Delta Airlines 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

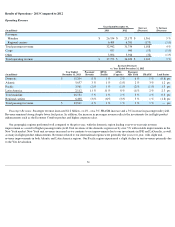

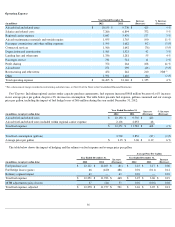

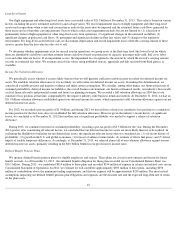

Non-Operating Results

The decline in interest expense, net is driven by reduced levels of debt and lower interest rates. Our principal amount of debt has declined

from $15.4 billion at the beginning of 2011 to $11.2 billion at December 31, 2013 . During 2012 and 2011, we recorded $118 million and $68

million in losses from the early extinguishment of debt, which primarily related to the write-off of debt discounts. These debt discounts are

primarily a result of fair value adjustments recorded in 2008 to reduce the carrying value of Northwest long-term debt due to purchase

accounting. As a result of these write-offs and scheduled amortization, our unamortized debt discount has decreased from $935 million at the

beginning of 2011 to $383 million at December 31, 2013 .

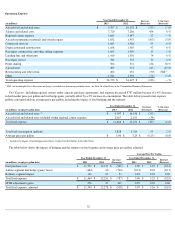

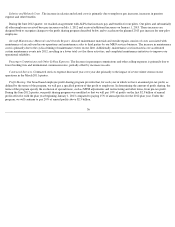

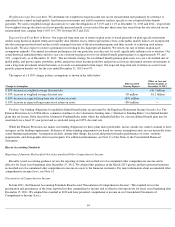

Income Taxes

We consider all income sources, including other comprehensive income, in determining the amount of tax benefit allocated to continuing

operations. The following table shows the components of our income tax benefit (provision):

During the December 2013 quarter, after considering all relevant factors, we concluded that our deferred income tax assets are more likely

than not to be realized. Accordingly, at December 31, 2013, we released almost all of our valuation allowance against our net deferred income

tax assets. The release of the allowance primarily resulted in a net tax benefit of $8.0 billion that was recorded in income tax benefit (provision)

in our Consolidated Statement of Operations. Beginning in 2014, we expect to record income tax expense with an effective rate of approximately

38%. At December 31, 2013 , we had $15.3 billion of U.S. federal pre-tax net operating loss carryforwards. Accordingly, we believe we will not

pay any cash federal income taxes during the next several years. Our U.S. federal pre-tax net operating loss carryforwards do not begin to expire

until 2023 . See Note 12 of the Notes to the Consolidated Financial Statements for more information.

During 2012 and 2011, we did not record an income tax provision for U.S. federal income tax purposes since our deferred tax assets were

fully reserved by a valuation allowance. During 2011, we recorded an income tax benefit of $85 million, primarily related to the recognition of

alternative minimum tax refunds.

37

Year Ended December 31,

Favorable (Unfavorable)

(in millions) 2013 2012 2011

2013 vs. 2012 2012 vs. 2011

Interest expense, net

$

(698

)

$

(812

)

$

(901

)

$

114

$

89

Amortization of debt discount, net

(154

)

(193

)

(193

)

39

—

Loss on extinguishment of debt —

(

118

)

(68

)

118

(50

)

Miscellaneous, net

(21

)

(27

)

(44

)

6

17

Total other expense, net

$

(873

)

$

(1,150

)

$

(1,206

)

$

277

$

56

Year Ended December 31,

(in millions) 2013 2012 2011

Current tax benefit (provision):

Federal

$

24

$

—

$

91

State and local

(3

)

15

(6

)

International

1

(14

)

(2

)

Deferred tax provision:

Federal

7,197

(4

)

2

State and local

794

(13

)

—

Income tax benefit (provision)

$

8,013

$

(16

)

$

85