Delta Airlines 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

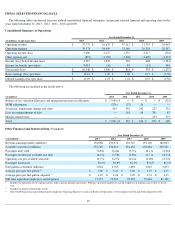

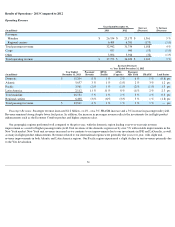

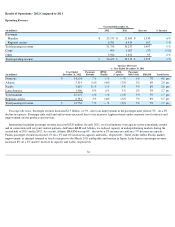

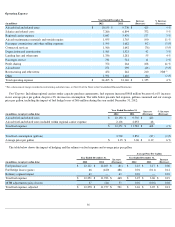

Fuel Purchase Cost. Fuel purchase cost is based on the market price for jet fuel at airport locations.

Refinery Impact. The refinery results include the impact on fuel expense of self-supply from the production of the refinery and from refined

products exchanged with Phillips 66 and BP. As described in Note 2 of the Notes to the Consolidated Financial Statements, to the extent that we

account for exchanges of refined products as non-monetary transactions, we include the results of those transactions within fuel expense.

Fuel Hedge (Gains) Losses and MTM Adjustments. During the year ended December 31, 2013, our airline segment fuel hedge gains of $444

million included $276 million of MTM adjustments. These MTM adjustments are based on market prices as of the end of the reporting period

for contracts settling in future periods. Such market prices are not necessarily indicative of the actual future value of the underlying hedge in the

contract settlement period. The gains for MTM adjustments are reflected in the table above to calculate an effective fuel cost for the period.

We adjust fuel expense for these items to arrive at a more meaningful measure of fuel cost. Our average price per gallon, adjusted (a non-

GAAP financial measure) was $3.07 for the year ended December 31, 2013.

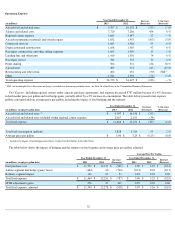

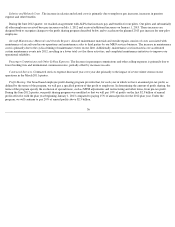

Salaries and Related Costs . The increase in salaries and related costs is primarily due to employee pay increases.

During the June 2012 quarter, we reached an agreement with ALPA that increases pay and benefits for our pilots. Our pilots and substantially

all other employees received base pay increases on July 1, 2012 and received additional increases on January 1, 2013. These increases are

designed both to recognize changes to the profit sharing program described below and to accelerate the planned 2013 pay increase for non-pilot

employees.

Aircraft Maintenance Materials and Outside Repairs. Aircraft maintenance materials and outside repairs consists of costs associated with

maintenance of aircraft used in our operations and maintenance sales to third parties by our MRO services business. The decrease in

maintenance costs is primarily due to lower volume of sales to third parties of our MRO services and the cyclical timing of maintenance events

on our fleet.

Contracted Services. Contracted services expense increased year-over-year due primarily to the impact of severe winter storms on our

operations and costs associated with the 1% increase in capacity.

Depreciation and amortization. Depreciation and amortization expense increased year-over-year primarily due to our investment in the

purchase of aircraft and aircraft modifications that upgraded aircraft interiors and enhanced our product offering.

Landing fees and other rents. Landing fees and other rents increased year-over-year primarily due to our investment in airport facilities.

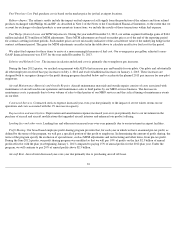

Profit Sharing. Our broad based employee profit sharing program provides that, for each year in which we have an annual pre-tax profit, as

defined by the terms of the program, we will pay a specified portion of that profit to employees. In determining the amount of profit sharing, the

terms of the program specify the exclusion of special items, such as MTM adjustments and restructuring and other items, from pre-tax profit.

During the June 2012 quarter, our profit sharing program was modified so that we will pay 10% of profits on the first $2.5 billion of annual

profits effective with the plan year beginning January 1, 2013 compared to paying 15% of annual profits for the 2012 plan year. Under the

program, we will continue to pay 20% of annual profits above $2.5 billion.

Aircraft Rent. Aircraft rent decreased year-over-year due primarily due to purchasing aircraft off-lease.

33