Delta Airlines 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

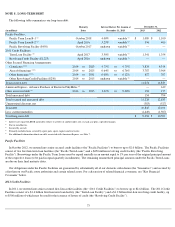

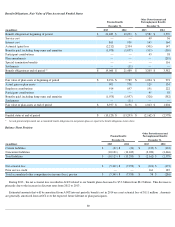

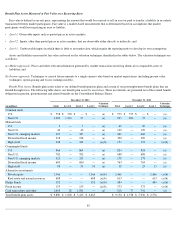

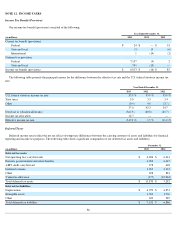

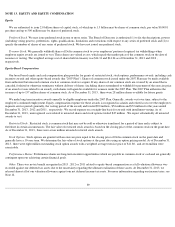

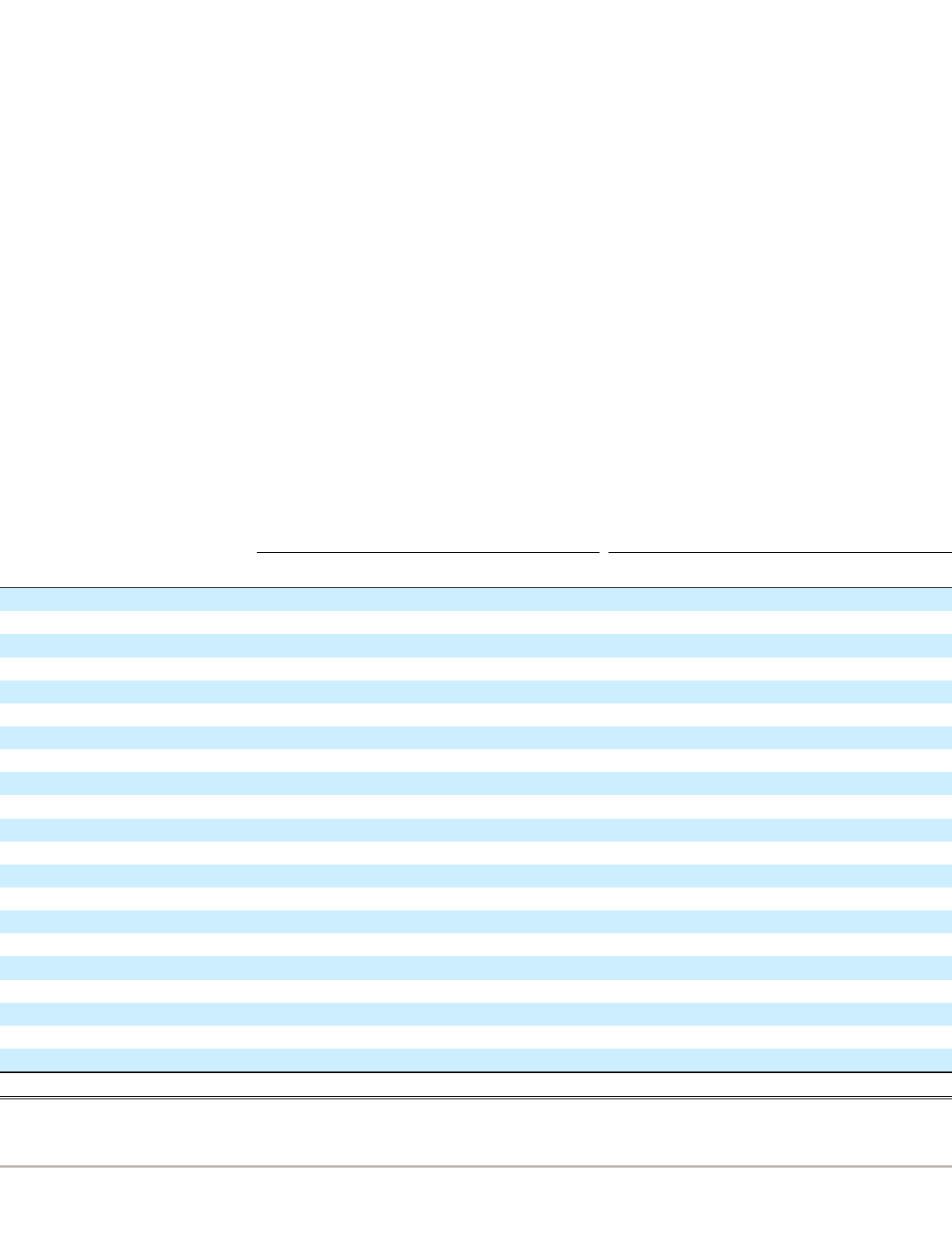

Benefit Plan Assets Measured at Fair Value on a Recurring Basis

Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants. Fair value is a market-based measurement that is determined based on assumptions that market

participants would use in pricing an asset or liability.

Assets and liabilities measured at fair value are based on the valuation techniques identified in the tables below. The valuation techniques are

as follows:

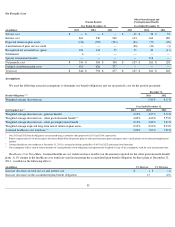

Benefit Plan Assets. Benefit plan assets relate to our defined benefit pension plans and certain of our postemployment benefit plans that are

funded through trusts. The following table shows our benefit plan assets by asset class. These investments are presented net of the related benefit

obligation in pension, postretirement and related benefits on the Consolidated Balance Sheets.

83

•

Level 1.

Observable inputs such as quoted prices in active markets;

•

Level 2

. Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

•

Level 3

. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

(a)

Market approach

. Prices and other relevant information generated by market transactions involving identical or comparable assets or

liabilities; and

(b)

Income approach.

