Delta Airlines 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

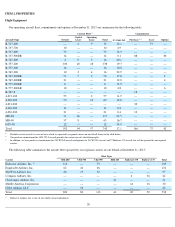

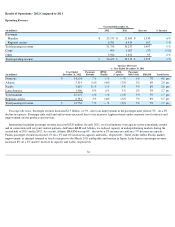

Fleet Restructuring

Fleet restructuring is an important component of our cost initiatives, and is focused on lowering unit costs while investing in our fleet to

enhance the customer experience. We are restructuring our domestic fleet by reducing our 50-seat regional flying and replacing other older, less

cost effective aircraft with newer, more efficient aircraft. Agreements with SkyWest Airlines, Inc. and Bombardier Aerospace, as well as our

acquisition of Endeavor, have produced a path for us to eliminate more than 200 50-seat aircraft. We are replacing these aircraft and older B-

757-200 aircraft with more efficient and customer preferred CRJ-900, B-717-200 and B-737-900ER aircraft.

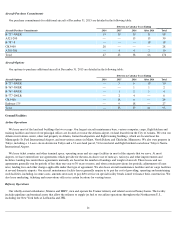

In addition, we entered into an agreement in September 2013 with Airbus to purchase 10 international capable widebody A330-300 and 30

large narrowbody A321-200 aircraft expected to serve domestic markets. Delivery of the first A330-300 aircraft is expected to occur in spring

2015, with three additional A330-300 aircraft expected to be delivered in 2015, four aircraft in 2016 and two in 2017. Delivery of three A321-

200 aircraft are scheduled for the first quarter of 2016, with 12 additional aircraft expected to be delivered later in 2016 and 15 in 2017.

As mentioned above, an important component of the fleet restructuring initiative is to reduce 50-seat CRJ aircraft, which are our least fuel

efficient aircraft and have the lowest customer satisfaction ratings. We are targeting a fleet size of 100 to 125 aircraft within the next two years.

Our current fleet includes aircraft we lease and aircraft that are operated for us by regional carriers that own or lease aircraft through third

parties. As part of the reduction, we will retire a significant portion of the fleet that is leased by us. We expect to continue to recognize material

restructuring charges, representing the remaining obligations under the leases, as we retire the leased aircraft. Although many factors could

change over the next two years, we currently estimate that future charges will be between $200 million to $300 million, in addition to the $107

million recorded in 2013. The timing and amount of these charges will depend on a number of factors, including our final negotiations with

lessors, the timing of removing aircraft from service and the ultimate disposition of aircraft included in the fleet restructuring program. Also, to

accelerate the restructuring of the fleet, we may park a portion of the fleet on a temporary basis until contracts for aircraft flying under contract

carrier agreements expire. The temporarily parked aircraft will be returned to service as aircraft flying under these expiring agreements exit the

fleet. We will continue to incur operating lease expense for these temporarily parked aircraft. As a result of restructuring the fleet, we expect to

benefit from improved operational and fuel efficiency, customer service and reduced future maintenance cost that we will experience over the

life of the new aircraft.

Fuel Expense, including refinery results

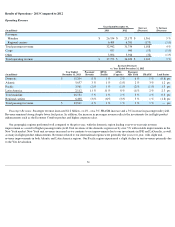

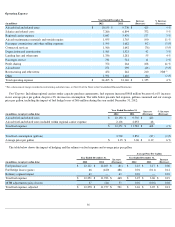

Fuel Expense. Fuel expense is our largest expense, representing 33% of total operating expenses. For 2013, our total fuel expense decreased

$787 million (including our regional carriers under capacity purchase agreements) compared to 2012. This decrease is primarily due to reduced

market jet fuel prices and an increase in gains from our hedging activities. Excluding mark-to-market adjustments on hedges recorded in periods

other than the settlement period ("MTM adjustments"), our fuel price per gallon, adjusted (a non-GAAP financial measure) for 2013 was $3.07

per gallon, compared to $3.26 per gallon in 2012.

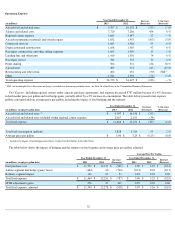

The market volatility of jet fuel prices greatly impacts our fuel costs. We manage our fuel cost through three primary methods: purchase

agreements, fuel hedging and the operation of a refinery.

29

• In 2012, we entered into an agreement with Bombardier Aerospace to purchase 40 CRJ-900 aircraft with 12 deliveries this year and 28 in

2014.

• Also in 2012, we finalized agreements with Southwest Airlines and The Boeing Company ("Boeing") to lease 88 B-717-200 aircraft.

Delivery of the aircraft began in September 2013, with a total of 13 aircraft delivered in 2013, 39 aircraft deliveries expected in 2014 and

36 aircraft deliveries expected in 2015. These B-717-200 aircraft are 110-seat aircraft and feature new, fully upgraded interiors, with 12

First Class seats, 15 Economy Comfort seats and in-flight WiFi throughout the cabin.

• In 2011, we entered into an agreement with Boeing to purchase 100 new fuel efficient B-737-

900ER aircraft. We took delivery of the first

B-737-900ER aircraft in September 2013 and will continue adding these aircraft to our fleet through 2018, primarily replacing older B-

757-200 aircraft. We expect the B-737-900ER to offer an industry leading customer experience, including expanded carry-on baggage

space and a spacious cabin.