Delta Airlines 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

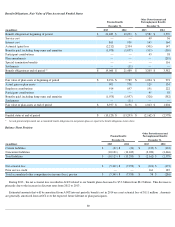

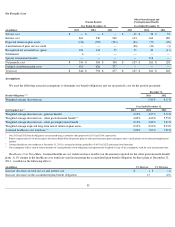

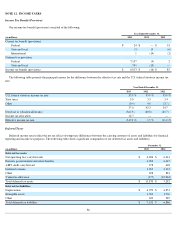

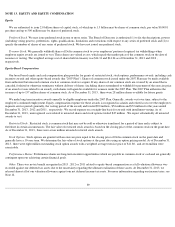

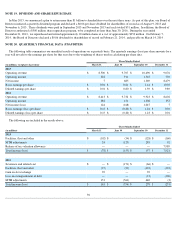

The following table shows the current and noncurrent deferred tax assets (liabilities):

The current and noncurrent components of our deferred tax balances are generally based on the balance sheet classification of the asset or

liability creating the temporary difference. If the deferred tax asset or liability is not based on a component of our balance sheet, such as our net

operating loss (“NOL”) carryforwards, the classification is presented based on the expected reversal date of the temporary difference. Our

valuation allowance has been allocated between current or noncurrent based on the percentages of current and noncurrent deferred tax assets to

total deferred tax assets.

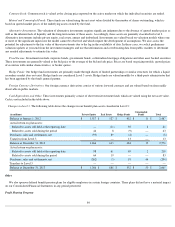

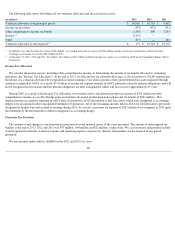

At December 31, 2013 , we had (1) $378 million of federal alternative minimum tax (“AMT”) credit carryforwards, which do not expire and

(2) $15.3 billion of federal pretax NOL carryforwards, which will not begin to expire until 2023 .

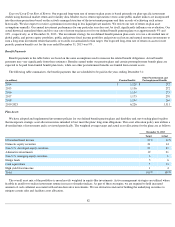

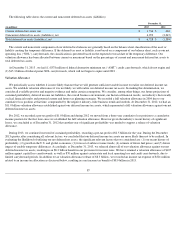

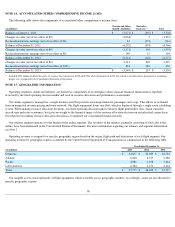

Valuation Allowance

We periodically assess whether it is more likely than not that we will generate sufficient taxable income to realize our deferred income tax

assets. We establish valuation allowances if it is not likely we will realize our deferred income tax assets. In making this determination, we

consider all available positive and negative evidence and make certain assumptions. We consider, among other things, our future projections of

sustained profitability, deferred income tax liabilities, the overall business environment, our historical financial results, our industry's historically

cyclical financial results and potential current and future tax planning strategies. We recorded a full valuation allowance in 2004 due to our

cumulative loss position at that time, compounded by the negative industry-wide business trends and outlook. At December 31, 2012, we had an

$11.0 billion

valuation allowance established against our deferred income tax assets, which represented a full valuation allowance against our net

deferred income tax assets.

For 2012, we recorded a pre-tax profit of $1.0 billion and during 2012 we moved from a three-year cumulative loss position to a cumulative

income position for the first time since we established the full valuation allowance. However given the industry's recent history of significant

losses, we concluded as of December 31, 2012 that another year of significant profitability was needed to support a release of valuation

allowance.

During 2013, we continued our trend of sustained profitability, recording a pre-tax profit of $2.5 billion for the year. During the December

2013 quarter, after considering all relevant factors, we concluded that our deferred income tax assets are more likely than not to be realized. In

evaluating the likelihood of utilizing our net deferred net assets, the significant relevant factors that we considered are: (1) our recent history of

profitability; (2) growth in the U.S. and global economies; (3) forecast of airline revenue trends; (4) estimate of future fuel prices; and (5) future

impact of taxable temporary differences. Accordingly, at December 31, 2013, we released almost all of our valuation allowance against our net

deferred income tax assets, resulting in an $8.3 billion benefit in our provision for income taxes. We have retained a valuation allowance of

$107

million against capital loss carryforwards, as well as $70 million against certain state and local operating loss and credit carryforwards, due to

limited carryforward periods. In addition to tax valuation allowance release of $8.3 billion , we recorded an income tax expense of $321 million

related to an income tax allocation as discussed below, resulting in a net income tax benefit of $8.0 billion in 2013.

87

December 31,

(in millions) 2013 2012

Current deferred tax assets, net

$

1,736

$

463

Noncurrent deferred tax assets (liabilities), net

4,992

(2,047

)

Total deferred tax assets (liabilities), net

$

6,728

$

(1,584

)