Techniques to convert future amounts to a single current value based on market expectations (including present value

techniques, option-pricing and excess earnings models).

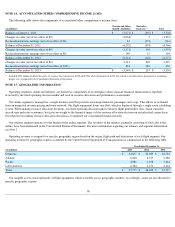

December 31, 2013

December 31, 2012

(in millions) Total Level 1 Level 2 Level 3 Valuation

Technique

Total Level 1 Level 2 Level 3 Valuation

Technique

Common stock

U.S.

$

558

$

558

$

—

$

—

(a)

$

575

$

575

$

—

$

—

(a)

Non-U.S.

1,269

1,216

53

—

(a)

923

886

37

—

(a)

Mutual funds

U.S.

3

—

3

—

(a)

69

—

69

—

(a)

Non-U.S.

43

—

43

—

(a)

129

—

129

—

(a)

Non-U.S. emerging markets

327

—

327

—

(a)

466

—

466

—

(a)

Diversified fixed income

218

—

218

—

(a)

390

—

390

—

(a)

High yield

348

—

348

—

(a)(b)

153

—

153

—

(a)(b)

Commingled funds

U.S.

864

—

864

—

(a)

824

—

824

—

(a)

Non-U.S.

782

—

782

—

(a)

688

—

688

—

(a)

Non-U.S. emerging markets

319

—

319

—

(a)

178

—

178

—

(a)

Diversified fixed income

680

—

680

—

(a)

763

—

763

—

(a)

High yield

98

—

39

59

(a)

38

—

25

13

(a)

Alternative investments

Private equity

1,366

—

—

1,366

(a)(b)

1,466

—

—

1,466

(a)(b)

Real estate and natural resources

688

—

—

688

(a)(b)

613

—

—

613

(a)(b)

Hedge Funds

552

—

—

552

(a)(b)

484

—

—

484

(a)(b)

Fixed income

155

—

155

—

(a)(b)

573

—

573

—

(a)(b)

Cash equivalents and other

1,610

28

1,582

—

(a)

818

77

741

—

(a)

Total benefit plan assets

$

9,880

$

1,802

$

5,413

$

2,665

$

9,150

$

1,538

$

5,036

$

2,576