Delta Airlines 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

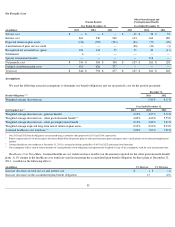

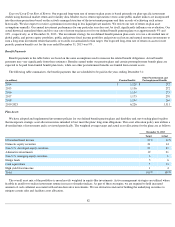

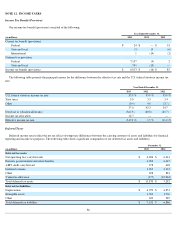

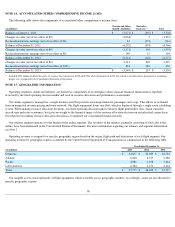

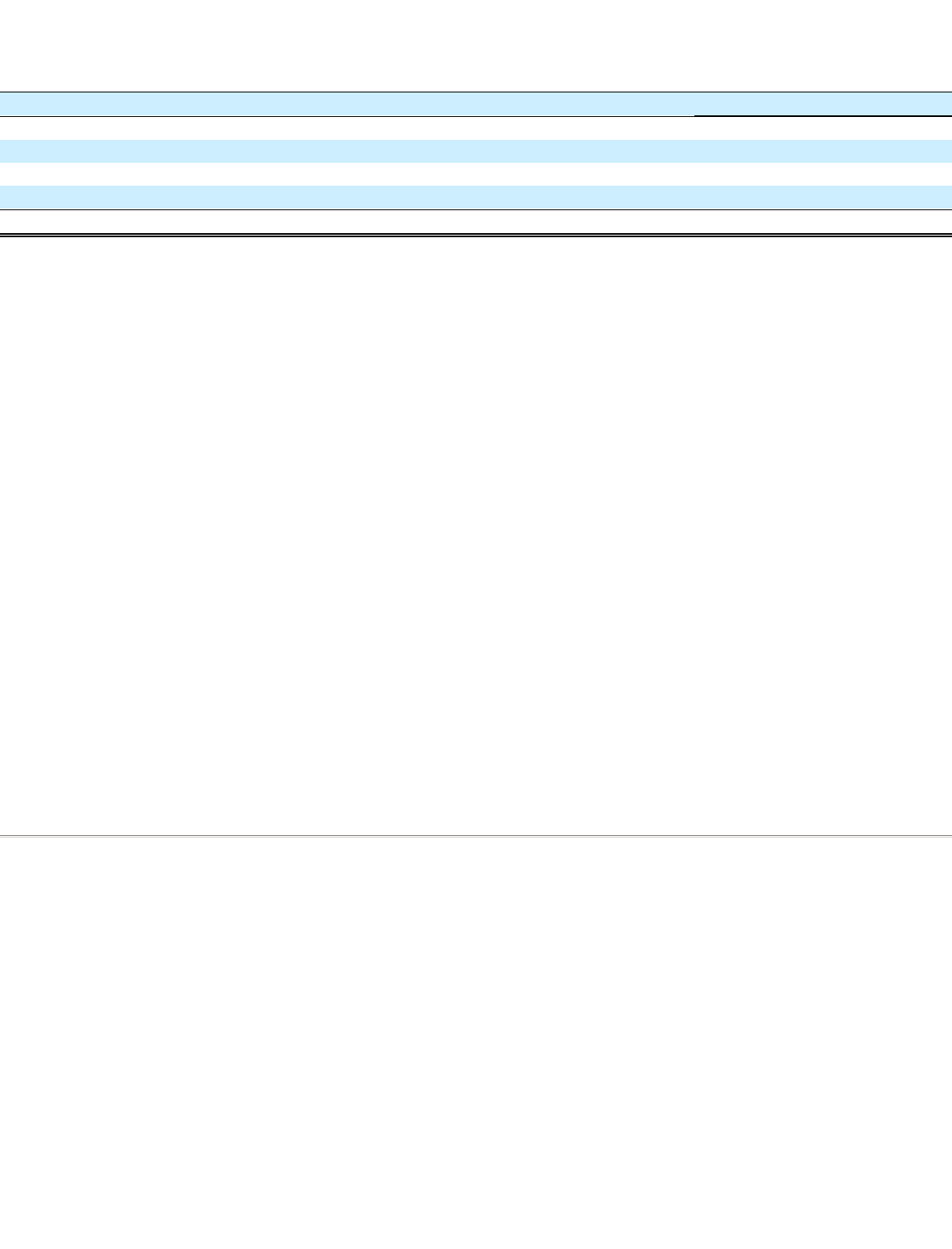

The following table shows the balance of our valuation allowance and the associated activity:

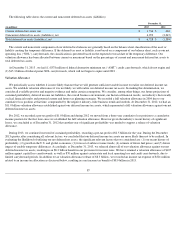

Income Tax Allocation

We consider all income sources, including other comprehensive income, in determining the amount of tax benefit allocated to continuing

operations (the "Income Tax Allocation"). At the end of 2013, we released our tax valuation allowance, as discussed above. GAAP requires that

the release of a valuation allowance be recognized in current earnings, even when a portion of the related deferred tax asset originated through

amounts recognized in AOCI. As a result, $1.9 billion

of income tax expense remains in AOCI, primarily related to pension obligations, and will

not be recognized in net income until the pension obligations are fully extinguished, which will not occur for approximately 25 years.

During 2009, as a result of the Income Tax Allocation, we recorded a non-cash deferred income tax expense of $321 million on other

comprehensive income as a result of hedge gains on fuel derivatives and an offsetting non-cash income tax benefit of $321 million . This

deferred income tax expense remained in AOCI until all amounts in AOCI that related to fuel derivatives which were designated as accounting

hedges were recognized in the Consolidated Statement of Operations. All of the remaining amounts held in AOCI for fuel derivatives previously

designated as hedges were reclassified to earnings during 2013. As a result, an income tax expense of $321 million

was recognized in 2013 upon

the settlement of the fuel derivative contracts designated as accounting hedges.

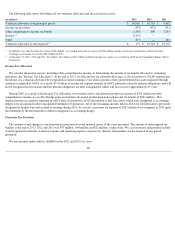

Uncertain Tax Positions

The amount of and changes to our uncertain tax positions were not material in any of the years presented. The amount of unrecognized tax

benefits at the end of 2013, 2012 and 2011 was $37 million , $44 million and $22 million , respectively. We accrue interest and penalties related

to unrecognized tax benefits in interest expense and operating expense, respectively. Interest and penalties are not material in any period

presented.

We are currently under audit by the IRS for the 2013 and 2012 tax years.

88

(in millions) 2013 2012 2011

Valuation allowance at beginning of period

$

10,963

$

10,705

$

9,632

Income tax provision

(975

)

(432

)

(351

)

Other comprehensive income tax benefit

(1,186

)

690

1,241

Release

(1)

(8,310

)

—

—

Other

(315

)

—

183

Valuation allowance at end of period

(2)

$

177

$

10,963

$

10,705

(1)

In addition to tax valuation allowance release of $8.3 billion , we recorded an income tax expense of $321 million related to an income tax allocation as discussed below,

resulting in a net income tax benefit of $8.0 billion in 2013.

(2)

At December 31, 2013 , 2012 and 2011 , $13 million , $3.1 billion and $2.5 billion of deferred income tax expense was recorded in AOCI on our Consolidated Balance Sheets,

respectively.