its early stages or the plaintiff does not specify the damages being sought. Although

the outcome of the legal proceedings in which we are involved cannot be predicted with certainty, management believes that the resolution of

these matters will not have a material adverse effect on our Consolidated Financial Statements.

77

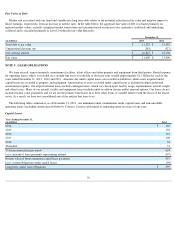

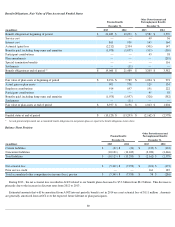

Years Ending December 31,

(in millions) Amount

(1)

2014

$

2,110

2015

2,040

2016

1,780

2017

1,560

2018

1,320

Thereafter

1,930

Total

$

10,740

(1)

These amounts exclude Contract Carrier payments accounted for as operating leases of aircraft, which are described in Note 9. The contingencies described below under

“Contingencies Related to Termination of Contract Carrier Agreements” are also excluded from this table.