Delta Airlines 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

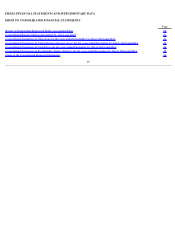

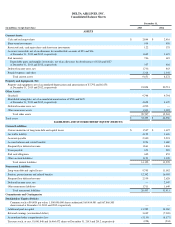

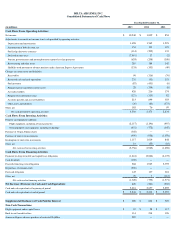

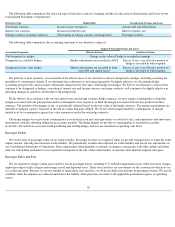

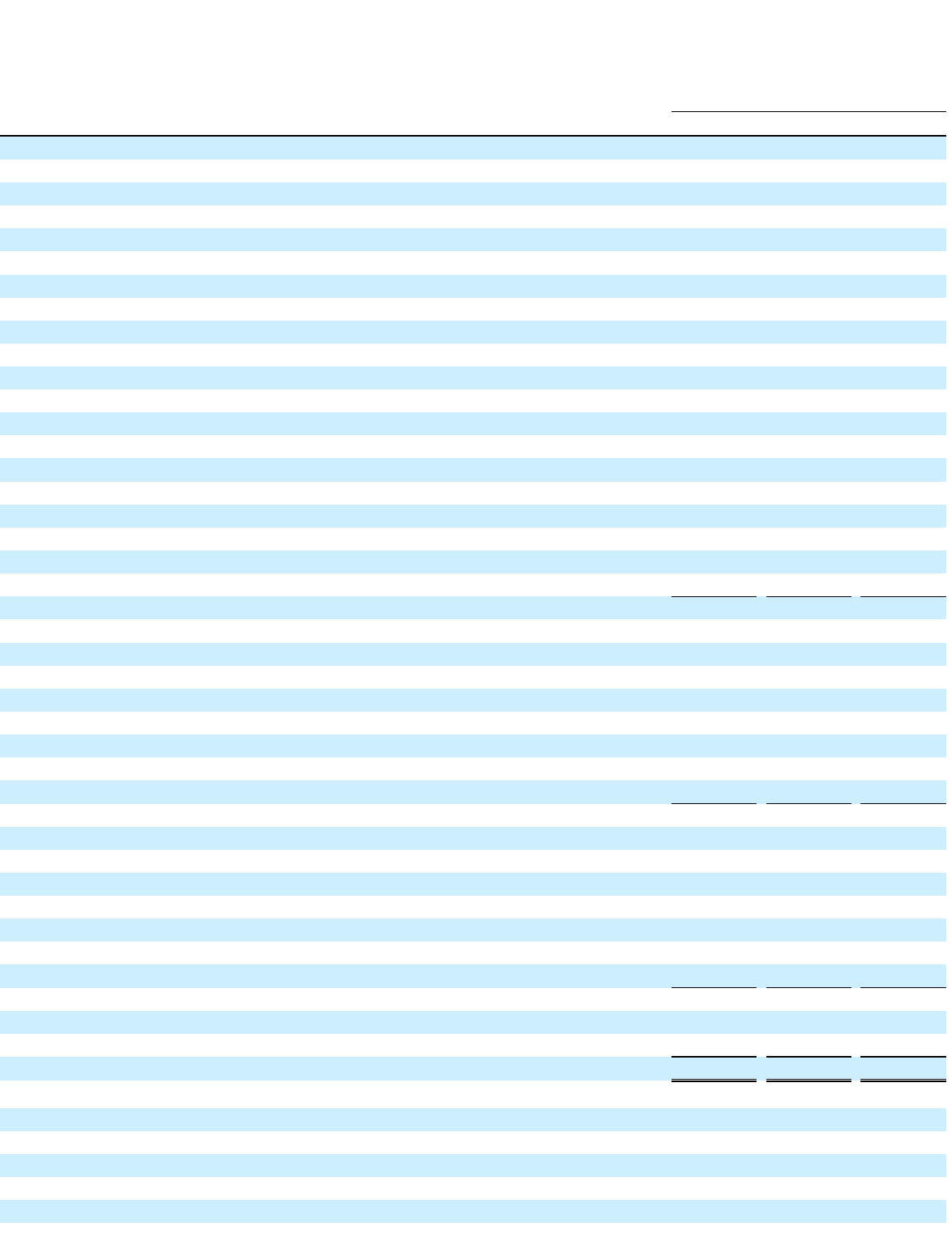

DELTA AIR LINES, INC.

Consolidated Statements of Cash Flows

Year Ended December 31,

(in millions) 2013

2012

2011

Cash Flows From Operating Activities:

Net income

$

10,540

$

1,009

$

854

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization

1,658

1,565

1,523

Amortization of debt discount, net

154

193

193

Fuel hedge derivative contracts

(114

)

(209

)

135

Deferred income taxes

(7,991

)

17

(2

)

Pension, postretirement and postemployment expense less than payments

(624

)

(208

)

(308

)

Restructuring and other items

285

184

142

SkyMiles used pursuant to advance purchase under American Express Agreements

(333

)

(333

)

(49

)

Changes in certain assets and liabilities:

Receivables

90

(116

)

(76

)

Restricted cash and cash equivalents

231

(51

)

153

Fuel inventory

(87

)

(451

)

(8

)

Prepaid expenses and other current assets

28

(134

)

(8

)

Air traffic liability

426

216

174

Frequent flyer deferred revenue

(121

)

(115

)

82

Accounts payable and accrued liabilities

213

899

303

Other assets and liabilities

(36

)

(66

)

(373

)

Other, net

185

76

99

Net cash provided by operating activities

4,504

2,476

2,834

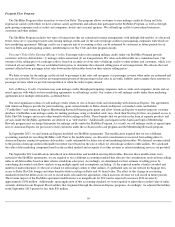

Cash Flows From Investing Activities:

Property and equipment additions:

Flight equipment, including advance payments

(2,117

)

(1,196

)

(907

)

Ground property and equipment, including technology

(451

)

(772

)

(347

)

Purchase of Virgin Atlantic shares

(360

)

—

—

Purchase of short-term investments

(959

)

(958

)

(1,078

)

Redemption of short-term investments

1,117

1,019

844

Other, net

14

(55

)

(10

)

Net cash used in investing activities

(2,756

)

(1,962

)

(1,498

)

Cash Flows From Financing Activities:

Payments on long-term debt and capital lease obligations

(1,461

)

(2,864

)

(4,172

)

Cash dividends

(102

)

—

—

Proceeds from long-term obligations

268

1,965

2,395

Repurchase of common stock

(250

)

—

—

Fuel card obligation

147

137

318

Other, net

78

7

(112

)

Net cash used in financing activities

(1,320

)

(755

)

(1,571

)

Net Increase (Decrease) in Cash and Cash Equivalents

428

(241

)

(235

)

Cash and cash equivalents at beginning of period

2,416

2,657

2,892

Cash and cash equivalents at end of period

$

2,844

$

2,416

$

2,657

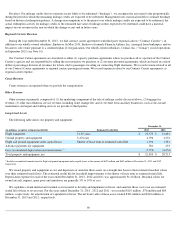

Supplemental Disclosure of Cash Paid for Interest

$

698

$

834

$

925

Non-Cash Transactions:

Flight equipment under capital leases

$

67

$

28

$

117

Built-to-suit leased facilities

114

214

126

American Express advance purchase of restricted SkyMiles

285

—

—