Delta Airlines 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

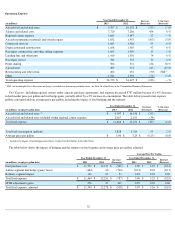

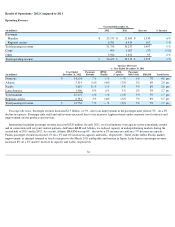

Financial Condition and Liquidity

We expect to meet our cash needs for the next 12 months from cash flows from operations, cash and cash equivalents, short-

term investments

and financing arrangements. As of December 31, 2013 , we had $5.7 billion in unrestricted liquidity, consisting of $3.8 billion in cash and cash

equivalents and short-term investments and $1.9 billion in undrawn revolving credit facilities.

Sources of Liquidity

Operating Cash Flow

Cash flows from operating activities continue to provide our primary source of liquidity. We generated positive cash flows from operations of

$4.5 billion in 2013 , $2.5 billion in 2012 and $2.8 billion in 2011 . We also expect to generate positive cash flows from operations in 2014.

Our operating cash flows can be impacted by the following factors:

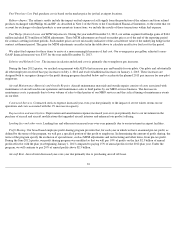

Seasonality of Advance Ticket Sales . We sell tickets for air travel in advance of the customer's travel date, and receive cash payment at the

time of sale. As a result, we record the cash received on advance sales as deferred revenue in Air Traffic Liability. The Air Traffic Liability

increases during the spring as we have increased sales in advance of the summer peak travel season. Our cash balances are typically higher at the

beginning of the summer and at a low point during the winter.

Fuel and Fuel Hedge Margins . The cost of jet fuel is our most significant expense, representing approximately 33% of our total operating

expenses for 2013 . The market price for jet fuel is highly volatile and can vary significantly from period to period. This price volatility affects

our cash flows from operations, impacting comparability from period to period.

We have jet fuel inventories at various airport locations, which are used in our airline operations. Also, we acquired the Trainer oil refinery in

2012, which, as part of refinery operations, has refined oil product inventories. Jet fuel and refined oil product inventories are recorded as Fuel

Inventory. Fuel Inventory increased during 2012 as a result of the start up of refinery operations in the September quarter and the transition of

our fuel supply program. The increase in Fuel Inventory to achieve normal operating levels at our refinery was offset by a similar increase in

accounts payable, and therefore, did not have a significant impact on operating cash flows during 2012. The remaining $180 million increase in

Fuel Inventory was a result of the transition in Delta's fuel supply program.

As part of our fuel hedging program, we may be required to pay hedge margin to counterparties when our portfolio is in a loss position.

Conversely, if our portfolio with counterparties is in a gain position, we may receive hedge margin. Our future cash flows are impacted

depending upon the nature of our derivative contracts and the market price of the commodities underlying our derivative contracts

Timing of SkyMiles Sales. In December 2011, we amended our American Express agreements and agreed to sell $675 million of unrestricted

SkyMiles to American Express in each December from 2011 through 2014. Under the December 2011 amendment, American Express purchased

$675 million of unrestricted SkyMiles in each of 2013, 2012 and 2011. In 2011, this operating cash flow was largely offset by working capital

changes. We anticipate American Express will make an additional purchase of $675 million of unrestricted SkyMiles in 2014.

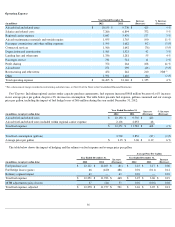

In 2008, we entered into a multi-

year extension of our American Express agreements and received $1.0 billion from American Express for an

advance purchase of restricted SkyMiles. The agreement, as modified, provided that our obligations with respect to the advance purchase would

be satisfied as American Express uses the purchased miles over a specified future period (“SkyMiles Usage Period”). During the SkyMiles

Usage Period, which commenced in December 2011, American Express utilized SkyMiles valued at $333 million annually over three years

beginning 2012 instead of paying cash to Delta for SkyMiles used. This draw down of $333 million in SkyMiles reduced cash flows from

operations in 2012 compared to 2011. In December 2013, we and American Express amended this agreement to allow American Express to use

these SkyMiles immediately and without restriction.

38