Delta Airlines 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impact of gains or losses as of December 31, 2013 associated with (1) the cumulative pension and other

post-

employment retirement benefits net balance recorded in AOCI; (2) the derivative contracts and

associated items net balance recorded in AOCI; and (3) the deferred tax asset valuation allowance balance

and (ii) using the following formula for each subsequent quarter thereafter, (A+B+C), where:

A = The Initial Value;

B = The cumulative amount starting as of January 1, 2014 and ending as of the last day of

the applicable calendar quarter of the Company’s pre-

tax income determined in accordance with

GAAP, but (i) excluding: (1) items present in the line item “restructuring and other items”

or such

similar line item; (2) mark-to-

market adjustments for fuel hedges recorded in periods other than the

settlement period; and (3) other special, unusual, or nonrecurring items which are disclosed in

publicly available filings with the SEC and (ii) including expenses due to amortization of post-

employment benefit losses in AOCI that have occurred during the Performance Period; and

C = in the event that the Company pays a dividend or issues or repurchases additional

Common Stock for cash during the Performance Period (but excluding the exercise of any

employee stock option for cash or any other issuance of Common Stock to employees), (i) the

gross cash proceeds of the equity issuance or (ii) the gross cash payments for the equity repurchase

or dividends, before adjustment for any applicable fees or charges associated therewith.

A = Total gross long term debt and capital leases (including current maturities) that reflect

Delta’

s actual obligations to lenders or lessors, including any adjustments from the book value to

reflect premiums or discounts that may be amortizing;

B = Annual aircraft rent expense multiplied by seven; and

C = Unrestricted cash, cash equivalents and short-term investments.

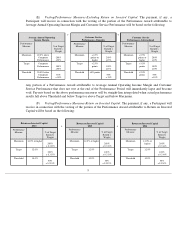

(v) Vesting .

(A) General.

Subject to the terms of the 2007 Performance Plan, the 2014 LTIP, and all other

conditions included in any applicable Award Agreement, the Performance Award shall vest, as described in this

Section 4(b)(v), as of the end of the Performance Period to the extent that the Company’

s actual performance

results meet or exceed Threshold level with respect to Average Annual Operating Income Margin, Customer

Service Performance and/or Return on Invested Capital, as applicable and as described below. For purposes of

Average Annual Operating Income Margin, the

7

(5) “Adjusted Net Debt”

for Delta shall be calculated quarterly based on its regularly prepared

internal financial statements using the following formula (A+B-

C), subject to Section 4(b)(v)(B),

where: